ICICI Bank 2012 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F45

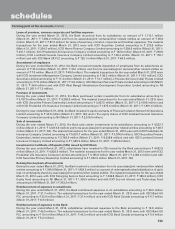

Dividend paid

During the year ended March 31, 2012, the Bank paid dividend to its key management personnel amounting to ` 4.5

million (March 31, 2011: ` 4.2 million). The dividend paid during the year ended March 31, 2012 to Ms. Chanda Kochhar

was ` 3.8 million (March 31, 2011: ` 3.2 million) and to Mr. N. S. Kannan was ` 0.7 million (March 31, 2011: ` 1.0 million).

The dividend paid for the year ended March 31, 2011 to Mr. Sandeep Bakhshi was ` 0.04 million.

Remuneration to whole-time directors

Remuneration paid to the whole-time directors of the Bank during the year ended March 31, 2012 was ` 111.3 million

(March 31, 2011: ` 79.6 million). The remuneration paid for the year ended March 31, 2012 to Ms. Chanda Kochhar was `

37.7 million (March 31, 2011: ` 25.2 million), to Mr. K. Ramkumar was ` 25.4 million (March 31, 2011: ` 17.6 million), to Mr.

N. S. Kannan was ` 25.0 million (March 31, 2011: ` 15.8 million) and to Mr. Rajiv Sabharwal was ` 23.2 million (March 31,

2011: ` 9.0 million). The remuneration paid for the year ended March 31, 2011 to Mr. Sandeep Bakhshi was ` 7.7 million and

to Mr. Sonjoy Chatterjee was ` 4.3 million.

Sale of fixed assets

During the year ended March 31, 2012, the Bank sold fixed assets to its subsidiaries amounting to ` 18.4 million (March 31,

2011: ` 0.9 million) and to its associates/joint ventures/other related entities amounting to Nil (March 31, 2011: ` 2.8 million).

The material transactions for the year ended March 31, 2012 were with ICICI Venture Funds Management Company Limited

amounting to ` 14.7 million (March 31, 2011: Nil), ICICI Lombard General Insurance Company Limited amounting to ` 2.7

million (March 31, 2011: Nil), ICICI Securities Limited amounting to ` 1.0 million (March 31, 2011: ` 0.8 million) and with ICICI

Merchant Services Private Limited amounting to Nil (March 31, 2011: ` 2.8 million).

Purchase of fixed assets

During the year ended March 31, 2012, the Bank purchased fixed assets from its subsidiaries amounting to ` 9.4 million

(March 31, 2011: ` 10.9 million). The material transactions for the year ended March 31, 2012 were with ICICI Lombard

General Insurance Company Limited amounting to ` 4.6 million (March 31, 2011: Nil), ICICI Prudential Life Insurance

Company Limited amounting to ` 4.2 million (March 31, 2011: ` 0.1 million) and with ICICI Home Finance Company Limited

amounting to Nil (March 31, 2011: ` 9.9 million).

Sale of gold coins

During the year ended March 31, 2012, the Bank sold gold coins to ICICI Prudential Life Insurance Company Limited

amounting to ` 45.4 million (March 31, 2011: ` 0.9 million).

Donation

During the year ended March 31, 2012, the Bank has given donation to ICICI Foundation for Inclusive Growth amounting

to ` 239.7 million (March 31, 2011: ` 61.0 million).

Purchase of loan

During the year ended March 31, 2012, the Bank has purchased loans from ICICI Bank UK PLC amounting to ` 12,870.5

million (March 31, 2011: ` 688.7 million).

Sale of loan

During the year ended March 31, 2012, the Bank has sold a loan to ICICI Bank UK PLC amounting to ` 2,543.8 million

(March 31, 2011: Nil).

Purchase of bank guarantees

A bank guarantee facility provided by ICICI Bank UK PLC to one of its clients was transferred to the Bank amounting to `

1,279.2 million (March 31, 2011: Nil) during the year ended March 31, 2012.

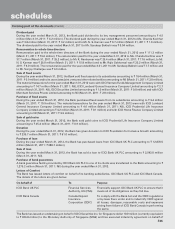

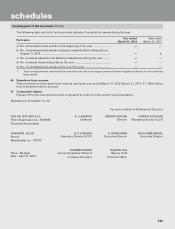

Letters of Comfort

The Bank has issued letters of comfort on behalf of its banking subsidiaries, ICICI Bank UK PLC and ICICI Bank Canada.

The details of the letters are given below.

On behalf of To Purpose

ICICI Bank UK PLC Financial Services

Authority, UK (FSA)

Financially support ICICI Bank UK PLC to ensure that it

meets all of its obligations as they fall due.

ICICI Bank Canada Canada Deposit

Insurance

Corporation (CDIC)

To comply with the Bank Act and the CDIC regulations

or by-laws there under and to indemnify CDIC against

all losses, damages, reasonable costs and expenses

arising from failure of ICICI Bank Canada in performing

the same.

The Bank has issued an undertaking on behalf of ICICI Securities Inc. for Singapore dollar 10.0 million (currently equivalent

to ` 404.8 million) to the Monetary Authority of Singapore (MAS) and has executed indemnity agreement on behalf of

forming part of the Accounts (Contd.)

schedules