ICICI Bank 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

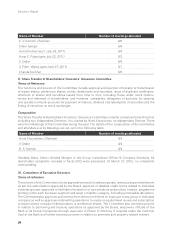

b) Awards passed by the Banking Ombudsman in fiscal 2012

Number of unimplemented awards at the beginning of the year 0

Number of awards passed by the Banking Ombudsman during the year 0

Number of awards implemented during the year 0

Number of unimplemented awards at the end of the year 0

COMPLIANCE CERTIFICATE OF THE AUDITORS

ICICI Bank has annexed to this report, a certificate obtained from the statutory auditors, S. R. Batliboi &

Co., Chartered Accountants, regarding compliance of conditions of Corporate Governance as stipulated

in Clause 49 of the listing agreement.

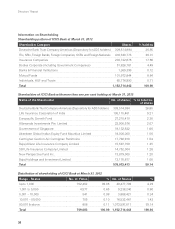

EMPLOYEE STOCK OPTION SCHEME

In fiscal 2000, ICICI Bank instituted an Employee Stock Option Scheme (ESOS) to enable the employees

and Directors of ICICI Bank and its subsidiaries to participate in future growth and financial success of

the Bank. The ESOS aims at achieving the twin objectives of (i) aligning employee interest to that of

the shareholders; and (ii) retention of talent. Through employee stock option grants, the Bank seeks to

foster a culture of long-term sustainable value creation. As per the ESOS, as amended from time to time,

the maximum number of options granted to any employee/Director in a year is limited to 0.05% of ICICI

Bank’s issued equity shares at the time of the grant, and the aggregate of all such options is limited to

5% of ICICI Bank’s issued equity shares on the date of the grant (equivalent to 57.64 million shares at

April 27, 2012).

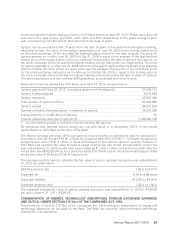

The Bank has up to April 27, 2012 granted 57.09 million stock options from time to time aggregating to

4.95% of the issued equity capital of the Bank at April 27, 2012. In view of the same and the benefits

of stock option grants as a compensation tool outlined above, the Board Governance, Remuneration &

Nomination Committee (the Committee) at its Meeting held on April 27, 2012 recommended that the

maximum number of equity shares of the Bank that can be created, offered, issued and allotted pursuant

to the options granted under ESOS should not exceed ten percent of the aggregate of the number of

issued equity shares of the Bank, from time to time, on the date(s) of the grant of option(s) under ESOS.

The Board of Directors at its Meeting held on April 27, 2012 accepted the recommendation of the

Committee and decided to seek the approval of the Members for the same. The enhancement of the

stock option pool upto ten percent of aggregate of the number of issued equity shares of the Bank is

in line with other large Indian private sector banks.

Options granted for fiscal 2003 and earlier years vest in a graded manner over a three-year period, with

20%, 30% and 50% of the grants vesting in each year, commencing not earlier than 12 months from

the date of the grant. Options granted from fiscal 2004 to 2008 vest in a graded manner over a four-year

period, with 20%, 20%, 30% and 30% of the grants vesting in each year commencing from the end of

12 months from the date of grant.

Options granted in April 2009 vest in a graded manner over a five year period with 20%, 20%, 30%

and 30% of grant vesting in each year, commencing from the end of 24 months from the date of the

grant. Out of the options the grant of which was approved by the Board at its Meeting held on October

29, 2010 (for which RBI approval for grant to wholetime Directors was received in January 2011), 50%

of the options granted vest on April 30, 2014 and the balance 50% on April 30, 2015. The other stock

options granted during the period April 2010 to April 2011 vest in a graded manner over a four year

period with 20%, 20%, 30% and 30% of the grant vesting in each year commencing from the end of

12 months from the date of grant.

Options granted in September 2011 vest in a graded manner over a five year period with 15%, 20%, 20%

and 45% of the grant vesting in each year, commencing from end of 24 months from the date of grant.

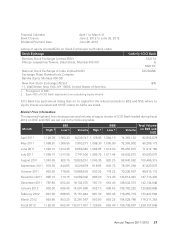

The Board at its Meeting held on April 27, 2012 approved a grant of approximately 4.45 million options

for fiscal 2012 to eligible employees and wholetime Directors (options granted to wholetime Directors

being subject to RBI approval). Each option confers on the employee a right to apply for one equity

share of face value of ` 10 of ICICI Bank at ` 841.45 which was closing price on the stock exchange

Directors’ Report