ICICI Bank 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F28

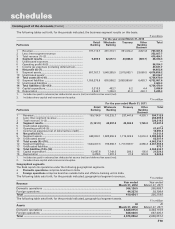

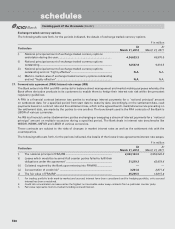

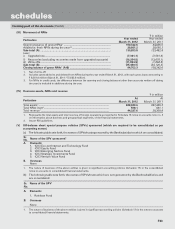

Exchange traded currency options

The following table sets forth, for the periods indicated, the details of exchange traded currency options.

` in million

Particulars At

March 31, 2012

At

March 31, 2011

i) Notional principal amount of exchange traded currency options

undertaken during the year ......................................................................... 4,34,623.3 43,970.0

ii) Notional principal amount of exchange traded currency options

outstanding .................................................................................................. 12,587.8 9,418.5

iii) Notional principal amount of exchange traded currency options

outstanding and not “highly effective” ....................................................... N.A. N.A.

iv) Mark-to-market value of exchange traded currency options outstanding

and not “highly effective” ........................................................................... N.A. N.A.

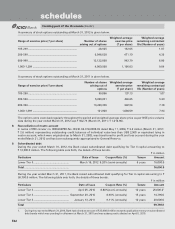

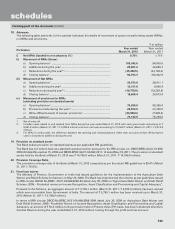

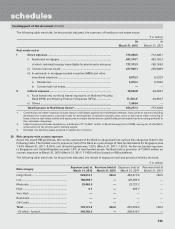

17. Forward rate agreement (FRA)/Interest rate swaps (IRS)

The Bank enters into FRA and IRS contracts for balance sheet management and market making purposes whereby the

Bank offers derivative products to its customers to enable them to hedge their interest rate risk within the prevalent

regulatory guidelines.

A FRA is a financial contract between two parties to exchange interest payments for a `notional principal’ amount

on settlement date, for a specified period from start date to maturity date. Accordingly, on the settlement date, cash

payments based on contract rate and the settlement rate, which is the agreed bench-mark/reference rate prevailing on

the settlement date, are made by the parties to one another. The benchmark used in the FRA contracts of the Bank is

LIBOR of various currencies.

An IRS is a financial contract between two parties exchanging or swapping a stream of interest payments for a `notional

principal’ amount on multiple occasions during a specified period. The Bank deals in interest rate benchmarks like

MIBOR, INBMK, MIFOR and LIBOR of various currencies.

These contracts are subject to the risks of changes in market interest rates as well as the settlement risk with the

counterparties.

The following table sets forth, for the periods indicated, the details of the forward rate agreements/interest rate swaps.

` in million

Particulars At

March 31, 2012

At

March 31, 2011

i) The notional principal of FRA/IRS .............................................................. 2,603,143.0 3,952,522.3

ii) Losses which would be incurred if all counter parties failed to fulfil their

obligations under the agreement1 ............................................................. 31,219.3 42,479.4

iii) Collateral required by the Bank upon entering into FRA/IRS .................... ——

iv) Concentration of credit risk2 ...................................................................... 3,261.6 2,871.4

v) The fair value of FRA/IRS3 ........................................................................... 25,235.5 13,615.4

1. For trading portfolio both mark-to-market and accrued interest have been considered and for hedging portfolio, only accrued

interest has been considered.

2. Credit risk concentration is measured as the highest net receivable under swap contracts from a particular counter party.

3. Fair value represents mark-to-market including accrued interest.

forming part of the Accounts (Contd.)

schedules