ICICI Bank 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

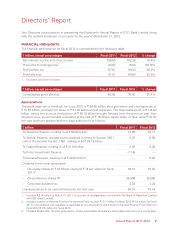

Based on the above progress in our underlying

funding profile, asset quality and profitability,

we were able to achieve 26% growth in profit

after tax at the standalone level and 25% at the

consolidated level in fiscal 2012 – a year which

saw significant changes in the operating and

regulatory environment. This resilience, coupled

with our strong capital position, has enabled us

to increase the dividend to shareholders from

` 14 per share in fiscal 2011 to ` 16.50 per share

in fiscal 2012.

However, the strength of a franchise is not only

about the numbers the organisation achieves

in a year – it is also about the foundation it is

building for the future. And we have continued

to make progress in this area as well. We

have grown our branch network to over 2,750

branches and our ATM network to over 9,000

ATMs. We have leveraged technology to enhance

customer convenience and customer experience

across a range of channels including ATMs,

mobile banking and internet banking. We have

undertaken focused initiatives to improve the

quality of service delivery to our customers, in line

with our philosophy of “Khayaal Aapka” – keeping

the customer’s needs as the focal point of our

business. We continuously evaluate ourselves in

this area and seek to keep enhancing the quality

of customer experience.

Fiscal 2012 was a year which saw our subsidiaries

contributing significantly to our profits. This is

reflected in the robust growth in our consolidated

profits, as well as healthy dividend streams from

the subsidiaries to the parent Bank. A key strength

of the ICICI Group franchise is its leadership

position across various segments of financial

services in India. We continue to strengthen

this franchise. Our insurance and mutual fund

businesses are focused on enhancing their market

positioning and profitability. Our private equity

business continues to pursue new fund raising

while unlocking value from past investments.

Our securities and primary dealership businesses

are strengthening their core franchise to deliver

healthy returns amidst a rapidly evolving market

environment. Our international subsidiaries are

repositioning their businesses in the changed

global environment, with a clear path towards

improving their profitability over the medium term.

Even as we execute these strategies, we remain

conscious of our role in nation building. This

takes many forms – from the wide range of our

business activities, like infrastructure financing

and financial inclusion; to the focused efforts of

the ICICI Foundation for Inclusive Growth in the

areas of education, healthcare and sustainable

livelihoods. ICICI Foundation’s initiatives in

education include a six year programme to

improve the quality of school education in

Rajasthan, which seeks to benefit over seven

million children. In the area of health, ICICI

Foundation’s initiatives include a pilot project to

provide insurance for outpatient treatment to the

rural poor. Through such efforts, we carry forward

our ethos of being an institution that supports the

realisation of our country’s potential in a manner

that takes the benefits of growth to every Indian.

Finally, I would like to say that we are optimistic

about our country’s future and the potential

for profitable growth in banking and financial

services. There could be short-term challenges

and cyclical upturns and downturns – but our

economic fundamentals are strong and will

support robust growth over the medium to long

term. It is our endeavour at the ICICI Group to

position ourselves to catalyse and participate

in this growth, on the back of a strong and

competitive franchise. We look forward to the

continued support of all our stakeholders in

this journey.

With best wishes,

Chanda Kochhar

Annual Report 2011-2012 5