ICICI Bank 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

in average volume of interest-earning assets, decrease in fee income, MTM losses on derivatives in fiscal

2012 as compared to MTM gains in fiscal 2011 and loss realised on sale of investments in fiscal 2012 as

compared to gains realised in fiscal 2011, offset, in part, by lower provisions.

Profit after tax of ICICI Bank Eurasia Limited Liability Company remained at similar levels at ` 0.21 billion in

fiscal 2011 and fiscal 2012.

Profit after tax of ICICI Securities Primary Dealership Limited increased from ` 0.53 billion in fiscal 2011

to ` 0.86 billion in fiscal 2012 due to increase in trading gains despite an increase in yield on 10 year

government securities during fiscal 2012 offset, in part, by decrease in net interest income on account of

higher funding costs.

Profit after tax of ICICI Securities Limited decreased from ` 1.13 billion in fiscal 2011 to ` 0.77 billion in fiscal

2012 primarily due to decrease in overall cash turnover in the equity markets and reduced opportunities in

investment banking business.

Profit after tax of ICICI Home Finance Company Limited increased from ` 2.33 billion in fiscal 2011 to ` 2.60

billion in fiscal 2012 primarily due to increase in net interest income, offset, in part, by higher provisions on

loans.

Profit after tax of ICICI Prudential Asset Management Company increased from ` 0.72 billion in fiscal 2011 to

` 0.88 billion in fiscal 2012 primarily due to lower operating and administrative expenses.

Profit after tax of ICICI Venture Funds Management Company Limited decreased from ` 0.74 billion in fiscal

2011 to ` 0.68 billion in fiscal 2012 primarily due to decrease in management fees and increase in staff cost,

offset, in part, by increase in distribution of income from venture capital funds in fiscal 2012.

Consolidated assets of the Bank and its subsidiaries and other consolidating entities increased from

` 5,337.68 billion at March 31, 2011 to ` 6,041.91 billion at March 31, 2012. Consolidated advances of

the Bank and its subsidiaries increased from ` 2,560.19 billion at March 31, 2011 to ` 2,921.25 billion at

March 31, 2012.

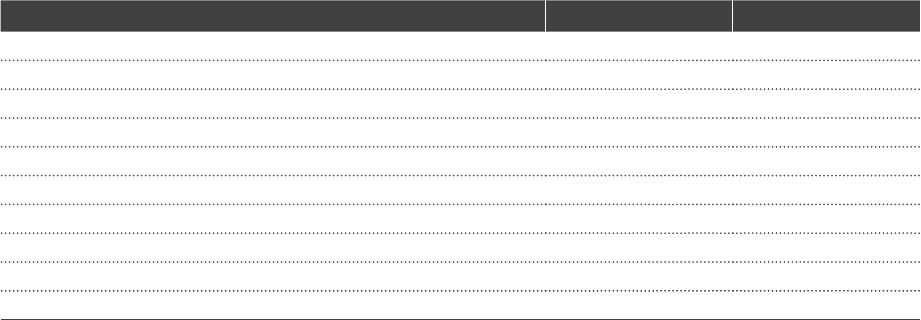

The following table sets forth, for the periods indicated, the profit/(loss) of our principal subsidiaries.

` in billion

Company Fiscal 2011 Fiscal 2012

ICICI Prudential Life Insurance Company Limited ` 8.08 ` 13.84

ICICI Lombard General Insurance Company Limited (0.80) (4.16)

ICICI Bank Canada 1.45 1.66

ICICI Bank UK PLC 1.67 1.22

ICICI Bank Eurasia Limited Liability Company 0.21 0.21

ICICI Securities Primary Dealership Limited 0.53 0.86

ICICI Securities Limited 1.13 0.77

ICICI Home Finance Company Limited 2.33 2.60

ICICI Prudential Asset Management Company Limited 0.72 0.88

ICICI Venture Funds Management Company Limited ` 0.74 ` 0.68

Management’s Discussion & Analysis