Volvo 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

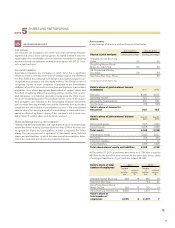

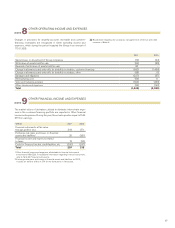

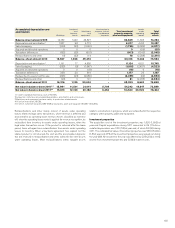

Reporting by product area

The Volvo Group’s operations are, until year end 2011, organized in nine

business areas: Volvo Trucks, Renault Trucks, North American Trucks,

Trucks Asia, Buses, Construction Equipment, Volvo Penta, Volvo Aero and

Customer Finance. In addition to the nine business areas, there are other

operations consisting mainly of business units that are designed to sup-

port the business areas’ operations. The business units include Volvo

Powertrain, Volvo 3P, Volvo IT, Volvo Logistics and Volvo Parts. As the four

truck brands share product development, production and other activities

in business units such as Volvo 3P and Volvo Powertrain and also share

certain infrastructure in distribution such as dealers, the four truck brands

are reported as one aggregated business segment. The Volvo Group is

thus reported divided in six segments in which net sales and operating

income are reported for each product area.

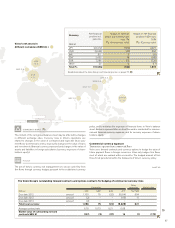

Each business area, except for Customer Finance, has total responsi-

bility for its operating income, operating capital and operating cash flow.

Volvo Financial Services within Customer Finance has responsibility for

its net income and total balance sheet within certain restrictions and prin-

ciples that are established centrally. The supervision and coordination of

treasury and tax matters is organized centrally to obtain the benefits of a

Group-wide approach. The legal structure of the Volvo Group is based on

optimal handling of treasury, tax and administrative matters and, accord-

ingly, differs from the operating structure.

The business units are designated to support the business areas and

are therefore not reportable business segments. The results from the syn-

ergies created in the business units are transferred back to the various

product areas based on the degree to which individual areas have utilized

the services of the business units. The heading Other contains mainly

earnings linked to corporate functions including the Group’s treasury

operations. The Group’s real estate, held in Volvo Group Real Estate, is

reported under industrial operations, and earnings are transferred back to

the business areas.

Reported segment information is based on the information used inter-

nally by the chief operating decision maker, which in Volvo is the Volvo

Group Executive Committee.

As from January 1, 2012, the Volvo Group has a new organizational

structure (see pages 8-9 in this report). The business will continue to be

divided in six segments under the new organization. The organizational

change may however result in some shifts between the segments.

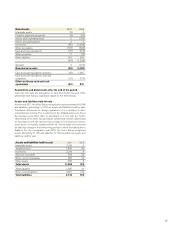

Net sales 2011 2010

Trucks 200,703 167,305

Construction Equipment 64,987 53,810

Buses 22,289 20,516

Volvo Penta 8,859 8,716

Volvo Aero 6,509 7,708

Other and eliminations 242 (680)

Industrial Operations 303,589 257,375

Customer Finance 8,883 9,031

Reclassifications and eliminations (2,104) (1,657)

Volvo Group 310,367 264,749

The above sales figures include internal sales in the following amounts:

Net sales to Group companies 2011 2010

Trucks 1,921 1,421

Construction Equipment 606 347

Buses 526 490

Volvo Penta 140 129

Volvo Aero 1 21

Other and eliminations (1,426) (984)

Industrial Operations 1,769 1,424

Customer Finance 337 231

Eliminations (2,106) (1,655)

Volvo Group 0 0

Internal sales between business areas are generally made at standard

cost of sales, including calculated interest and product improvement

expenses. Internal sales from service companies are generally made at

market prices.

Operating income 2011 2010

Trucks 18,260 10,112

Construction Equipment 6,653 6,180

Buses 1,036 780

Volvo Penta 781 578

Volvo Aero 336 286

Other (1,109) (102)

Industrial Operations 25,957 17,834

Customer Finance 942 167

Volvo Group 26,899 18,000

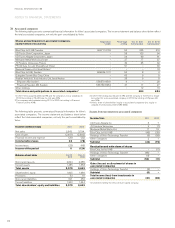

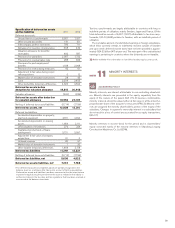

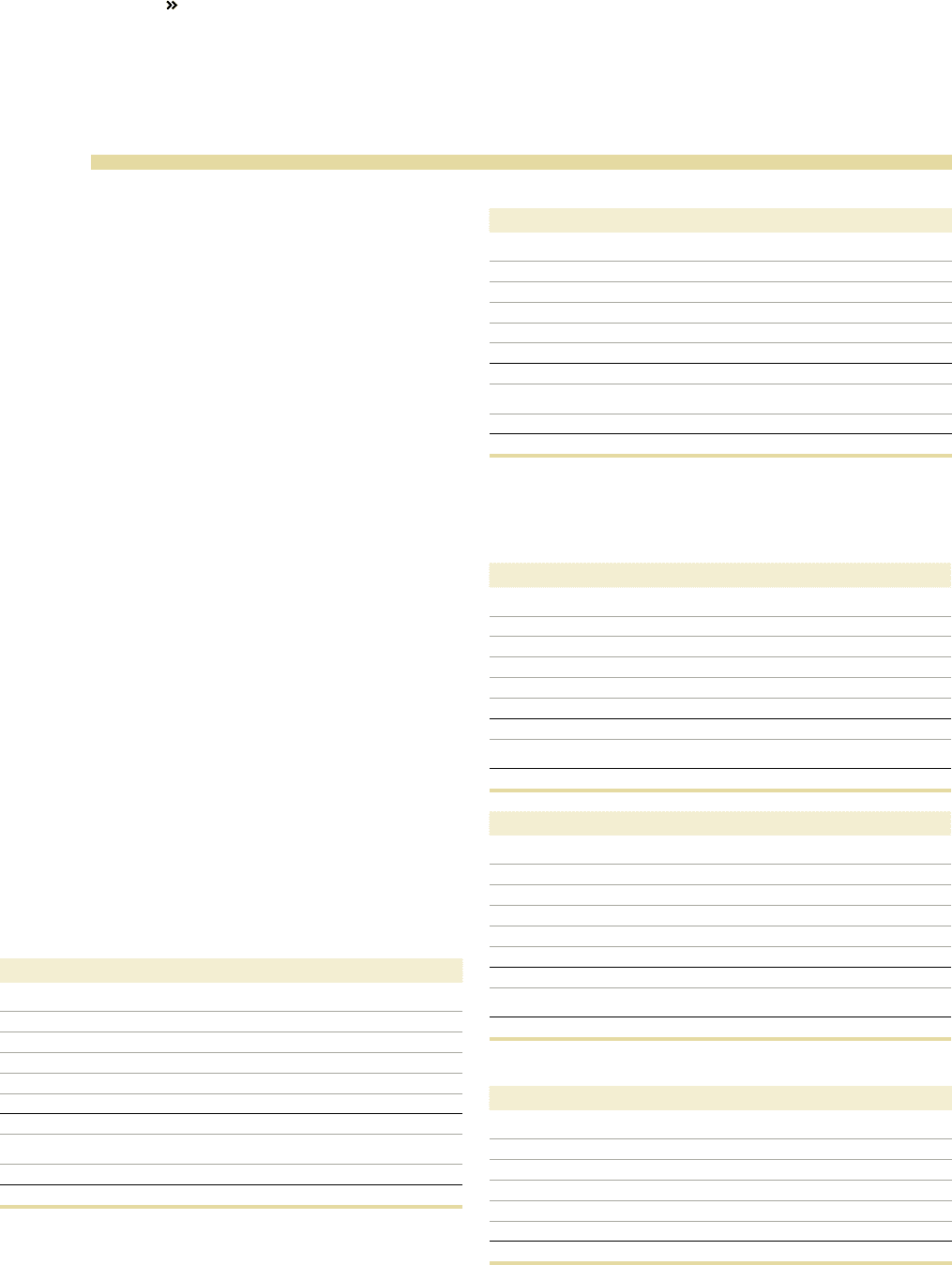

Depreciation and amortization 2011 2010

Trucks 8,531 8,721

Construction Equipment 1,903 1,975

Buses 472 464

Volvo Penta 474 453

Volvo Aero 504 436

Other (464) (710)

Industrial Operations 11,419 11,338

Customer Finance 2,572 2,454

Volvo Group total113,992 13,792

1 Of which write-down 102 (33).

Research and development expenses 2011 2010

Trucks 8,627 9,230

Construction Equipment 2,556 1,972

Buses 1,052 882

Volvo Penta 692 670

Volvo Aero 275 156

Other 74 60

Volvo Group total 13,276 12,970

SEGMENT REPORTING

6

NOTE

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

94