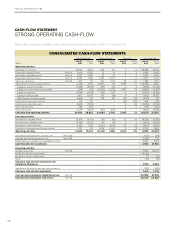

Volvo 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Volvo’s goal is a strong and stable

financial position

A long-term competitive market position requires

availability of capital to implement investments.

The financial strategy ensures that the

Group’s capital is used in the best possible man-

ner by:

• balancing shareholders’ expectations on favora-

ble returns with creditors’ demands for financial

stability

• strong and stable credit ratings

• diversified access to financing from the capital

markets

• margin in the balance sheet to cope with a

strong decline in the economy

• financing at competitive conditions to customers.

The goal concerning capital structure is defined

as the financial net debt for the Industrial Opera-

tions and it shall under normal circumstances be

below 40% of shareholders’ equity.

Volvo carefully monitors the trend of financial

key ratios to confirm that the financial position is

in line with the Group’s policy. The financial key

ratios include order intake as well as operational

and financial development.

The good demand for the Group’s products

continued in 2011 and has contributed to the

improvement of the Volvo Group’s profitability

and financial position. The financial net debt in

Industrial Operations declined during the year

from 37.4% of shareholders’ equity to 25.2%.

Volvo strives for strong, stable

credit ratings

The Volvo Group has continual meetings with

the credit rating agencies Moody’s and Standard

& Poor’s (S&P) to update them on the company’s

development. These meetings contribute to the

credit rating agencies’ ability to assess the

Group’s future ability to repay loans. A high long-

term credit rating provides access to additional

sources of financing and lower borrowing costs.

In April, 2011, S&P changed Volvo’s credit rat-

ing from BBB-/Baa3 with stable outlook to

BBB/Baa2 with stable outlook. The change

was attributable to a change in Volvo’s credit

measurement.

Moody’s rating of Volvo is BBB/Baa2 with

stable outlook since July 24, 2009.

Funding

Volvo works actively for a good balance between

short and long-term loans, as well as borrowing

preparedness in the form of credit facilities, to

satisfy the Volvo Group’s long-term financing

needs.

At the end of 2011, the Group had the equiva-

lent of SEK 37.2 billion in cash and cash equiva-

lents and short-term investments. In addition,

the Group had SEK 33.4 billion in granted but

unutilized credit facilities.

The purpose of Volvo’s long-term financial strategy is to ensure the best use of Group resources in

providing shareholders with a favorable return and offering creditors financial stability.

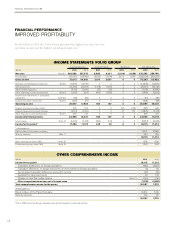

Credit rating at February 6, 2012

Short-term Long-term

Moody’s P-2 Baa2 stable

Standard & Poor's A2 BBB stable

DBRS (Canada) R-2 (high) –

R&I (Japan) a-1 A- positive

FINANCIAL STRATEGY

BALANCING GOOD RETURNS AND

FINANCIAL STABILITY

BOARD OF DIRECTORS’ REPORT 2011

68