Volvo 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Risk may be due to events in the world and can

affect a given industry or market. Risk can be

specific to a single company. At Volvo work is

carried out daily to identify, measure and man-

age risk – in some cases the Group can influ-

ence the likelihood that a risk-related event will

occur. In cases in which such events are beyond

the Group’s control, the Group strives to mini-

mize the consequences.

The risks to which the Volvo Group are exposed

are classified into three main categories:

• External-related risks – such as the cycli-

cal nature of the commercial vehicles busi-

ness, intense competition, changes in prices

for commercial vehicles and government reg-

ulations

• Financial risks – such as currency fluctua-

tions, interest levels fluctuations, valuations of

shares or similar instruments, credit risk and

liquidity risk.

• Operational risks – such as market recep-

tion of new products, reliance on suppliers,

protection and maintenance of intangible

assets, complaints and legal actions by cus-

tomers and other third parties and risk related

to human capital.

External-related risk

The commercial vehicles industry is cyclical

The Volvo Group’s markets undergoes signifi-

cant changes in demand as the general eco-

nomic environment fluctuates. Investments in

infrastructure, major industrial projects, mining

and housing construction all impact the Group’s

operations as its products are central to these

sectors. Adverse changes in the economic con-

ditions for the Volvo Group’s customers may also

impact existing order books through cancella-

tions of previously placed orders. The cyclical

demand for the Group’s products makes the

financial result of the operations dependable on

the Group’s ability to react to changes in demand,

in particular to the ability to adapt production lev-

els and production and operating expenses.

Intense competition

Continued consolidation in the industry is

expected to create fewer but stronger competi-

tors. Our major competitors are Daimler, Paccar,

Navistar, MAN, Scania, Caterpillar, Komatsu,

Cummins and Brunswick. In recent years, new

competitors have emerged in Asia, particularly

in China. These new competitors are mainly

active in their domestic markets, but are

expected to increase their presence in other

parts of the world.

Prices may change

The prices of commercial vehicles have, at

times, changed considerably in certain markets

over a short period. This instability is caused by

several factors, such as short-term variations in

demand, shortages of certain component prod-

ucts, uncertainty regarding underlying eco-

nomic conditions, changes in import regulations,

excess inventory and increased competition.

Overcapacity within the industry can occur if

there is a lack of demand, potentially leading to

increased price pressure.

Extensive government regulation

Regulations regarding exhaust emission levels,

noise, safety and levels of pollutants from pro-

duction plants are extensive within the industry.

Most of the regulatory challenges regarding

products relate to reduced engine emissions.

The Volvo Group is a significant player in the

commercial vehicle industry and one of the

world’s largest producers of heavy-duty diesel

engines. The product development capacity

within the Volvo Group is well consolidated to be

able to focus resources for research and devel-

opment to meet tougher emission regulations.

Future product regulations are well known, and

the product development strategy is well tuned

to the introduction of new regulations.

Financial risk

In its operations, the Volvo Group is exposed to

various types of financial risks. Group-wide policies,

which are updated and decided upon annually,

form the basis of each Group company’s manage-

ment of these risks. The objectives of the

Group’s policies for management of financial

risks are to optimize the Group’s capital costs by

utilizing economies of scale, to minimize negative

effects on income as a result of changes in

currency or interest rates, to optimize risk exposure

and to clarify areas of responsibility. Monitoring

and control that established policies are adhered

to is continuously conducted. Information about

key aspects of the Group’s system for internal

controls and risk management in conjunction

with the financial reporting is provided in the

Corporate Governance Report on page 150–159.

Most of the Volvo Group’s financial transactions

are carried out through Volvo’s in-house bank,

Volvo Treasury, that conducts its operations

within established risk mandates and limits.

Credit risks are mainly managed by the different

business areas.

All business operations involve risk – managed risk-taking is a condition

of maintaining a sustained favorable profitability.

RISKS AND UNCERTAINTIES

MANAGED RISK-TAKING

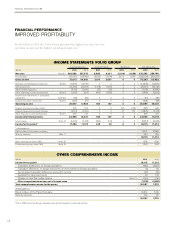

Currencies Interest rates in Sweden, Europe and the U.S.

09

7.2

10.4

04

7.3

9.1

05

7.5

9.2

06

7.4

9.3

07

6.8

9.3

08

7.8

10.9

03

8.0

9.1

02

9.7

9.1

01

10.3

9.2

SEK/USD

SEK/EUR

SEK/100 JPY

7.76.5 6.7 5.8 5.8 8.66.77.37.9

Source: Reuters

10

6.7

9.0

8.3

11

6.9

8.9

9.0

Sweden

Europe

The U.S.

07

4.3

4.3

4.0

08

2.4

2.9

2.2

09

3.4

3.4

3.8

02

5.3

4.8

4.5

03

4.6

4.1

4.0

04

4.4

4.0

4.2

05

3.4

3.4

4.3

06

3.7

3.8

4.8

01

5.1

4.8

5.0

Source: Reuters

Government bonds, 10 year benchmarks

10

3.3

3.0

3.3

%

%

%

11

1.6

1.8

1.9

69