Volvo 2011 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

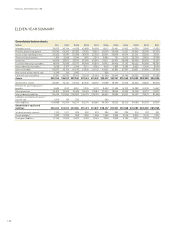

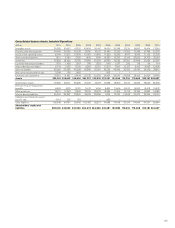

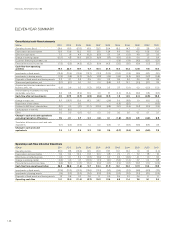

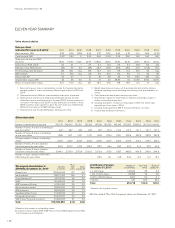

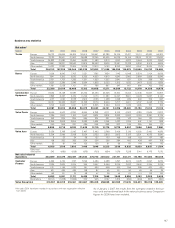

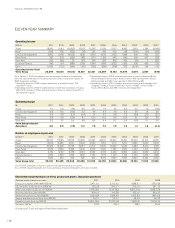

ELEVEN-YEAR SUMMARY

Volvo share statistics

Data per share

(adjusted for issues and splits)12011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001

Basic earnings, SEK18.75 5.36 (7.26) 4.90 7.37 8.03 6.44 4.72 0.14 0.66 (0.70)

Cash dividend, SEK 3.0010 2.50 0 2.00 5.50 10.0093.35 2.50 1.60 1.60 1.60

Share price at year-end, SEK

(B share) 75.30 118.50 61.45 42.90 108.50 90.70 74.90 52.70 43.70 28.40 35.20

Direct return, % (B share)24.0 2.1 – 4.7 5.1 11.0 4.5 4.7 10.585.6 4.5

Effective return, % (B share)3(34) 97 43 (59) 25.7 39.8 48.5 25.5 71.2 (14.8) 17.6

Price/earnings ratio (B share)48.6 22.1 neg 8.8 14.7 11.3 11.6 11.2 310 43 neg

EBIT multiple55.1 12.0 neg 3.6 9.7 10.3 9.3 9.2 14 23 25

Payout ratio, %634 47 – 41 75 62 52 53 1,143 242 neg

Shareholders’ equity, SEK742 36 33 41 41 43 38.80 34 34.60 37.40 40.60

Return on shareholders' equity 23.1 16.0 neg 12.1 18.1 19.6 17.8 13.9 0.4 1.7 neg

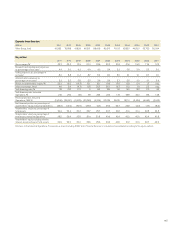

Other share data

2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001

Number of shareholders at year-end 251,715 240,043 233,311 220,192 197,519 183,735 195,442 202,300 208,500 211,000 214,000

Number of Series A shares outstanding at

year-end, million 643 657 657 657 657 131.4 131.4 131.5 131.7 131.7 131.7

Number of Series B shares outstanding

at year-end, million 1,385 1,371 1,371 1,371 1,369 273.4 273.1 278.6 287.8 287.8 287.8

Average number of shares outstanding,

million 2,027 2,027 2,027 2,027 2,025 404.7 405.2 418.5 419.4 419.4 422.4

Number of Series A shares traded in

Stockholm during the year, million 130.5 203.2 147.0 308.0 172.3 56.4 39.3 42.0 31.4 27.3 40.3

Number of Series B shares traded in

Stockholm during the year, million 2,944.1 2,272.4 2,713.9 3,130.0 2,712.4 617.0 518.7 498.0 404.8 349.4 344.4

Number of shares traded in ADR, NAS-

DAQ during the year, million – ———113.5 14.1 19.8 24.0 10.4 11.0 15.0

1 Basic earnings per share is calculated as income for the period divided by

average number of shares outstanding. Reporting according to IFRS from

2004.

2 Proposed dividend in SEK per share divided by share price at year-end.

3 Share price at year-end, including proposed dividend during the year,

divided by share price at beginning of the year, (2000 includes premium in

connection with repurchase, 2003 includes distribution of shares in Ainax,

2006 includes a share split 6:1 in which the sixth share was redeemed by

AB Volvo for an amount of SEK 5.00 per share).

4 Share price at year-end divided by basic earnings per share.

5 Market value at year-end minus net financial position and minority interests

divided by operating income excluding restructuring costs and revaluation of

shares.

6 Cash dividend divided by basic earnings per share.

7 Shareholders’ equity for shareholders in AB Volvo divided by number of

shares outstanding at year-end.

8 Including distribution of shares in Ainax equal to SEK 3.01 (share-split

adjusted) per Volvo share in 2004.

9 Including extra payment of SEK 5 through redemption of shares.

10 Proposed by the Board of Directors.

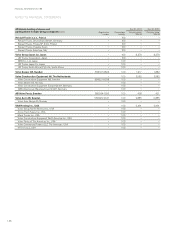

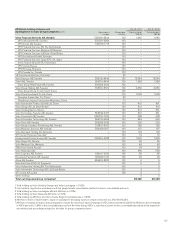

The largest shareholders in

AB Volvo, December 31, 20111Number

of shares

% of

total

votes Share

capital, %

Renault s.a.s. 138,604,945 17.7 6.8

Industrivärden 122,811,457 15.6 6.1

Violet Partners LP 43,727,400 5.6 2.2

SHB236,405,612 4.7 1.8

AMF Insurance & Funds 61,051,900 3.9 3.0

Alecta (pension funds) 87,650,000 3.8 4.3

AFA Insurance 26,024,563 3.3 1.3

Swedbank Robur Funds 81,098,942 2.7 4.0

Norwegian Government 63,945,595 2.4 3.2

SEBFunds/Trygg Life Insurance 44,469,536 2.1 2.2

Total 705,789,950 61.8 34.8

Distribution of shares,

December 31, 20111Number of

shareholders % of total

votes1Share of

capital, %1

1–1,000 shares 190,646 2.8 2.4

1,001–10,000 shares 56,088 7.6 5.5

10,001–100,000 shares 4,434 5.0 3.1

100,001– 547 84.6 89.0

Total 251,715 100.0 100.0

1 Based on the number of outstanding shares.

2 Comprises shares held by SHB, SHB Pension Fund, SHB Employee Fund, SHB

Pensionskassa and Oktogonen.

1 Based on all registered shares.

AB Volvo held 4.7% of the Company’s shares on December 31, 2011.

FINANCIAL INFORMATION 2011

146