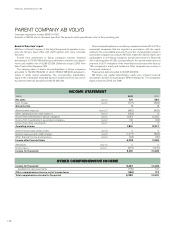

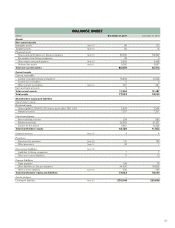

Volvo 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

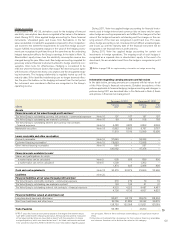

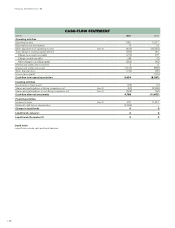

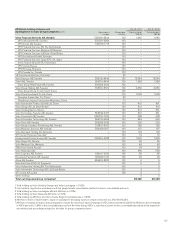

2011 2010

Current taxes – (176)

Deferred taxes (597) (1,055)

Total income taxes (597) (1,231)

Current taxes relate to prior periods.

Deferred taxes relate to estimated tax on the change in tax-loss carry-

forwards and temporary differences. Deferred tax assets are reported to

the extent that it is probable that the amount can be utilized against future

taxable income.

Deferred taxes related to change in tax-loss carryforwards amount to

an expense of 602 (1,063) and to changes in other temporary differences

to 5 (8).

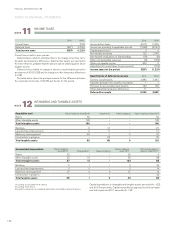

The table below shows the principal reasons for the difference between

the corporate income tax of 26.3% and the tax for the period.

2011 2010

Income before taxes 6,078 11,559

Income tax according to applicable tax rate (1,598) (3,040)

Capital gains/losses 0 0

Non-taxable dividends 723 2,146

Non-taxable revaluations of shareholdings (16) (8)

Other non-deductible expenses (6) (156)

Other non-taxable income 300 3

Adjustment of current taxes for prior periods – (176)

Income taxes for the period (597) (1,231)

Specification of deferred tax assets 2011 2010

Tax-loss carryforwards 2,885 3,487

Valuation allowancefor doubtful receivables 1 1

Provision for post-employment benefits 163 169

Other deductible temporary differences 11 –

Deferred tax assets 3,060 3,657

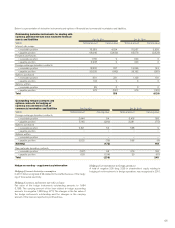

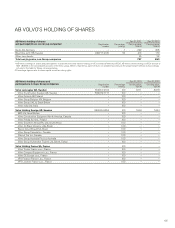

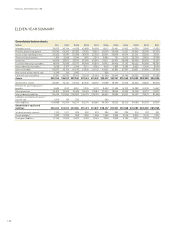

Acquisition cost Value in balance sheet 2010 Investments Sales/scrapping Value in balance sheet 2011

Rights 52 – – 52

Other intangible assets 138 – – 138

Total intangible assets 190 – – 190

Buildings 6 21 – 27

Land and land improvements 3 11 – 14

Machinery and equipment 46 1 0 47

Construction in progress – 32 – 32

Total tangible assets 55 65 0 120

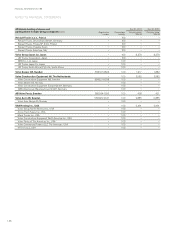

Accumulated depreciation Value in balance

sheet 20101Depreciation2Sales/scrapping Value in balance

sheet 2011 Net carrying value in

balance sheet 20113

Rights 52 – – 52 0

Other intangible assets 35 15 – 50 88

Total intangible assets 87 15 – 102 88

Buildings 2 1 – 3 24

Land and land improvements 0 0 – 0 14

Machinery and equipment 37 0 0 37 10

Construction in progress – – – – 32

Total tangible assets 39 1 0 40 80

1 Including accumulated write-downs.

2 Including write-downs.

3 Acquisition value, less accumulated depreciation, amortization and write-downs.

Capital expenditures in intangible and tangible assets amounted to – (22)

and 65 (1) respectively. Capital expenditures approved but not yet imple-

mented at year-end 2011 amounted to 1 (0).

INCOME TAXES

11

NOTE

INTANGIBLE AND TANGIBLE ASSETS

12

NOTE

FINANCIAL INFORMATION 2011

132

NOTES TO FINANCIAL STATEMENTS