Volvo 2011 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

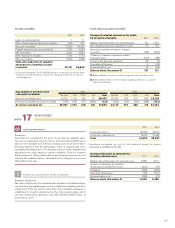

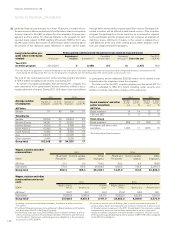

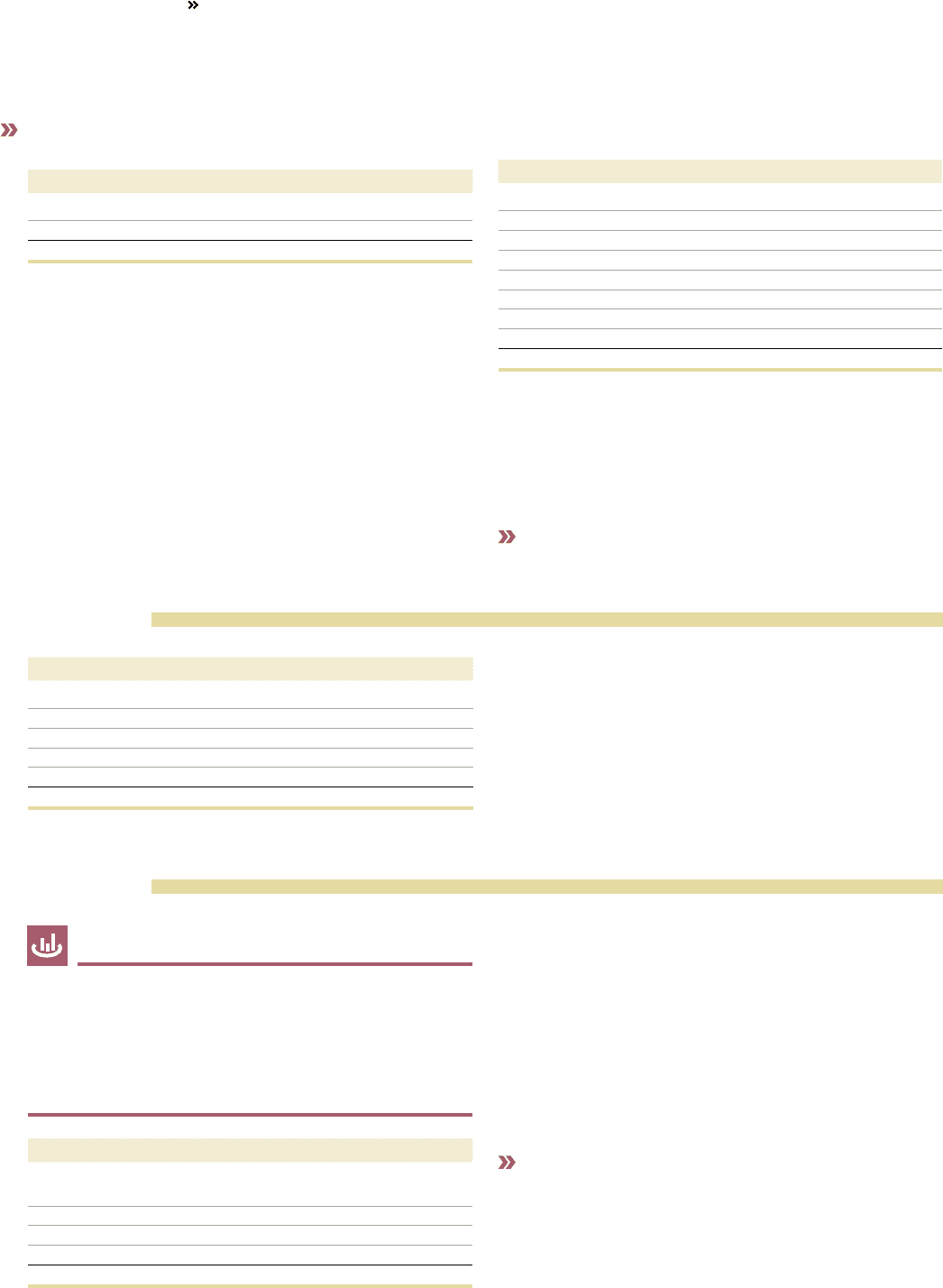

Current liabilities

Balance sheet amounts for loans were as follows:

2011 2010

Bank loans 12,639 12,261

Other loans 31,883 27,340

Total144,522 39,601

1 Of which loans raised to finance the credit portfolio of the customer financing

operations amount to 31,844 (29,690) and financial derivatives at fair value

1,362 (458).

Bank loans include current maturities of non-current loans 5,803 (3,246).

Other loans include current maturities of non-current loans, 17,681

(22,007), and commercial paper, 8,393 (1,416). Non-interest-bearing

current liabilities accounted for 99,152 (84,457), or 69% (68) of the Group’s

total current liabilities.

Balance sheet amounts for other current liabilities were as follows:

2011 2010

Advances from customers 3,642 3,416

Wages, salaries and withholding taxes 8,041 8,824

VAT liabilities 2,099 2,023

Accrued expenses and prepaid income 12,528 12,626

Deferred leasing income 1,683 1,640

Residual value liability 1,783 2,154

Other financial liabilities 367 242

Other liabilities 5,120 4,416

Total 35,263 35,341

Current liabilities also include trade payables of 56,788 (47,250), current

tax liabilities of 2,391 (1,732) and non interest-bearing and interest-bearing

liabilities held for sale, as recognized in Note 3. Secured bank loans at

year-end 2011 totalled 127 (216). The corresponding amount for other

current liabilities was 584 (1,442). Of current liabilities including trade

payables 102,331 (87,494) pertains to financial instruments. Refer to

note 30 Financial instruments.

Refer to Note 23 for an explanation of changes to assets pledged.

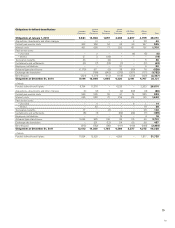

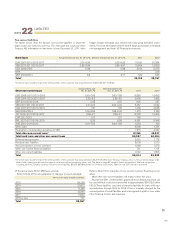

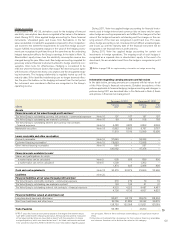

ASSETS PLEDGED

23

NOTE

2011 2010

Property, plant and equipment – mortgages 128 168

Assets under operating leases 265 107

Receivables 1,333 2,964

Cash, loans andmarketable securities 78 100

Other assets pledged 28 –

Total 1,832 3,339

At year-end, liabilities for which the above assets were pledged totalled

1,227 (2,946).

In 2010 an asset-backed securitization was completed. Under the

terms of the transaction, USD 616 M of securities were issued tied to

US-based loans with trucking and construction equipment assets as

collaterals. During 2011 the loans have been amortized and the collaterals

reduced.

CONTINGENT LIABILITIES

24

NOTE

Contingent liabilities

A contingent liability is recognized for a possible obligation, for which it is

not yet confirmed that a present obligation exists that could lead to an

outflow of resources; or for a present obligation that does not meet the

definitions of a provision or a liability as it is not probable that an outflow

of resources will be required to settle the obligation or when a sufficiently

reliable estimate of the amount cannot be made.

2011 2010

Credit guarantees issued for customers and

others 8,970 3,709

Tax claims 521 490

Residual value guarantees 2,969 2,993

Other contingent liabilities 4,694 3,811

Total 17,154 11,003

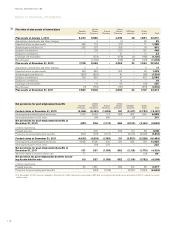

Tax claims amounting to 521 (490) pertain to charges against the Volvo

Group for which provisions are not considered necessary.

Other contingent liabilities include for example bid and performance

clauses and legal proceedings.

The recognized amounts for contingent liabilities reflect the Volvo

Group’s risk exposure on a gross basis. The recognized amounts have

thus not been reduced because of counter guarantees received or other

collaterals in cases where a legal offsetting right does not exist. At

December 31, 2011, the estimated value of counter guarantees received

and other collaterals, for example the estimated net selling price of used

products, amounted to 3,726 (3,893) and mainly pertains to credit guar-

antees and residual value guarantees.

For more information regarding residual value guarantees, see note 21.

Legal proceedings

The former labor agreement between Mack Trucks, Inc. and the United

Auto Workers Union (UAW) expired on September 30, 2007. Mack Trucks

and UAW subsequently entered into a new 40-month Master Agreement.

The agreement includes the establishment of an independent trust that

will completely eliminate Mack’s commitments for providing healthcare to

ACCOUNTING POLICY

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

116