Volvo 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

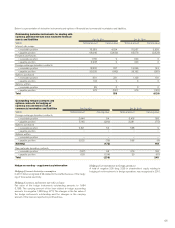

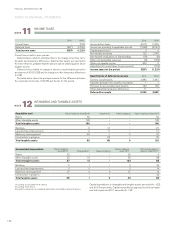

Provisions for pensions and similar benefits correspond to the actuarially

calculated value of obligations not insured with third parties or secured

through transfers of funds to pension foundations. The amount of pen-

sions falling due within one year is included. AB Volvo has insured the

pension obligations with third parties. Of the amount reported, 8 (0) per-

tains to contractual obligations within the framework of the PRI (Pension

Registration Institute) system.

The Volvo Pension Foundation was formed in 1996. Plan assets amount-

ing to 224 were contributed to the foundation at its formation, corresponding

to the value of the pension obligations at that time. Since its formation, net

contributions of 25 have been made to the foundation.

AB Volvo’s pension costs amounted to 69 (81).

In previous years, part of social costs has been reclassified to pension

costs. In the 2011 Annual Report, this part has not been reclassified to pen-

sion costs as an adaption to praxis. Pension costs for 2010 has been

adjusted downwards with 23.

The accumulated benefit obligation of all AB Volvo’s pension obligations

at year-end 2011 amounted to 646, which has been secured in part through

provisions in the balance sheet and through transfer of funds to pension

foundations. Net asset value in the Pension Foundation, marked to market,

accrued to AB Volvo was 9 lower than the corresponding pension obliga-

tions. A provision was recorded to cover this deficit.

Other provisions include provisions for restructuring measures of 42 (–).

Of the contingent liabilities amounting to 270,346 (250,606), 270,336

(250,597) pertained to Group companies.

Guarantees for various credit programs are included in amounts cor-

responding to the credit limits. These guarantees amount to 261,576

(243,089), of which guarantees on behalf of Group companies totalled

261,576 (243,089).

At the end of each year, the utilized portion amounted to 125,123

(108,562), including 125,113 (108,476) pertaining to Group companies.

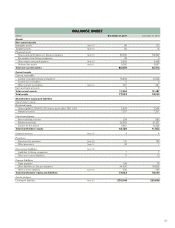

2011 2010

Wages, salaries and withholding taxes 70 94

Other liabilities 19 2

Accrued expenses and prepaid income 146 173

Total 235 269

No collateral is provided for current liabilities.

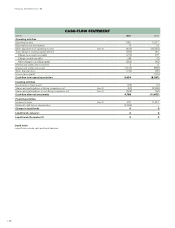

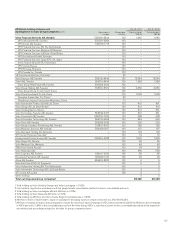

Other adjustments of operating income 2011 2010

Revaluation of shareholdings (46) 116

Group contributions and transfer price

adjustments, current year (7,110) (6,673)

Settlements of previous year’s Group contri-

butions and transfer price adjustments 6,673 (14,016)

Other 79 30

Total (404) (20,543)

Further information is provided in Notes 5, 6 and 7.

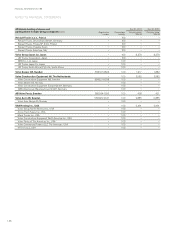

Shares and participations in non-Group

companies, net 2011 2010

Investments (508) (78)

Disposals – 15

Net investments in shares and

participations in non-Group companies (508) (63)

Investments and sales of shares in non-Group companies are presented

in Note 13.

Increase in loans

Increase in loans is related to the company’s liability in thegroup account

at Volvo Treasury AB. The liability has increased by281 (11,457).

Shares and participations in Group

companies, net 2011 2010

Investments (94) (2,386)

Disposals 1 –

Net investments in shares and

participations in Group companies (93) (2,386)

Investments and sales of shares in Group companies are shown in

Note13.

PROVISIONS FOR PENSIONS

16

NOTE

OTHER PROVISIONS

17

NOTE

OTHER CURRENT LIABILITIES

19

NOTE

CONTINGENT LIABILITIES

20

NOTE

CASH-FLOW

21

NOTE

NON-CURRENT LIABILITIES

18

NOTE

Non-current debt matures as follows:

2013 11

2016 or later 7

Total 18

FINANCIAL INFORMATION 2011

134

NOTES TO FINANCIAL STATEMENTS