Volvo 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

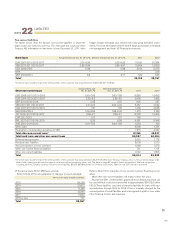

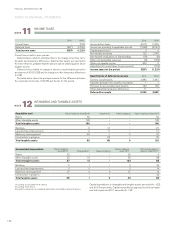

December 31, 2011 December 31, 2010

SEK M Carrying

value Fair

value Carrying

value Fair

value

Assets

Financial assets at fair value through profit and loss1

The Volvo Group's outstanding currency risk contracts – commercial exposure Note 16 107 107 197 197

The Volvo Group's outstanding raw materials contracts Note 16 68 68 168 168

The Volvo Group's outstanding interest and currencyrisk contracts

– financial exposure Note 16 4,482 4,482 3,863 3,863

Marketable securities Note 18 6,862 6,862 9,767 9,767

11,519 11,519 13,995 13,995

Loans receivable and other receivables

Accounts receivable Note 16 27,699 – 24,433 –

Customer financing receivables2Note 15 78,699 – 72,688 –

Other interest-bearing receivables Note 16 564 – 357 –

106,962 – 97,478 –

Financial assets available for sale1

Shares and participations for which:

a market value can be calculated Note 5 635 635 836 836

a market value can not be calculated Note 5 1,239 – 1,262 –

1,874 635 2,098 836

Cash and cash equivalents Note 18 30,379 30,379 22,966 22,966

Liabilities Note 22

Financial liabilities at fair value through profit and loss1

The Volvo Group'scommodity contracts – commercial exposure 279 279 79 79

The Volvo Group's outstanding raw materials contract 134 134 41 41

The Volvo Group's outstanding interest risk contracts – financial exposure 4,323 4,323 4,487 4,487

4,736 4,736 4,607 4,607

Financial liabilities valued at amortized cost

Long term bond loans and other loans 85,571 90,174 82,679 88,304

Short term bank loans and other loans 43,159 41,884 39,142 39,379

128,730 132,058 121,821 127,683

Trade Payables 56,788 – 47,250 –

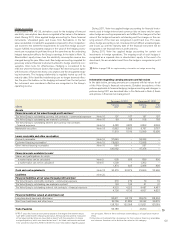

Hedge accounting

In accordance with IAS 39, derivatives used for the hedging of forecast

electricity consumption have been recognized at fair value in the balance

sheet. During 2011, Volvo applied hedge accounting for these financial

instruments. Unrealized gains and losses from fluctuations in the fair

value are debited or credited to a separate component in other comprehen-

sive income to the extent the requirements for cash-flow hedge account-

ing are fulfilled. Accumulated changes in the value of the hedging instru-

ments are recognized in profit and loss at the same time as the underlying

hedged transaction affects the Group’s earnings. In the table in Note 19,

Shareholders’ equity shows how the electricity consumption reserve has

changed during the year. When cash-flow hedge accounting is applied for

previously entered financial instruments utilized to hedge electricity con-

sumption, Volvo tests for effectiveness. Hedging is considered to be

effective when the forecast factors that impact the electricity price agree

with forecasts of future electricity consumption and the designated hedg-

ing instruments. The hedging relationship is regularly tested up until its

maturity date. If the identified relationships are no longer deemed effec-

tive, the price fluctuations on the hedging instrument from the last period

the instrument was considered effective are recognized in the Group’s

operating income.

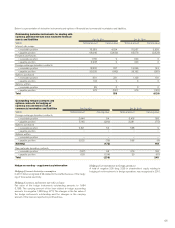

During 2011, Volvo has applied hedge accounting for financial instru-

ments used to hedge interest and currency risks on loans only for cases

when hedge accounting requirements are fulfilled. The changes in the fair

value of the hedge instruments outstanding and the changes in the car-

rying amount of the loan are recognized in profit and loss. For cases

where hedge accounting is not considered to be fulfilled, unrealized gains

and losses up until the maturity date of the financial instrument will be

recognized in net financial items in profit and loss.

During 2011, Volvo has applied hedge accounting for certain net

investments in foreign operations. The ongoing result of such hedges is

recognized as a separate item in shareholders’ equity. In the event of a

divestment, the accumulated result from the hedge is recognized in profit

and loss.

Refer to page 125 for supplementary information on hedge accounting.

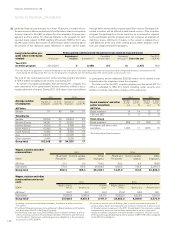

Information regarding carrying amounts and fair values

In the table below, carrying amounts are compared with fair values for all

of the Volvo Group’s financial instruments. Detailed descriptions of the

policies applicable to financial hedging, hedge accounting and changes in

policies during 2011 are described later in this Note and in Note 4, Goals

and policies in financial risk management.

1 IFRS 7 classifies financial instruments based on the degree that market values

have been utilized when measuring fair value. All financial instruments measured

at fair value held by Volvo are classified as level 2 with the exception of shares

and participations, which are classified as level 1 for listed instruments and level

3 for unlisted instruments. Refer to Note 5 for more information regarding valua-

tion principles. None of these individual shareholdings is of significant value for

Volvo.

2 Volvo does not estimate the risk premium for the customer financing receivables

and chooses therefore not to disclose fair value for this category. 123