Volvo 2011 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

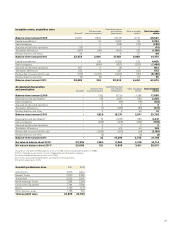

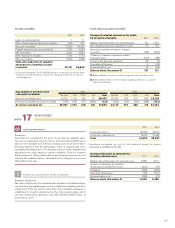

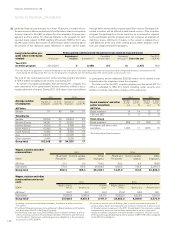

Summary of provision for

post-employment benefits 2011 2010

Obligations 40,358 36,121

Fair value of plan assets 23,873 22,954

Funded status (16,485) (13,167)

Unrecognized actuarial (gains) and losses 11,939 6,995

Unrecognized past service costs 222 310

Net provisions for post-employment

benefits (4,324) (5,862)

Whereof related to Assets held for sale 64 –

Net provision for post-employment

benefits excluding Assets held for sale (4,388) (5,862)

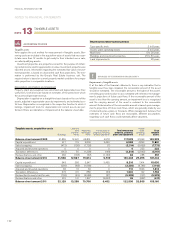

Assumptions applied for actuarial

calculations, % December 31

2011 December 31

2010

Sweden

Discount rate13.50 4.75

Expected return on plan assets26.00 6.00

Expected salary increase 3.00 3.00

Inflation 1.50 1.50

United States

Discount rate1 3 3.00–4.75 3.25–5.50

Expected return on plan assets27.65 7.65

Expected salary increase 3.00 3.00

Inflation 2.00 2.00

France

Discount rate14.50 4.50

Expected salary increase 3.00 1.00–3.00

Inflation 1.50 1.50

Great Britain

Discount rate14.75–5.00 5.40–5.50

Expected return on plan assets23.60–4.50 5.00

Expected salary increases 3.30–3.40 3.70–3.85

Inflation 3.20 3.20

1 The discount rate for each country is determined by reference to market yields

on high-quality corporate bonds. In countries where there is no functioning market

in such bonds, the market yields on government bonds are used. The discount

rate for the Swedish pension obligation 2011 is determined by reference to

mortgage bonds.

2 Applicable in the subsequent accounting period. These assumptions reflect the

expected long-term return rate on plan assets, based upon historical yield rates

for different categories of investments and weighted in accordance with the

foundation’s investment policy. The expected return has been calculated net of

administrative expenses and applicable taxes.

3 For all plans except one the discount rate used is within the range 4.25–4.75%

(4.75–5.50).

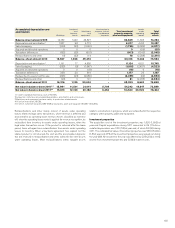

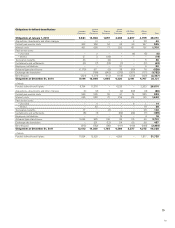

Pension costs 2011 2010

Current year service costs 867 896

Interest costs 1,448 1,510

Expected return on plan assets (1,405) (1,402)

Actuarial gains and losses1326 420

Past service costs

– Unvested 9 19

– Vested 60 28

Curtailments and settlements 50 (38)

Termination benefits 84 34

Pension costs for the period, defined-

benefit plans 1,439 1,467

Pension costs for defined-contribution plans22,032 2,107

Total pension costs for the period 3,471 3,574

1 For each plan, actuarial gains and losses are recognized as income or expense

when the accumulated amount exceeds the so-called corridor. The income or

expenses are then recognized over the expected average remaining service

period of the employees.

2 In certain countries, part of social cost relate to pensions. In previous years,

Volvo has reclassified such portion of social cost to pension cost for Swedish

group companies. In the 2011 Annual Report, these pension related components

of social cost has not been reclassified to pension cost, which makes for a better

comparison with other Swedish companies. Pension cost for 2010 has been

adjusted downwards with an amount of 1,166 compared to the 2010 Annual

Report.

Costs for the period, post-employment

benefits other than pensions 2011 2010

Current year service costs 85 49

Interest costs 148 170

Expected return on plan assets – –

Actuarial gains and losses19 (1)

Past service costs

– Unvested 5 –

– Vested – 26

Curtailments and settlements (35) 2

Termination benefits 25 7

Total costs for the period, post-employ-

ment benefits other than pensions 237 253

1 For each plan, actuarial gains and losses are reported as income or expense when

the accumulated amount exceed the so called corridor. The income or expenses

are then recognized over the expected average remaining service period of the

employees.

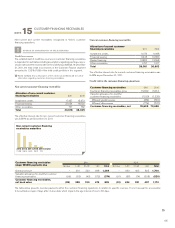

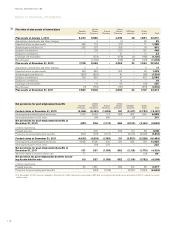

An increase of one percentage point per year in healthcare costs would

increase the accumulated post-employment benefit obligation as of

December 31, 2011 by approximately 164, and the post-employment benefit

expense for the period by approximately 8. A decrease of one percentage

point would decrease the accumulated value of obligations by about 136

and reduce costs for the period by approximately 7. Calculations made as

of December 31, 2011 show an annual increase of 8% in the weighted

average per capita costs of covered health care benefits. It is assumed

that the percentage will decline gradually to 4.5% until 2029 and subse-

quently remain at that level.

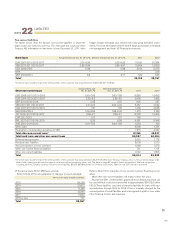

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

110