Volvo 2011 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A GLOBAL GROUP 2011

16

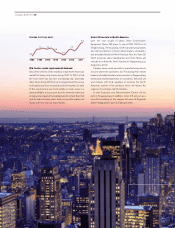

Growing truck market

In 2011, the total market for heavy-duty trucks in North

America increased by 52% to 216,100 trucks compared to

142,100 in the previous year. Demand was strong through-

out the year, driven primarily by the need to replace the

industry’s aging highway tractor population. In 2012, the

total market for heavy-duty trucks in North America is

expected to grow to a level of about 250,000 trucks.

Following a number of years with weak market condi-

tions, the market for construction equipment rose by

37% in 2011 compared to 2010. For 2012, the market is

expected to grow by 15–25% compared to 2011.

The North American market for city buses declined

due to the budget cuts still in effect in many cities. The

coach market was also weak.

Increased market shares thanks to good products

During 2011, Volvo Group captured market shares in North

America. In the U.S. the Group’s combined market share in

the heavy-duty segment rose from 18.0% in 2010 to

19.8% in 2011. The increased market share is the result of

a competitive customer offering of trucks equipped with

engines that provide considerable fuel savings.

The new generations of engines that comply with the

EPA 2010 emission standards combined with the Group’s

automated mechanical transmissions, the I-shift of Volvo

Trucks and the Mack mDRIVE, provide for fuel savings of

up to 5% compared to the previous generations of

engines. The driveline package also has better driveability,

less wear and improved safety.

At the annual Mid-America Trucking Show in Louisville,

Kentucky, both Mack and Volvo Trucks furthermore intro-

duced trucks with new aerodynamic and powertrain features

which, when combined with the improvements already

achieved through the use of SCR technology, deliver fuel

efficiency gains of 8-12% over previous generations of

trucks.

The new and improved drivelines has meant that an

increasing number of customers opt for Volvo Group

engines. During 2011, 79% of Volvo trucks built in North

America were equipped with Volvo engines. Mack Trucks

are solely equipped with the Group’s Mack engines.

The Group’s bus business also had successes. In spite

of a weak market, Prevost’s share of the North American

market for coaches increased to 34% (24). Nova Bus had

a market share of 15% for city buses.

North America is the Group’s third largest market and

its overall development was very positive in 2011.

A GLOBAL GROUP 2011

DEVELOPMENT BY CONTINENT

SUCCESS IN NORTH AMERICA