Volvo 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

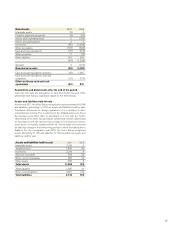

The Volvo Group’s cash, cash equivalents and

marketable securities combined, amounted to

SEK 37.2 billion at December 31, 2011. Of this,

SEK 9.3 billion are restricted for immediate use

by the Volvo Group compared to SEK 7.4 billion

a year earlier. In addition to this, granted but not

utilized credit facilities amounted to SEK 33.4

billion.

Total assets in the Group amounted to SEK

353.2 billion on December 31, 2011, an

increase of SEK 35.2 billion compared to year-

end 2010. The increase is mainly a result of

increase in inventories and accounts receiva-

bles, increased customer financing receivables

due to portfolio growth in the Customer Finance

Operations and increase in assets under oper-

ating lease mainly related to the construction

equipment rental operation.

The Group’s intangible assets amounted to

SEK 39.5 billion on December 31, 2011. Invest-

ments in research and development amounted

to SEK 4.2 billion in 2011, resulting in a net

value of capitalized development costs of SEK

11.5 billion at the end of the year. The Group’s

total goodwill amounted to SEK 23.9 billion on

December 31, 2011, an increase by SEK 1.0 bil-

lion compared to year-end 2010 as a result of

aquisitions in the construction equipment rental

operation.

The tangible assets increased by SEK 4.6 bil-

lion during 2011, mainly related to the expansion

in the construction equipment rental operation.

The value of the inventories increased by

SEK 4.8 billion during 2011. The increase is

mainly related to finished products within the

truck operations and construction equipment.

The net value of assets and liabilities related

to pensions and similar obligations amounted to

SEK 4.4 billion on December 31, 2011, a

decrease of SEK 1.5 billion compared to year-

end 2010. Post-employment benefits valued at

SEK 12.2 billion were reported outside the

Volvo Group’s balance sheet. For further infor-

mation see Note 20.

At year-end, the equity ratio in the Industrial

Operations was 28.5% and in the Volvo Group

24.3%. Shareholder’s equity in the Volvo Group

amounted to SEK 85.7 billion at December 31,

2011.

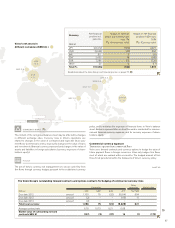

Net financial position, SEK M Industrial Operations Volvo Group

Dec 31

2011

Dec 31

2010

Dec 31

2011

Dec 31

2010

Non-currentinterest-bearing assets

Non-current customer-financing receivables – – 40,618 36,025

Non-current interest-bearing receivables 757 941 694 766

Currentinterest-bearing assets

Customer-financing receivables – – 38,081 36,663

Interest-bearing receivables 1,461 1,071 667 342

Internal funding 2,253 7,505 – –

Interest-bearing assets held for sale 4 – 4 –

Marketable securities 6,838 9,735 6,862 9,767

Cash and bank 29,113 21,756 30,379 22,966

Total financial assets 40,426 41,008 117,305 106,529

Non-currentinterest-bearing liabilities

Bond loans (38,192) (38,767) (38,192) (38,767)

Other loans (38,848) (37,180) (47,765) (45,327)

Internal funding 35,453 26,971 – –

Currentinterest-bearing liabilities

Loans (38,644) (32,101) (44,522) (39,601)

Internal funding 24,837 21,220 – –

Interest-bearing liabilities held for sale (6) – (6) –

Total financial liabilities (55,400) (59,857) (130,485) (123,695)

Net financial position excl. post employment

benefits (14,974) (18,849) (13,180) (17,166)

Provision for post employment benefits, net (4,372) (5,842) (4,388) (5,862)

Net financial position incl. post employment

benefits (19,346) (24,691) (17,568) (23,028)

Change in net financial position, Industrial Operations, SEK bn 2011 2010

Beginning of period (24.7) (41.5)

Cash flow from operating activities 26.9 28.8

Investments in fixed assets (to)/from (14.0) (10.6)

Disposals 1.2 0.8

Operating cash-flow 14.1 19.0

Investments and divestments of shares (0.1) (0.1)

Acquired and divested operations, net (3.0) 0.2

Capital injections (to)/from Customer Finance Operations (0.1) (0.5)

Currency effect (1.9) (1.6)

Payment to AB Volvo shareholders (5.1) –

Dividend paid to minority shareholders 0.0 (0.1)

Other 1.5 (0.1)

Total change 5.4 16.8

Net financial position at end of period (19.3) (24.7)

Net debt, Industrial Operations, SEK bn

2010 2011

Q4

(19.3)

Q3

(29.6)

Q2

(28.3)

Q1

(27.3)

Q4

(24.7)

Q3

(38.4)

Q2

(39.9)

Q1

(45.0)

Read more about capital structure on page 6–7

77