Volvo 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

retired employees. The trust was approved by the U.S. District Court for

the Eastern District of Pennsylvania in September 2011. The Volvo Group

will fund the trust with USD 525 M, whereof a significant part has been

paid during the fourth quarter 2011. The remaining funding obligation is

recognized as a financial liability and the remaining amortizations will be

recognized as cash flow from financing activities.

In July 1999, Volvo Truck Corporation (VTC) and Volvo Construction

Equipment (VCE) entered into a Consent Decree with the U.S. Environ-

mental Protection Agency (EPA). The Consent Decree stipulated, among

other provisions, that new stricter emission requirements for certain

engines that would come into effect on January 1, 2006, should be

applied by VTC and VCE from January 1, 2005. The Consent Decree was

later transferred from VTC and VCE to Volvo Powertrain Corporation. Dur-

ing 2008, the EPA demanded stipulated penalties from Volvo Powertrain

Corporation in the amount, including interest, of USD 72 M, alleging that

the stricter standards under the Consent Decree should have been applied

to engines manufactured by Volvo Penta during 2005. Volvo Powertrain

disagrees with EPA’s interpretation and is defending the case vigorously

based on, among other grounds, the fact that the Volvo Penta engines

were not subject to the Consent Decree. The dispute was referred to a

U.S. court. The amount requested by the EPA is included in other contingent

liabilities.

Nissan Diesel Thailand Co. Limited (the “NDT”) on November 30, 2009

filed a claim at the Pathumthani Provincial Court of First Instance, Thai-

land, against AB Volvo and three of its employees, claiming damages in

the sum of Baht 10.5 billion (equivalent to approximately SEK 2.3 billion).

NDT was one of UD Trucks Corporation’s (UDT), a wholly-owned subsidiary

of AB Volvo, private dealers. NDT claims that AB Volvo’s actions caused

UDT to unlawfully terminate two agreements dated December 27, 2002

between UDT and NDT. In September 2011, a settlement was reached´,

finally settling the submitted claims. The settlement had an insignificant

impact on the consolidated operating income and financial position of the

Volvo Group.

Volvo is subject to a number of investigations initiated by competition

authorities. The Volvo Group is cooperating fully with the respective

authority.

In September 2010, Volvo Trucks’ and Renault Trucks’ UK subsidiaries

have, together with a number of other international truck companies,

become the subject of an investigation initiated by the OFT (Office of Fair

Trading), the British Competition Commission. Volvo Trucks’ and Renault

Trucks’ British subsidiaries have received letters from the OFT as part of

the investigation.

In January 2011, the Volvo Group and a number of other companies in

the truck industry became part of an investigation by the European Com-

mission regarding a possible violation of EU antitrust rules.

In April 2011, the Volvo Group’s truck business in Korea and a number

of other truck companies became the subject of an investigation by the

Korean Fair Trade Commission.

In May 2011, Volvo Penta became part of an investigation by the European

Commission regarding a possible violation of EU antitrust rules.

In August 2011, Volvo Penta became part of an investigation by the

Swedish competition authority regarding a possible violation of antitrust

rules. In December 2011, the Swedish Competition Authority closed the

investigation, without further actions.

Given the nature of the ongoing investigations initiated by competition

authorities, the Volvo Group cannot exclude that they may affect the

Group’s result and cash flow with an amount that may be material. How-

ever, as regards the investigations initiated in Europe, it is too early to

assess whether and when such effect may occur and hence if and when

it could be accounted for. The Volvo Group has therefore not reported any

contingent liability or any provision for any of the investigations initiated in

Europe. Concerning the investigation initiated in Korea a contingent liability

has however been registered.

Global companies such as Volvo are occasionally involved in tax pro-

cesses of varying scope and in various stages. Volvo regularly assesses

these tax processes. When it is probable that additional taxes must be

paid and the outcome can be reasonably estimated, the required provision

is made.

Volvo is also involved in a number of other legal proceedings. Volvo

does not believe that any liabilities related to such proceedings are likely

to entail any risk, in the aggregate, of having a material effect on the

financial position of the Volvo Group.

TRANSACTIONS WITH RELATED PARTIES

25

NOTE

The Volvo Group engages in transactions with some of its associated

companies. The transactions consist mainly of sales of vehicles to deal-

ers. Commercial terms and market prices apply for the supply of goods

and services to/from associated companies.

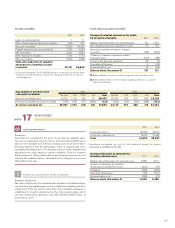

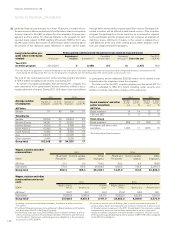

2011 2010

Sales to associated companies 1,296 1,082

Purchase from associated companies 60 50

Receivables from associated companies,

Dec 31 186 174

Liabilities to associated companies,

Dec 31 129 125

The Group’s holdings of shares in associated companies are presented in

Note 5, Shares and participations.

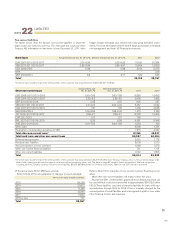

The Volvo Group also engages in transactions with Renault s.a.s. and

its subsidiaries. Sales to and purchases from Renault s.a.s. amounted to

53 (52) and 2,321 (1,654). Receivables from and liabilities to Renault

s.a.s. totalled 11 (15) and 372 (291), respectively, at December 31, 2011.

Sales were mainly from Renault Trucks to Renault s.a.s. and comprised

components and spare parts. Purchases were mainly made by Renault

Trucks from Renault s.a.s. and primarily comprised light trucks. Renault

Trucks has a license from Renault s.a.s. for the use of the trademark

Renault.

Equipment of minor value was divested to a former member of Group

management after valuation by an independent valuer.

117