Volvo 2011 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

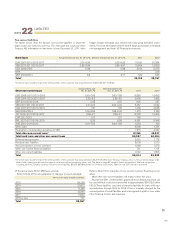

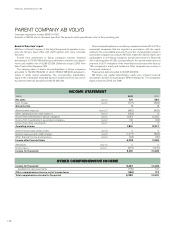

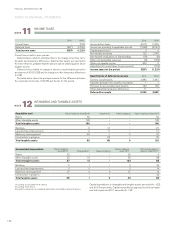

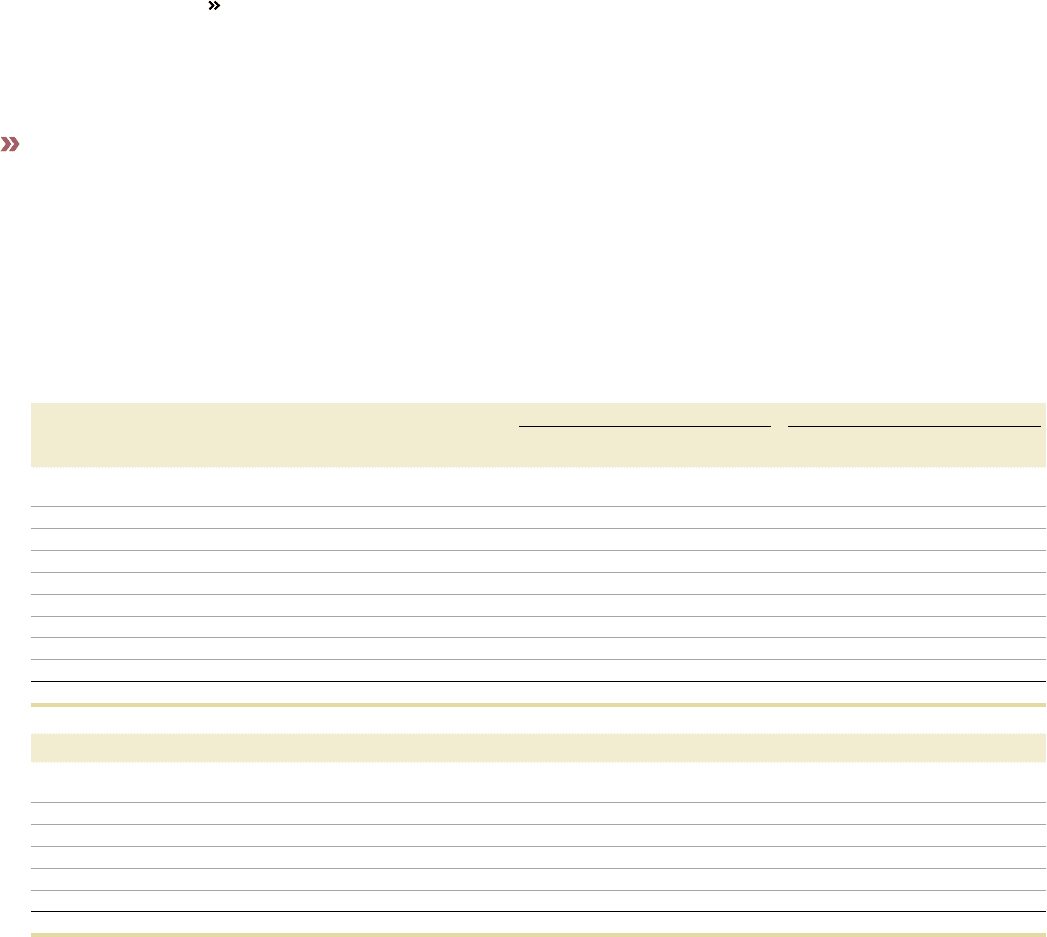

Reported in operating income12011 2010

SEK M Gains/

losses Interest

income Interest

expenses Gains/

losses Interest

income Interest

expenses

Financial assets and liabilities at fair value through

profit and loss2

Currency riskcontracts-commercial exposure3(91) – – 661 – –

Loans receivable and other receivables

Accounts receivables / trade payables 65 – – (239) – –

Customer financing receivables VFS 68 4,862 – 58 5,144 –

Financial assets available for sale

Shares and participations for which a market value can be calculated 20 – – 40 – –

Shares and participations for which a market value cannot be calculated 25 – – 10 – –

Financial liabilities valued at amortized cost4– – (2,456) – – (2,830)

Effect on operating income 87 4,862 (2,456) 530 5,144 (2,830)

Reported in net financial items5

Financial assets and liabilities at fair value through

profit and loss

Marketable securities 224 – – 290 – –

Interest and currencyrate riskcontracts- financial exposure6(409) – – (1,319) – –

Loans receivable and other receivables – 3 – – 7 –

Cash and Cash equivalents7– 545 – (274) 423 –

Financial liabilities valued at amortized cost6771 – (2,642) 1,560 – (2,591)

Effect on net financial items 586 548 (2,642) 257 430 (2,591)

1 Information is provided regarding changes in provisions for doubtful receivables

and customer financing in Notes 15 and 16, Accounts receivable and customer

financing receivables, as well as in Note 8, Other financial income and expenses.

2 Accrued and realized interest is included in gains and losses related to Financial

assets and liabilities at fair value through profit and loss.

3 Volvo uses forward contracts and currency options to hedge the value of future

payment flows in foreign currency. Both unrealized and realized result on currency

risk contracts are included in the table. Refer to Note 4, Goals and policies in

financial risk management.

4 Interest expenses attributable to financial liabilities valued at amortized cost rec-

ognized in operating income include interest expenses for financing operational

leasing activities, not classified as financial instruments.

5 In gains, losses, income and expenses related to financial instruments recognized

in Net financial items, 569 (520) was recognized under other financial income

and expenses. Refer to Note 9, Other financial income and expenses for further

information. Interest expenses attributable to pensions, 191 (276) are not included

in this table.

6 Gains and losses related to changes in foreign currency rates on currency rate

risk contracts for financial exposure is neg 746 (neg 1,637) and 771 (1,560) for

financial liabilities valued at amortized cost. Refer to Note 9, Other financial income

and expenses for further information.

7 The net effect of gains and losses related to the devaluation in Venezuela 2010

was neg 274.

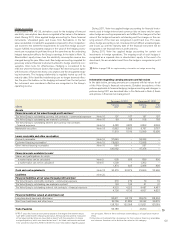

Derecognition of financial assets

Financial assets that have been transferred are included in full or in part

in the reported assets of the Volvo Group pursuant to the degree the risk

and rewards related to the asset have been transferred to the recipient. In

line with IAS 39, Financial Instruments, Recognition and Measurement, an

evaluation is performed to establish whether, substantially, all the risks

and rewards have been transferred to an external party. Where Volvo con-

cludes this is not the case, the portion of the financial assets correspond-

ing to Volvo’s continuous involvement is recognized. At December 31,

2011, assets corresponding to Volvo’s continuous involvement, primarily

within customer financing operations, in an amount of SEK 0.6 billion (1.2)

were recognized by Volvo.

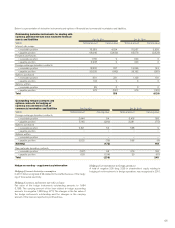

Gains, losses, interest income and expenses related to financial

instruments

The table below shows how gains and losses as well as interest income

and expenses have affected income after financial items in the Volvo

Group divided on the different categories of financial instruments.

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

124