Volvo 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

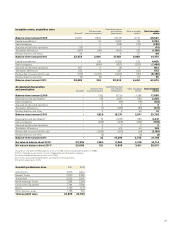

LEASING

14

NOTE

Volvo as the lessor

Leasing contracts are defined in two categories, operational and financial

leases, depending on the contract’s financial implications. Operational

leasing contracts are recognized as non-current assets in Assets under

operational leases. Income from operational leasing is recognized equally

distributed over the leasing period. Straight-line depreciation is applied to

these assets in accordance with the terms of the undertaking and the

deprecation amount is adjusted to correspond to the estimated realizable

value when the undertaking expires. Assessed impairments are charged

to the income statement. The product’s assessed realizable value at expi-

ration of the undertaking is reviewed continuously on an individual basis.

Financial leasing agreements are recognized as either non-current or

current receivables in the customer finance operations. Payments from

financial leasing contracts are distributed between interest income and

amortization of the receivable in the customer finance operations.

Volvo as the lessee

Volvo evaluates leasing contracts in accordance with IAS 17, Leases. In

those cases in which risks and rewards that are related to ownership are

substantially held by Volvo, so-called financial leases, Volvo recognizes

the asset and related obligation in the balance sheet at the lower of the

leased asset’s fair value or the present value of minimum lease payments.

Future leasing fee commitments are recognized as obligations. The lease

asset is depreciated in accordance with Volvo’s policy for the respective

non-current asset. The lease payments when made are allocated between

amortization and interest expenses. If the leasing contract is considered

to be a so-called operational lease, lease payments are charged to profit

or loss over the lease contract period.

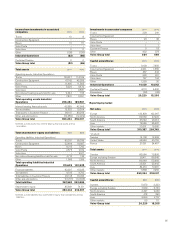

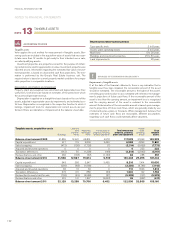

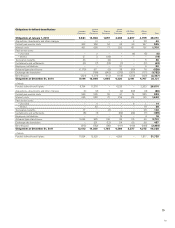

Volvo as the lessor

At December 31, 2011, future rental income from non-cancellable finan-

cial and operational leases (minimum leasing fees) amounted to 50,704

(45,530). Future rental income is distributed as follows:

Finance

leases Operating

leases

2012 12,562 4,111

2013–2016 24,227 8,447

2017 or later 604 753

Total 37,393 13,311

Allowance for uncollectible future rental

income (414)

Unearned rental income (3,100)

Present value of future rental income related

to non-cancellable leases 33,879

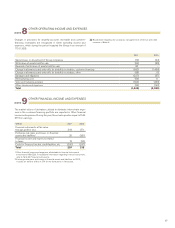

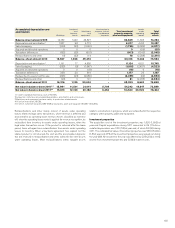

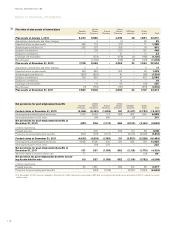

Volvo as a lessee

At December 31, 2011, future rental payments (minimum leasing fees)

related to non-cancellable leases amounted to 3,799 (3,916).

Future rental payments are distributed as follows:

Finance

leases Operating

leases

2012 459 834

2013–2016 360 1,660

2017 or later 63 423

Total 882 2,917

Rental expenses amounted to:

2011 2010

Finance leases:

Contingent rents (12) (8)

Operating leases:

Contingent rents (20) (20)

Rental payments (1,035) (923)

Sublease payments 5 6

Total (1,062) (945)

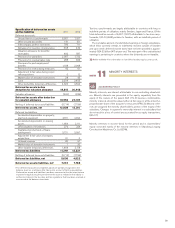

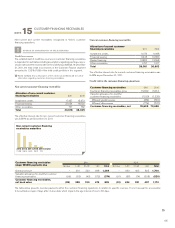

Carrying amount of assets subject to financial leases:

2011 2010

Costs:

Buildings 92 124

Land and land improvements 53 69

Machinery and equipment 1,901 1,863

Assets under operating lease1194 338

Total 2,240 2,394

Accumulated depreciation:

Buildings (30) (41)

Land and land improvements - –

Machinery and equipment (1,231) (1,174)

Assets under operating lease1(68) (81)

Total (1,329) (1,296)

Carrying amount in the balance sheet:

Buildings 62 83

Land and land improvements 53 69

Machinery and equipment 670 689

Assets under operating lease1126 257

Total 911 1,098

1 Refer to assets leased by Volvo as financial lease which are later leased to

customers as operating lease.

ACCOUNTING POLICIES

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

104