Volvo 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

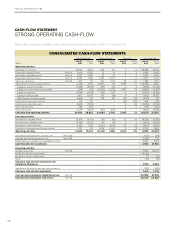

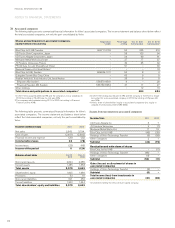

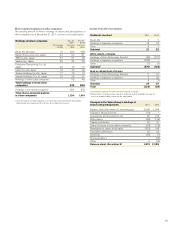

Currencies Other

currencies Market value

Millions USD GBP EUR JPY Net SEK

Due date 2012 amount 1,100 75 (22) (5,514) 604

Due date 2013 amount (2) – – (115) 17

Due date 2014 amount (2) – – – -

Total local currency 1,096 75 (22) (5,629) 621

Average contract rate 6.76 10.73 9.21 0.08

Market value of outstanding forward

contracts SEK M (147) (3) (37) 16 (1) (172)

The Volvo Group’s outstanding forward contracts and options contracts for hedging of commercial currency risks

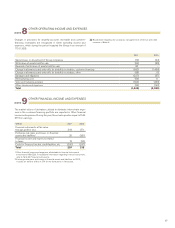

CURRENCY RISKS B

The content of the recognized balance sheet may be affected by changes

in different exchange rates. Currency risks in Volvo’s operations are

related to changes in the value of contracted and expected future pay-

ment flows (commercial currency exposure), changes in the value of loans

and investments (financial currency exposure) and changes in the value of

assets and liabilities in foreign subsidiaries (currency exposure of share-

holders’ equity).

POLICY

The aim of Volvo’s currency risk management is to secure cash flow from

firm flows through currency hedges pursuant to the established currency

CURRENCY RISKS

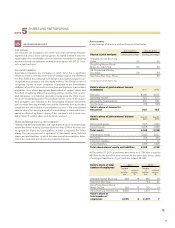

D

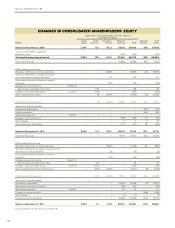

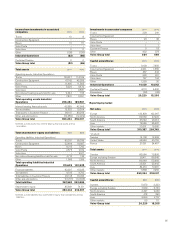

Currency Net financial

position incl.

pensions

Impact onearnings

before tax if interest rate

rises 1%

A (Interest-rate risks)

Impact on Net financial

position if SEK rises

10%

B

(Currency risks)

SEK M

JPY (24,272) (182) 2,427

USD (5,644) (42) 564

INR 811 6 (81)

CNY 2,453 18 (245)

EUR 7,286 55 (729)

Other 20 0 (17)

Total C (19,346) (145) 1,919

Read more about the Volvo Group’s net financial position on page 77.

F

cont. >>

policy, and to minimize the exposure of financial items in Volvo’s balance

sheet. Below is a presentation on how this work is conducted for commer-

cial and financial currency exposure, and for currency exposure of share-

holders’ equity.

Commercial currency exposure

Transaction exposure from commercial flows

Volvo uses forward contracts and currency options to hedge the value of

future payment flows in foreign currencies. Volvo only hedges firm flows,

most of which are realized within six months. The hedged amount of firm

flows for all periods fall within the framework of Volvo’s currency policy.

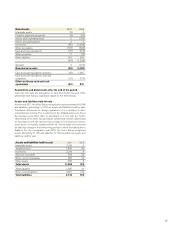

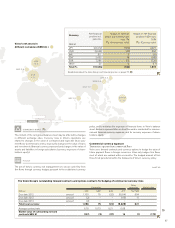

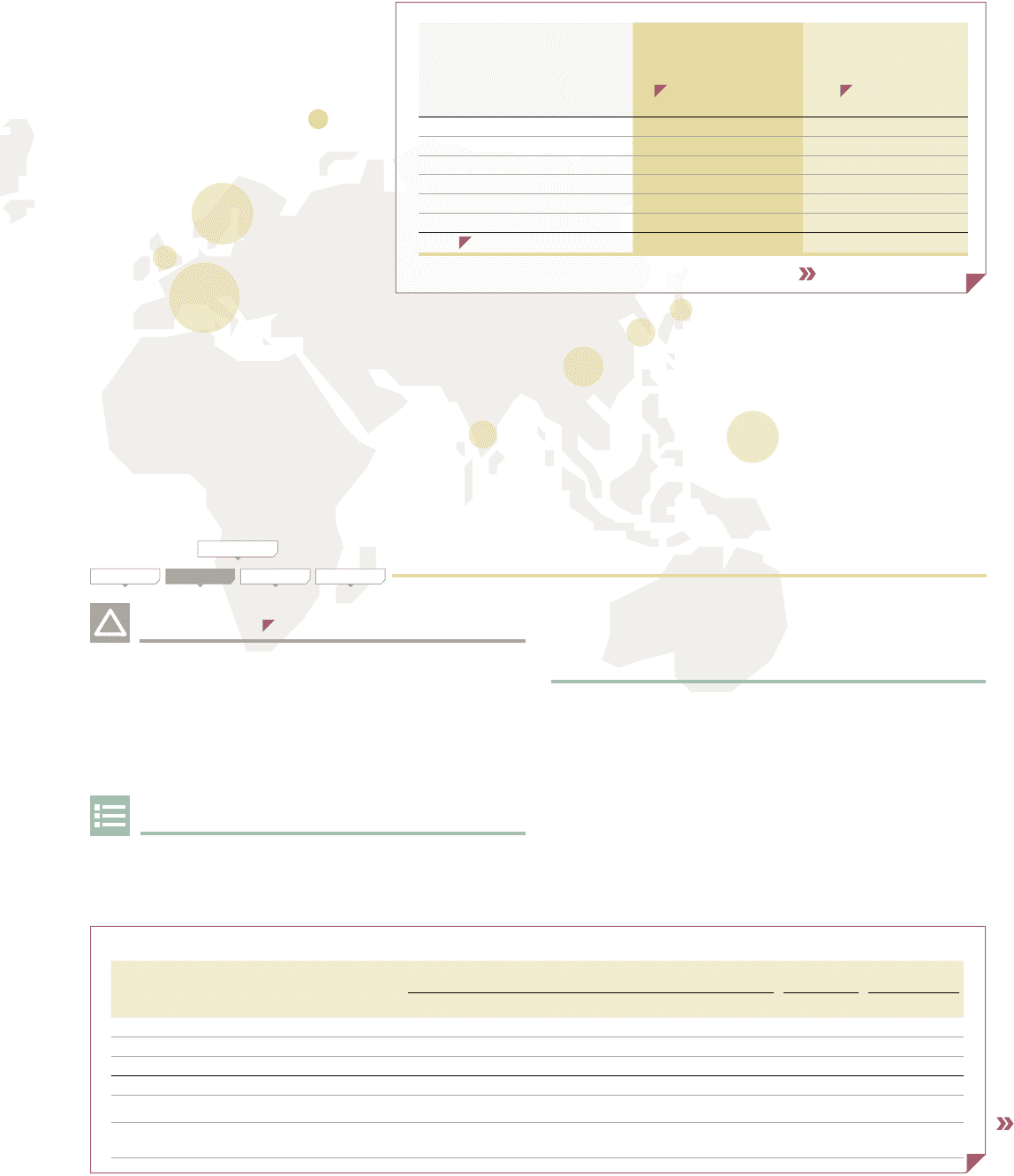

Volvo’s net assets in

different currencies (SEK bn) =

SEK

16.9

GBP 2.6

CNY 7.2

INR 3.5

JPY 2.3

KRW 3.6

OTHER

12.0

EUR

22.1

87