Volvo 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

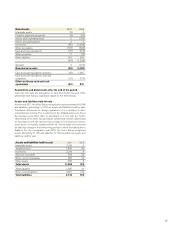

Total new financing volume in 2011 amounted

to SEK 44.8 billion (35.1). Adjusted for changes

in exchange rates, new business volume

increased by 35% compared to 2010 as a

result of increased sales volumes of the Volvo

Group products and stable penetration levels.

In total, 49,757 new Volvo vehicles and

machines (34,522) were financed during the

year. In the markets where financing is offered,

the average penetration rate was 25% (25).

As of December 31, 2011, the credit portfolio

was SEK 95,544 M (84,550). During 2011 the

credit portfolio increased by 13.8% (decrease: 4.4),

adjusted for exchange-rate movements. The

funding of the credit portfolio is matched in

terms of maturity, interest rates and currencies

in accordance with Volvo Group policy. For fur-

ther information see note 15.

The operating income for the year amounted

to SEK 942 M compared to SEK 167 M in the

previous year. Return on shareholders’ equity

was 7.3% (0.4). The equity ratio at the end of

the year was 9.1% (9.0). The improvement in

profitability is driven mainly by lower credit pro-

visions and higher earning assets. During the

year, credit provision expenses amounted to

SEK 682 M (1,438) while write-offs of SEK 804

M (1,460) were recorded. The write-off ratio for

2011 was 0.93% (1.65). At the end of December

31, 2011, credit reserves were 1.33% (1.69%)

of the credit portfolio.

Income Statement Customer Finance, SEK M 2011 2010

Finance and lease income 8,883 9,031

Finance and lease expenses (5,693) (5,974)

Gross income 3,190 3,057

Selling and administrative expenses (1,645) (1,526)

Credit provision expenses (682) (1,438)

Other operating income and expenses 78 73

Operating income (loss) 942 167

Income taxes (323) (134)

Income (Loss) for the period 619 32

Return on Equity 7.3 0.4

Key ratios, Customer Finance1 2011 2010

Credit portfolio net, SEK bn 94.3 83.1

Operating income, SEK M 942 167

Return on shareholders' equity, % 7.3 0.4

Total penetration rate, % 24.8 24.5

Penetration by business area1, %

Volvo CE 35 35

Volvo Trucks 27 29

Renualt Trucks 19 17

MackTrucks 20 20

Buses 15 11

UD Trucks 14 12

1 Share of unit sales financed by Volvo Financial Services in relation to the total

number units sold by the Volvo Group in markets where financial services are

offered.

Customer Finance Operations

75