Volvo 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Provision for product warranty

Warranty provisions are estimated with consideration of historical claims

statistics, the warranty period, the average time-lag between faults occurr ing

and claims to the company and anticipated changes in quality indexes.

Estimated costs for product warranties are charged to cost of sales when

the products are sold. Estimated warranty costs include contractual warranty

and goodwill warranty (warranty cover in excess of contractual warranty or

campaigns which is accepted as a matter of policy or normal practice in

order to maintain a good business relation with the customer). Differences

between actual warranty claims and the estimated claims generally affect

the recognized expense and provisions in future periods. Refunds from

suppliers, that decrease Volvo’s warranty costs, are recognized to the

extent these are considered to be certain. At December 31, 2011 warranty

cost provisions amounted to 8,652 (7,841).

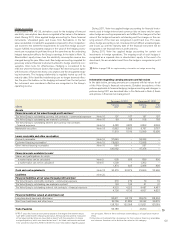

Legal proceedings

Volvo recognizes obligations in the Group accounts as provisions or other

liabilities only in cases where Volvo has a present obligation from a past

event, where a financial responsibility is probable and Volvo can make a

reliable estimate of the size of the amount. In instances where these cri-

teria are not met, a contingent liability may be disclosed in the notes to the

accounts.

Volvo regularly reviews the development of significant outstanding

legal disputes in which Group companies are parties, both civil law and tax

disputes, in order to assess the need for provisions and contingent liabili-

ties in the financial statements. Among the factors that Volvo considers in

making decisions on provisions and contingent liabilities are the nature of

the dispute, the amount claimed, the progress of the case, the opinions or

views of legal counsels and other advisers, experience in similar cases,

and any decision of Volvo’s management as to how Volvo intends to han-

dle the dispute. The actual outcome of a legal dispute may deviate from

the expected outcome of the dispute. The difference between actual and

expected outcome of a dispute might materially affect future financial

statements, with an adverse impact upon the Group’s results of operation,

financial position and liquidity.

Read more about the Volvo Group’s gross exposure to contingent liabilities in

Note 24.

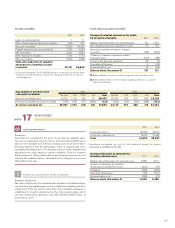

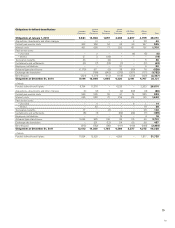

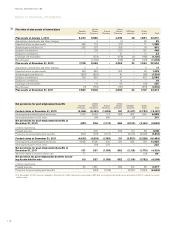

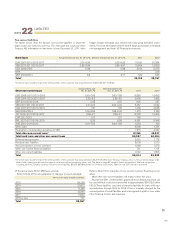

Value in

balance

sheet

2010 Provi-

sions Reversals Utiliza-

tions

Acquired

and

divested

companies

Trans-

lation

differ-

ences

Reclassifica-

tion to assets

held for sale

Other

reclassi-

fica-

tions

Value in

balance

sheet

2011

Of which

due

within 12

months

Of which

due after

12

months

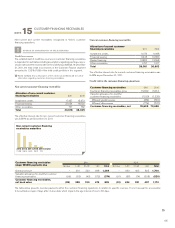

Warranties 7,841 7,718 (1,184) (5,651) (5) 31 (94) (5) 8,652 5,532 3,120

Provisions in insurance

operations 450 186 (49) (101) 0 3 0 0 488 4 484

Restructuring measures 247 123 (17) (152) 0 (1) 0 0 199 166 33

Provisions for residual

value risks 859 167 (63) (226) 1 (5) 0 8 741 290 451

Provisions for service

contracts 444 202 (57) (212) 0 (3) 0 6 380 182 198

Dealer bonus 1,651 3,401 (43) (3,007) 0 3 0 29 2,033 1,892 141

Other provisions 2,978 2,779 (427) (2,471) (18) (60) (65) (32) 2,686 1,467 1,219

Total 14,470 14,576 (1,840) (11,820) (22) (32) (159) 6 15,179 9,533 5,646

Long-term provisions as above is expected to be settled within 2 to 3 years.

SOURCES OF UNCERTAINTY IN ESTIMATES

!

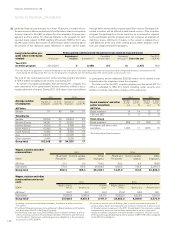

Residual value risks

In the course of its operations, Volvo is exposed to residual value risks

through operating lease agreements and sales combined with repurchase

agreements. Residual value commitments amount to SEK 14,349

(13,339) at December 31, 2011. Residual value risks are reflected in dif-

ferent ways in the Volvo consolidated financial statements depending on

the extent to which the risk remains with Volvo.

In cases where significant risks pertaining to the product remain with

Volvo, the products, primarily trucks, are generally recognized in the bal-

ance sheet as assets under operating leases. Depreciation expenses for

these products are charged on a straight-line basis over the term of the

commitment in amounts required to reduce the value of the product to its

estimated net realizable value at the end of the commitment. The esti-

mated net realizable value of the products at the end of the commitments

is monitored individually on a continuing basis. A decline in prices for used

trucks and construction equipment may negatively affect the consoli-

dated operating income. High inventories in the truck industry and the

construction equipment industry and low demand may have a negative

impact on the prices of new and used trucks and construction equipment.

In monitoring estimated net realizable value of each product under a

residual value commitment, management makes consideration of current

price-level of the used product model, value of options, mileage, condition,

future price deterioration due to expected change of market conditions,

alternative distribution channels, inventory lead-time, repair and recondi-

tioning costs, handling costs and overhead costs in the used product divi-

sions. Additional depreciations and estimated impairment losses are

immediately charged to income.

The total risk exposure for assets under operating lease is reported as

current and non-current residual value liabilities.

Read more in Note 22.

If the residual value risk commitment is not significant, independent from

the sale transaction or in combination with a commitment from the cus-

tomer to buy a new Volvo product in connection to a buy-back option, the

asset is not recognized on balance. Instead, the risk exposure is reported

as a residual value provision equivalent to the estimated residual value

risk.

To the extent the residual value exposure does not meet the definition

of a provision, the remaining residual value risk exposure is reported as a

contingent liability.

Read more in Note 24.

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

114