Volvo 2011 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

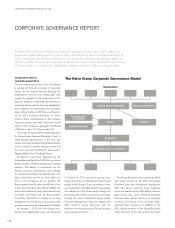

The Annual General Meeting resolves on the

fees to be paid to the Board members elected

by the shareholders. The Annual General Meet-

ing held on April 6, 2011, approved fee pay-

ments to the Board, for the time until the end of

the next Annual General Meeting, as follows:

Chairman of the Board should receive a fee of

SEK 1,800,000 and each of the remaining

members should receive a fee of SEK 600,000,

with the exception of the President. In addition,

the Chairman of the Audit Committee should

receive SEK 300,000, the other members of

the Audit Committee SEK 150,000 each and

the members of the Remuneration Committee

SEK 100,000 each.

In March 2011, the Board announced that it

had resolved to appoint Olof Persson as the

new President and CEO for Volvo as of September

1, 2011, to replace Leif Johansson when he

would be stepping down. Olof Persson was

previously the President of Volvo Construction

Equipment since 2008. Prior to that, he was the

President of Volvo Aero. The Board also

resolved in September 2011 to introduce new

financial targets for the Volvo Group to apply as

of 2012, with the aim of annually measuring

growth and profitability among the Group’s various

operations and making comparisons with a

number of selected competitors. As a result of

the uncertainty about the macroeconomic

trend, the Board specifically focused on moni-

toring the business environment in order to

continuously adapt the company’s activities to

the prevailing demand. The Board also focused

on the trend for the Group’s operations and visited

several of the Group’s facilities in the US in

2011, meeting management and customers.

The Board also reviewed the financial positions

of AB Volvo and the Volvo Group on a regular

basis and acted in order to ensure that there are

efficient systems with regard to follow-up and

control of the business and financial position of

the Volvo Group. In connection therewith, the

Audit Committee was responsible for preparing

the Board’s work to assure the quality of the

Group’s financial reporting by reviewing the

interim reports, the Annual Report and consoli-

dated accounting. In connection therewith, the

Board met with the company’s auditors during

2011. The Board continuously evaluates the per-

formance of the CEO.

During 2011, following preparation in the

Remuneration Committee, the Board evaluated

Volvo’s systems for variable remuneration to

senior executives, where the performance targets

were based on operating income and operating

rolling cash flow for executives in the industrial

operation. For executives in the customer-

financing operation, the performance targets

were related to operating income and return on

equity. The Board has concluded that the out-

come for 2011 has been satisfactory and con-

sequently found that the existing system was

well-functioning. Irrespective of this, the Board

came to the conclusion that in future, the operating

margin would be a better measure of the per-

formance of the industrial operation than oper-

ating income. In view of the new financial targets

for the Group presented by the Board in Sep-

tember 2011, the Board also believes that the

new financial target pertaining to competitive

comparison of operating margins should be

reflected in the performance targets for variable

remuneration for 2012, pertaining to executives

in the industrial operation. According to the

Board, the operating cash flow is still relevant

as a measure of the performance of the indus-

trial operation. The Board has also found that

for the customer financing operation performance

targets based on return on equity and operating

income are still relevant.

Based on the above mentioned evaluation of

the variable-remuneration systems, the Board

resolved to introduce partly amended perform-

ance targets for variable remuneration to senior

executives to apply for 2012 pertaining to most

of the industrial operation. The new perform-

ance targets are based on the following para-

meters; (i) six months’ operating rolling cash flow,

(ii) operating margin compared to last year and

(iii) profitability measured on operating margin

compared with competitors. For the customer

financing operation, the Board resolved that the

performance targets for variable remuneration

will continue to focus on return on equity and

operating income.

The Board’s work is mainly performed within

the framework of formal Board meetings and

through meetings in the respective committees

of the Board. In addition, the Chairman of the

Board maintains regular contact with the CEO

in order to discuss on-going business and to

ensure that the decisions taken by the Board

are executed. An account of each Board member’s

age, principal education, professional experience,

assignments in the Company, other important

board memberships, their own and related par-

ties’ ownership of shares in Volvo as of February

23, 2012, and the year they were elected on the

Volvo Board, is presented in the section Board

of Directors and auditors on page 153.

During 2011, the Board performed its yearly

evaluation of the Board’s work. The Chairman

has informed the Election Committee on the

result of the evaluation.

Independence requirements

The Board of Directors of AB Volvo must meet

independence requirements pursuant to the

Code. The Audit Committee must also meet inde-

pendence requirements pursuant to the Code

and the Swedish Companies Act. Below is a short

description of the independence requirements. The

independence requirements mainly state that only

one person from the company’s management

may be a member of the Board, that a majority of

the Board members elected by the General

Meeting shall be independent of the company

and the company management and that at least

two of the Board members elected by the Gen-

eral Meeting who are independent of the com-

pany and the company’s management shall also

be independent of the company’s major share-

holders. In addition, the Code stipulates that a

majority of the members in the Audit Committee

shall be independent of the company and the

company management, and that at least one of

the members who is independent of the company

and the company management shall also be inde-

pendent of the company’s major shareholders.

According to the Swedish Companies Act, the

members of the Audit Committee may not be

employees of the company and at least one

member of the Audit Committee shall be inde-

pendent of the company, company management

and the company’s largest shareholders and have

accounting or auditing expertise. With regard to

the Remuneration Committee, the Code sets the

requirement that members of the Remuneration

Committee, with the exception of the Board

Chairman if a member of the Remuneration Com-

mittee, shall be independent of the company and

company management.

CORPORATE GOVERNANCE REPORT 2011

156