Volvo 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Impairment of goodwill and other intangible assets

Intangible assets other than goodwill are amortized and depreciated over

their useful lives. Useful lives are based on estimates of the period in

which the assets will generate revenue. If, at the date of the financial

statements, any indication exists that an intangible non-current asset has

been impaired, the recoverable amount of the asset is calculated. The

recoverable amount is the higher of the asset’s net selling price and its

value in use, estimated with reference to management’s projections of

future cash flows. If the recoverable amount of the asset is less than the

carrying amount, an impairment loss is recognized and the carrying

amount of the asset is reduced to the recoverable amount. Determination

of the recoverable amount is based upon management’s projections of

future cash flows, which are generally based on internal business plans or

forecasts. While management believes that estimates of future cash flows

are reasonable, different assumptions regarding such cash flows could

materially affect valuations. The need for impairment of goodwill and cer-

tain other intangible assets with indefinite useful lives is determined on an

annual basis, or more frequently if required through calculation of the

value of the asset. Such an impairment review will require management to

determine the fair value of Volvo’s cash generating units, on the basis of

projected cash flows and internal business plans and forecasts. Surplus

values differ between the business areas and they are, to a varying

degree, sensitive to changes in assumptions and the business environ-

ment. Volvo has performed similar impairment reviews since 2002. No

need for impairment losses was required for the period 2002 until 2011.

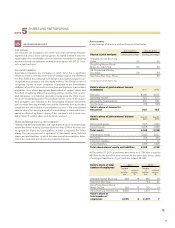

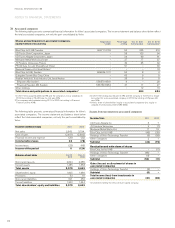

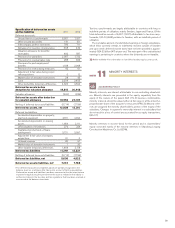

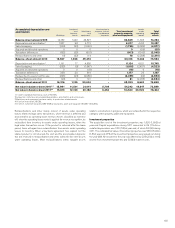

INTANGIBLE ASSETS

12

NOTE

Intangible assets

Volvo applies the cost method of valuation for measurement of intangible

assets. Borrowing costs are included in the cost of assets that necessar-

ily take more than 12 months to prepare for their intended use or sale,

known as qualifying assets.

When participating in industrial projects in partnership with other com-

panies, such as the aircraft engine projects in which Volvo Aero partici-

pates, Volvo pays an entrance fee to participate in certain cases. These

entrance fees are capitalized as intangible assets.

Research and development expenses

Volvo applies IAS 38, Intangible Assets, for the recognition of research

and development expenses. Pursuant to this standard, expenditures for

the development of new products, production systems and software are

recognized as intangible assets if such expenditures, with a high degree

of certainty, will result in future financial benefits for the company. The

cost for such intangible assets is amortized over the estimated useful life

of the assets.

The rules require stringent criteria to be met for these development

expenditures to be recognized as assets. For example, it must be possible

to prove the technical functionality of a new product or software prior to

its development being recognized as an asset. In normal cases, this

means that expenditures are capitalized only during the industrialization

phase of a product development project. Other research and development

expenses are charged to income as incurred.

Volvo has developed a process for conducting product development

projects named the Global Development Process (GDP). The GDP has six

phases focused on separate parts of the project. Every phase starts and

ends with a reconciliation point, known as a gate, the criteria for which

must be met for the project’s decision-making committee to open the

gate and allow the project to progress to the next phase. During the

industrialization phase, the industrial system is prepared for series pro-

duction and the product is launched.

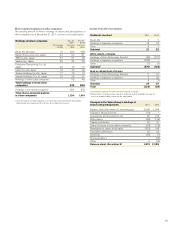

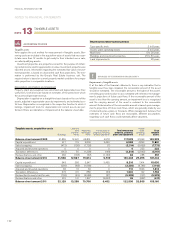

Goodwill

Goodwill is recognized as an intangible asset with indefinite useful life.

For non-depreciable assets such as goodwill, impairment tests are per-

formed annually, as well as if there are indications of impairments during

the year, by calculating the asset’s recovery value. If the calculated recov-

ery value is less than the carrying value, the asset’s recovery value is

impaired.

Volvo’s measurement model is based on a discounted cash-flow model,

with a forecast period of four to six years. Cash-generating units, identified

as Volvo’s business areas, are measured.

Goodwill assets are allocated to these cash-generating units on the

basis of anticipated future utility. Measurements are based on manage-

ment’s best estimation of the operations’ development. The basis for this

estimation is long-term forecasts of the market’s growth, 2 to 4%, in rela-

tion to the performance of Volvo’s operations. In the model, Volvo is

expected to maintain stable capital efficiency over time. Measurements

are based on nominal values and utilize a general rate of inflation in line

with the European target. Volvo uses a discounting factor calculated to

12% (12) before tax for 2011.

In 2011, the value of Volvo’s operations exceeded the carrying amount

of goodwill for all business areas, which is why no impairment was recog-

nized. Volvo has also tested whether a surplus value would still exist after

being subjected to reasonable potential changes to the assumptions,

negatively adjusted by one percentage point on an individual basis,

whereof no adjustment would have sufficient impact to require impairment

for the majority of the carrying amount.

Since the surplus values differ between the business areas, they are to

a varying degree sensitive to changes in the assumptions described

above. Therefore, Volvo continuously follows the performance of the busi-

ness areas whose overvalue is dependent on the fulfillment of Volvo’s

assessments. Instability in the recovery of the market and volatility in

interest and currency rates may lead to indications of a need for impair-

ment. The most important factors for the future operations of Volvo are

described in the Volvo business area section, as well as in the Risk man-

agement section.

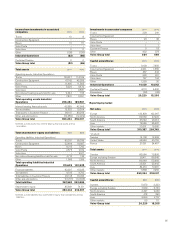

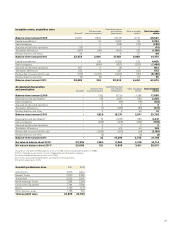

Depreciation, amortization and impairment

Depreciation is made on a straight-line basis based on the cost of the

assets, adjusted in appropriate cases by impairments, and estimated use-

ful lives. Depreciation is reported in the respective function to which it

belongs. Impairment tests for depreciable assets are performed if there

are indications of impairment at the balance sheet date.

Depreciation/amortization periods

Trademarks 20 years

Distribution networks 10 years

Product and software development 3 to 8 years

Aircraft engine projects 35 years

* The depreciation/amortization period for aircraft engine projects was changed

from 20 to 35 years as of 2010.

ACCOUNTING POLICIES

SOURCES OF ESTIMATION UNCERTAINTY

!

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

100