Volvo 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the preceding year, 2010.

The consolidated financial statements for AB Volvo and its subsidiaries have

been prepared in accordance with International Financial Reporting Stand-

ards (IFRS) issued by the International Accounting Standards Board (IASB),

as adopted by the EU. The portions of IFRS not adopted by the EU have no

material impact on this report. This Annual Report is prepared in accordance

with IAS 1 Presentation of Financial Statements and with the Swedish Com-

panies Act. In addition, RFR 1 Supplementary Rules for Groups, has been

applied, which is issued by the Swedish Financial Reporting Board. As of

2005, Volvo has applied International Financial Reporting Standards (IFRS)

in its financial statements. In accordance with the IFRS transitions rules in

IFRS 1, Volvo applies retrospective application from the IFRS transition date

at January 1, 2004. The details of the transition from Swedish GAAP to IFRS

are set out in Note 3 in the annual reports of 2005 and 2006. Refer to the

2004 Annual Report for a description of the previous Swedish accounting

policies applied by Volvo.

How should Volvo’s accounting policies be read?

Volvo describes the accounting policies in conjunction with each note in

the aim of providing enhanced understanding of each accounting area.

Volvo focuses on describing the accounting choices that the Group has

made within the framework of the prevailing IFRS policy and avoids

repeating the actual text of the standard, unless Volvo considers it par-

ticularly important to the understanding of the note’s content. Refer to the

table below to see the note in which each accounting policy is listed and

for the relevant and material IFRS standard.

ACCOUNTING PRINCIPLES

1

NOTE

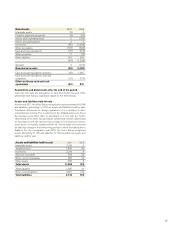

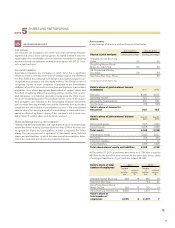

Accounting principle Note IFRS-standard

Non-currentassets held for sale and discontinued

operations 3, Acquisitions and divestments of sharesin subsidiaries IFRS 5

Joint ventures 5, Shares and participations IAS 31

Investments in associates 5, Shares and participations IAS 28

Operating segments 6, Segment reporting IFRS 8

Revenue 7, Income IAS 17, IAS 18

Shares and participations 5, Shares and participations IAS 28, IAS 32, IAS 36,

IAS 39

Financial income and expenses 9, Other financial income and expenses IAS 39

Income taxes 10, Income taxes IAS 12

Minority interests 11, Minority interests IAS 27

Research and development expenditure 12, Intangible assets IAS 38

Intangible assets 12, Intangible assets IAS 36, IAS 38

Tangible assets 13, Tangible assets IAS 16,IAS 40

Leasing 14, Leasing IAS 17

Customer-financing receivables 15, Customer-financing receivables IAS 17, IAS 18, IAS 39, IFRS 7

Inventories 17, Inventories IAS 2

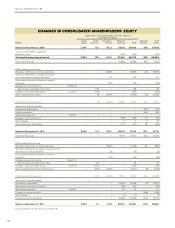

Earnings per share 19, Shareholder's equity IAS 33

Pensions and similar obligations 20, Provisions for post-employment benefits IAS 19

Provisions for residual value risks 21, Other provisions IAS 17, IAS 18, IAS 37

Warranty expenses 21, Other provisions IAS 37

Restructuring costs 21, Other provisions IAS 37

Liabilities 22, Liabilities IAS 37, IAS 39, IFRS 7

Contingent liabilities 24, Contingent liabilities IAS 37

Transactions with related parties 25, Transactions with related parties IAS 24

Government grants 26, Government grants IAS 20

Share-based payments 27, Personnel IFRS 2

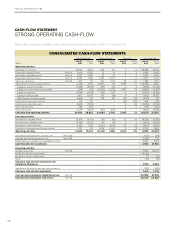

Cash-flow statement 29, Cash flow IAS 7

Financial instruments 4, Goals and policies in financial risk management IAS 32, IAS 39, IFRS 7

16, Receivables

18, Marketable securities and liquid funds

30, Financial instruments

81