Volvo 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The truck operations consist of Volvo Trucks, Renault

Trucks, UD Trucks, Mack Trucks and VECV in India

(50% direct and indirect ownership). The product

offer stretches from heavy-duty trucks for long-

haulage and construction work to light-duty trucks

for distribution.

Number of employees

41,469

Demand in Europe and North America increased

during the year, but towards the end of the year it

weakened in Europe. The Japanese market was

negatively affected by the earthquake and tsunami

that hit the country in March but recovered

towards the end of the year. In Brazil demand

was strong during the year.

Total market

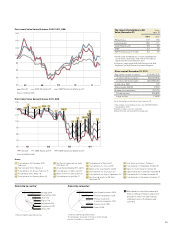

In 2011 the heavy-duty truck market in Europe

29 (EU, Norway and Switzerland) increased by

35% to 242,400 trucks compared to 2010. The

situation still varied significantly within Europe.

While parts of Southern Europe were struggling,

other regions in Northern and Eastern Europe

had recovered from the low levels of 2010. In

2012, the total market for heavy-duty trucks in

Europe 29 is expected to experience a moder-

ate decline to a level of about 220,000 trucks.

The start of the year is expected to be slow with

a gradual pick-up in demand as customers start

to renew their fleets ahead of the new emission

regulation in 2014.

In 2011, the total market for heavy-duty trucks

in North America increased by 52% to 216,100

trucks compared to 142,100 in the previous

year. Demand was strong throughout the year,

driven primarily by the need to replace the

industry’s aging highway tractor population.

Activity in the refuse vehicle segment was

steady. Although the vocational truck segment

continued to suffer as a result of the depressed

construction market, some positive signs were

seen in the energy sector, particularly natural

gas production. In 2012, the total market for

heavy-duty trucks in North America is expected

to grow to a level of about 250,000 trucks.

In 2011, the total market in Brazil increased

by 2% to 111,500 heavy-duty trucks (109,800).

The increase was lower than anticipated

because of less prebuying than expected ahead

of the new, stricter emission regulation that

came into effect on January 1, 2012. The total

Brazilian market for heavy-duty trucks is

expected to record a slight decline and reach a

level of about 105,000 trucks in 2012. The

beginning of the year is expected to be slow fol-

lowed by a gradual pick-up in demand driven by

a general increase in economic activity and

increased acceptance of the new, more expen-

sive Euro V trucks.

In Japan the market for heavy-duty trucks

was 24,800 vehicles in 2011 (24,500), which

was an increase of 1%. Following the earth-

quake and the subsequent tsunami that hit

Japan on March 11, 2011 there were signs of a

market-recovery during the latter part of 2011

and into 2012. For 2012, the total Japanese

market for heavy-duty trucks is expected to

increase to about 30,000 trucks.

The Indian market for heavy-duty trucks grew

by 12% to 237,000 trucks in 2011 compared to

212,000 vehicles in 2010.

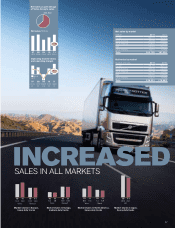

Earnings

In 2011, net sales in the truck operations increased

by 24% to SEK 207,703 M (167,305). The operat-

ing income improved to SEK 18,260 M (10,112),

while the operating margin was 9.1% (6.0).

Increased sales volumes, higher capacity utili-

zation and continued strict control on operating

costs had a positive impact on profitability.

TRUCKS

CONTINUED EARNINGS IMPROVEMENT

2011 was characterized by a continued recovery in demand in the Group’s mature

markets and a continued strong development in the emerging markets. Towards the

end of the year the first signs of a moderate slowdown became visible in Europe.

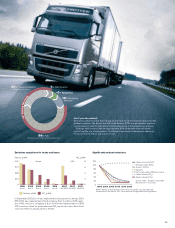

Position on world market

In total, the Volvo Group is Europe’s largest and the

world’s second largest Western manufacturer of

heavy trucks.

Brands

Volvo, Renault Trucks, UD Trucks, Mack and Eicher.

New products

At the annual Mid-America Trucking Show in Lou-

isville, Kentucky, both Mack and Volvo Trucks

introduced trucks with new aerodynamic and

powertrain features which, when combined with

the improvements already achieved through the

use of SCR technology, deliver fuel efficiency

gains of 8-12% over previous generations of

trucks (EPA 2007).

The world’s most powerful hybrid truck was

launched by Volvo Trucks in the first quarter. The

Volvo FE Hybrid, the first parallel hybrid from

Volvo Trucks, uses techniques able to reduce fuel

consumption and carbon dioxide emissions by up

to 20%, and it makes the truck much more silent.

In May, Volvo Trucks launched the new Volvo

FM MethaneDiesel truck, a gas-powered truck for

long-haul operations enhancing its focus on alter-

native fuels. This truck can be powered by up to

75% gas and if run on biogas, emissions of car-

bon dioxide from fossil fuel could be cut by up to

70% compared with a conventional diesel engine.

In September, a 750 hp version of the Volvo

FH16 was launched.

Renault Trucks delivered the first serial Renault

Premium Distribution hybrid truck (Hybrys Tech).

Renault Trucks also launched a system called

Optiroll on the Renault Premium Route Optifuel

truck, which further reduces fuel consumption.

In July, UD Trucks launched its new Condor

medium-duty trucks, which have undergone a

full model change.

BOARD OF DIRECTORS’ REPORT 2011

Fuel-efficient engines is one important factor

behind the truck operations’ success.

56