Volvo 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

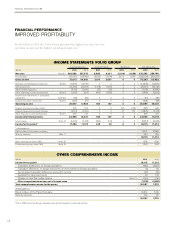

Net sales

Net sales for the Volvo Group increased by 17%

to SEK 310,367 M in 2011, compared with SEK

264,749 M in the preceding year.

Operating income

Volvo Group operating income improved to SEK

26,899 M (18,000).

Operating income for the Industrial Opera-

tions increased to SEK 25,957 M compared

with SEK 17,834 M in the preceding year. The

Customer Finance operations’ operating income

rose to SEK 942 M (167).

Net financial items

Net interest expense was SEK 2,267 M, com-

pared with SEK 2,700 M in the preceding year.

During the year, market valuation of derivatives,

mainly used for eliminating interest exposure in

the customer financing portfolio, had a positive

effect on Other financial income and expenses

in an amount of SEK 544 M. During 2010 the

impact was positive and amounted to SEK 871 M.

The currency in Venezuela was devalued

twice during 2010, which negatively impacted

Other financial income and expenses by SEK

274 M in 2010.

Income taxes

The tax expense for the year amounted to SEK

6,814 M (4,302) corresponding to a tax rate of

27% (28).

Income for the period and earnings per

share

The income for the period amounted to SEK

18,115 M (11,212), corresponding to diluted

earnings per share of SEK 8.75 (5.36). The

return on shareholders’ equity was 23.1% (16.0).

Net sales by business area, SEK M 2011 2010 %

Trucks 200,703 167,305 20

Construction Equipment 64,987 53,810 21

Buses 22,289 20,516 9

Volvo Penta 8,859 8,716 2

Volvo Aero 6,509 7,708 (16)

Eliminations and other 242 (680)

Industrial Operations1303,589 257,375 18

Customer Finance 8,883 9,031 (2)

Reclassifications and eliminations (2,104) (1,658)

Volvo Group 310,367 264,749 17

1 Adjusted for acquired and divested units and changes in currency rates, net sales

increased by 20%. Change in operating income, SEK bn

Operating income 2010 18.0

Gross income 19.4

Recognition of VAT credits in Brazil relating to previous years 0.6

Disturbances in operations in Japan as an effect of the

earthquake and tsunami (0.7)

Resultfrom divestments of companiesin 2010 0.2

Changes in currency exchange rates, Industrial operations (5.2)

Write-down of shares listed in Japan (0.2)

Higher capitalization of development costs 1.0

Higher research and development expenditures (2.0)

Tax credit for research and development activities 0.3

Higher selling and administrative expenses (4.7)

Lower credit losses 0.6

Other (0.4)

Operating income 2011 26.9

Operating income (loss) by business area, SEK M 2011 2010

Trucks 18,260 10,112

Construction Equipment 6,653 6,180

Buses 1,036 780

Volvo Penta 781 578

Volvo Aero 336 286

Eliminations and other (1,109) (102)

Industrial Operations 25,957 17,834

Customer Finance 942 167

Volvo Group 26,899 18,000

Operating margin, % 2011 2010

Trucks 9.1 6.0

Construction Equipment 10.2 11.5

Buses 4.6 3.8

Volvo Penta 8.8 6.6

Volvo Aero 5.2 3.7

Industrial Operations 8.6 6.9

Volvo Group 8.7 6.8

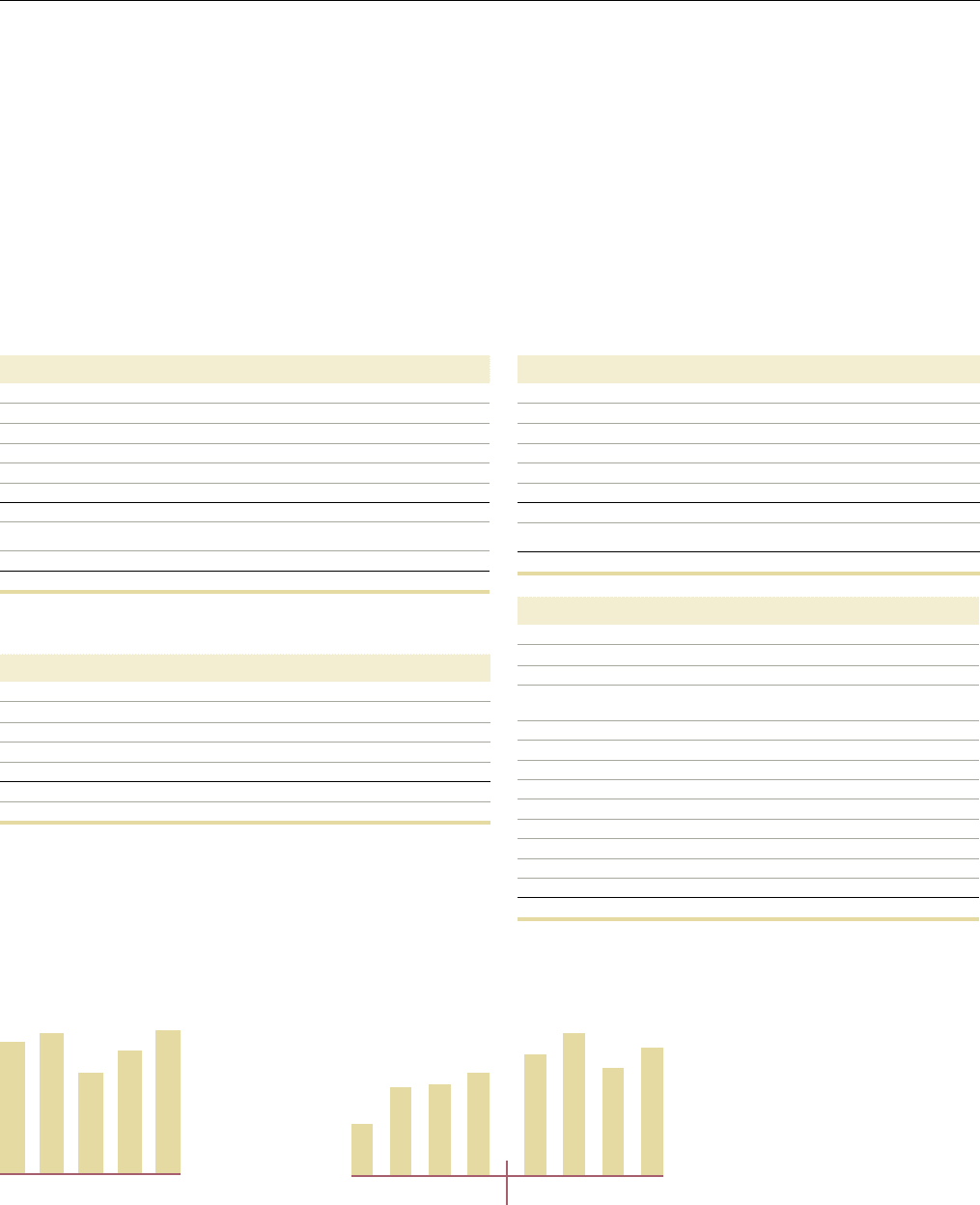

Net sales, SEK bn

11100908

265218304285

07

310

The Volvo Group

Operating income, SEK M

2010 2011

Q4

6,955

Q3

5,774

Q2

7,648

Q1

6,522

Q4

5,518

Q3

4,913

Q2

4,770

Q1

2,799

73