Volvo 2011 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

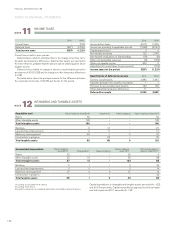

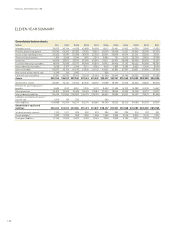

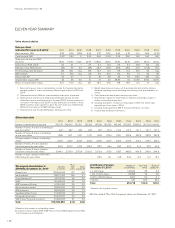

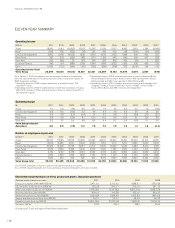

ELEVEN-YEAR SUMMARY

The eleven-year summary presents each year in accordance with the

Generally Accepted Accounting Practice (GAAP) for that year. Earlier

years are not restated when new accounting standards are applied. The

years 2001–2003 are accounted for in accordance with Swedish GAAP

for the respective year. As from 2004 the reporting is based on IFRS. The

transition to IFRS is described in Note 3 in the 2005 and 2006 Annual

Reports. As from January 1, 2007, the benefits from the synergies created

in the business units are transferred back to the product areas. Also, as

from January 1, 2007, the responsibility for the Group’s treasury operations

and real estate has been transferred from Volvo Financial Services, which,

as from January 1, 2007, only are consolidated in accordance with the

purchase method. Comparison figures for 2006 have been recalculated.

Consolidated income statements

SEK M 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001

Net sales 310,367 264,749 218,361 303,667 285,405 258,835 240,559 211,076 183,291 186,198 189,280

Cost of sales (235,104) (201,797) (186,167) (237,578) (219,600) (199,054) (186,662) (164,170) (146,879) (151,569) (155,592)

Gross income 75,263 62,952 32,194 66,089 65,805 59,781 53,897 46,906 36,412 34,629 33,688

Research and development

expenses (13,276) (12,970) (13,193) (14,348) (11,059) (8,354) (7,557) (7,614) (6,829) (5,869) (5,391)

Selling expenses (26,001) (24,149) (25,334) (27,129) (26,068) (21,213) (20,778) (19,369) (16,866) (16,604) (15,766)

Administrative expenses (7,132) (5,666) (5,863) (6,940) (7,133) (6,551) (6,301) (5,483) (5,467) (5,658) (6,709)

Other operating income and

expenses (1,649) (2,023) (4,798) (1,915) 163 (3,466) (588) (618) (1,367) (4,152) (4,096)

Income (loss) from investments

in associated companies (81) (86) (14) 25 430 61 (557) 27 200 182 50

Income from other investments (225) (58) (6) 69 93 141 37 830 (3,579) 309 1,410

Restructuring costs – – – – – – – – – – (3,862)

Operating income (loss) 26,899 18,000 (17,013) 15,851 22,231 20,399 18,153 14,679 2,504 2,837 (676)

Interest income and

similar credits 608 442 390 1,171 952 666 654 821 1,096 1,217 1,275

Interest expenses

and similar charges (2,875) (3,142) (3,559) (1,935) (1,122) (585) (972) (1,254) (1,888) (1,840) (2,274)

Other financial income

and expenses 297 213 (392) (1,077) (504) (181) 181 (1,210) (55) (201) (191)

Income (loss) after financial

items 24,929 15,514 (20,573) 14,010 21,557 20,299 18,016 13,036 1,657 2,013 (1,866)

Income taxes (6,814) (4,302) 5,889 (3,994) (6,529) (3,981) (4,908) (3,129) (1,334) (590) 326

Income (loss) for the period 18,115 11,212 (14,685) 10,016 15,028 16,318 13,108 9,907 323 1,423 (1,540)

Attributable to

Equity holders of the Parent

Company 17,751 10,866 (14,718) 9,942 14,932 16,268 13,054 9,867 298 1,393 (1,467)

Minority interest 364 346 33 74 96 50 54 40 25 30 (73)

18,115 11,212 (14,685) 10,016 15,028 16,318 13,108 9,907 323 1,423 (1,540)

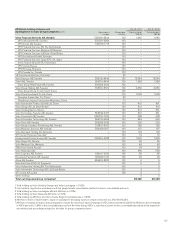

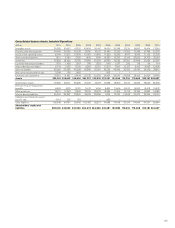

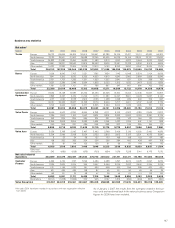

Consolidated income statements Industrial Operations

SEK M 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001

Net sales 303,589 257,375 208,487 294,932 276,795 249,020 231,191 202,171 174,768 177,080 180,615

Cost of sales (231,516) (197,480) (179,578) (232,247) (214,160) (192,400) (180,823) (158,453) (141,256) (145,453) (149,477)

Gross income 72,073 59,895 28,909 62,685 62,635 56,620 50,368 43,718 33,512 31,627 31,138

Research and development

expenses (13,276) (12,970) (13,193) (14,348) (11,059) (8,354) (7,557) (7,614) (6,829) (5,869) (5,391)

Selling expenses (24,383) (22,649) (23,752) (25,597) (24,671) (19,999) (19,616) (18,317) (15,891) (15,393) (14,663)

Administrative expenses (7,105) (5,640) (5,838) (6,921) (7,092) (6,481) (6,147) (5,310) (5,259) (5,464) (6,474)

Other operating income and

expenses (1,045) (659) (2,432) (1,457) 249 (3,275) (397) 7 (540) (2,989) (3,071)

Income from Volvo Financial

Services – – – – – – 2,033 1,365 926 490 325

Income (loss) from investments

in associated companies (82) (86) (15) 23 428 61 (568) 2 166 126 (86)

Income from other investments (225) (57) (13) 69 93 141 37 828 (3,581) 309 1,408

Restructuring costs – – – – – – – – – – (3,862)

Operating income (loss) 25,957 17,834 (16,333) 14,454 20,583 18,713 18,153 14,679 2,504 2,837 (676)

141