Volvo 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

world’s largest manufacturers of commercial vehicles

with strong positions in mature markets and with an

increasingly important presence in growth markets. As a

step in further streamlining the Volvo Group towards

commercial vehicles, during the year we initiated a pro-

cess aimed at divesting Volvo Aero.

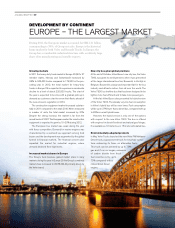

Financially strong Group

Driven by improved profitability and the good cash flow,

the net financial debt in the industrial operation was

down to 25% of shareholders’ equity at year-end, which

means that the Group is financially strong in an environ-

ment that in the beginning of 2012 is characterized by

turmoil in the financial markets and uncertain macro-

economic trends.

The Board of Directors proposes a dividend of SEK

3.00 per share for 2011, up SEK 0.50 per share com-

pared with the preceding year.

Reorganization to increase sales and profitability

We have a new vision – to become the world leader in

sustainable transport solutions. We shall fulfill this by

creating value for our customers and by pioneering the

development in our industries. We have new financial tar-

gets, a new organization and a number of new manage-

ment teams in place. On January 1, 2012, we introduced

the new organization which was put in place to better

capitalize on the global potential in our products and

brands and to improve the Group’s efficiency.

With the recent very positive trends in the Group’s

development, we are in a favorable position. However,

this does not mean that everything will run on rails. A

great deal of work remains. We have now taken the first

steps on a journey which will be full of challenges, but I

am convinced that there is potential to increase sales and

improve profitability over time. This is a journey that I am

very much looking forward to.

Olof Persson

President and CEO

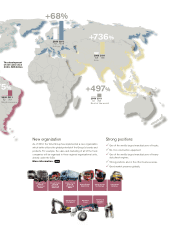

Volvo Construction Equipment (Volvo CE) has also

strengthened its positions in several growth markets

worldwide. In China our brands Volvo and SDLG gained

the position as market leader within wheel loaders and

excavators. SDLG recently launched new models of exca-

vators, so we have hopes that the success in this giant

market will continue.

I would also like to mention our hybrid buses that are

attracting an increasing amount of interest around the

world.

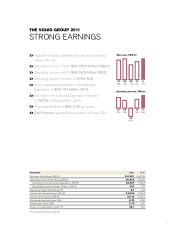

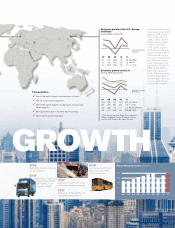

Increased profitability

Good market conditions in the main and increasing market

shares driven by competitive products translated into us

delivering some 238,000 trucks during 2011 – an increase

of 32% compared to the preceding year. Net sales in the

truck operations surpassed SEK 200 billion and profit-

ability improved to an operating margin of 9.1%.

Volvo CE increased its deliveries by almost 30% to the

new record level of 84,000 machines. The year was

intense with the launch of many new products and a con-

tinued expansion in growth markets. Despite a strong

headwind from the weak dollar, Volvo CE delivered an

operating income of SEK 6.7 billion and an operating

margin of 10.2%.

From a historic perspective, Volvo Buses had a good

year, both in terms of volumes and profitability. This was

achieved by successful efforts to grow in emerging mar-

kets, which offset the continued weak markets in Europe

and the U.S. Operating income increased to SEK 1 billion

and operating margin improved to 4.6%, which is below the

Group average but good when compared to competitors.

Volvo Penta was impacted by a continued weak market

for marine engines and towards the end of the year also

for industrial engines, but despite this, achieved an oper-

ating income of almost SEK 800 M with an operating

margin of 8.8%.

For our Customer Finance Operations, the trend pointed

in the right direction, with portfolio growth and lower

credit losses.

Volvo Aero also had to struggle with a significant

headwind from currency. Despite this, Volvo Aero’s oper-

ating margin amounted to 5.2%.

During my predecessor Leif Johansson’s 14 years as

CEO, the Volvo Group established itself as one of the

3