Volvo 2011 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

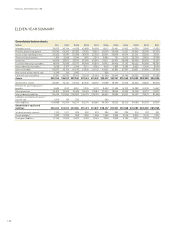

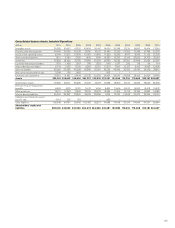

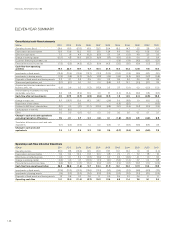

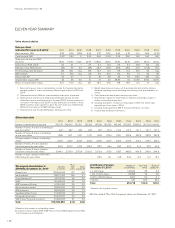

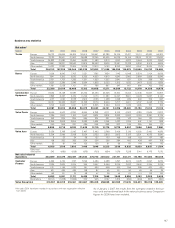

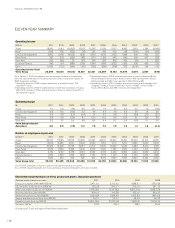

Key ratios

2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001

Gross margin, %123.7 23.3 13.9 21.3 22.6 22.7 21.8 21.6 19.2 17.9 17.2

Research and development expenses

as percentage of net sales14.4 5.0 6.3 4.9 4.0 3.4 3.3 3.8 3.9 3.3 3.0

Selling expenses as percentage of

net sales18.0 8.8 11.4 8.7 8.9 8.0 8.5 9.1 9.1 8.7 8.1

Administration expenses as

percentage of net sales12.3 2.2 2.8 2.3 2.6 2.6 2.7 2.6 3.0 3.1 3.6

Return on shareholders' equity, % 23.1 16.0 (19.7) 12.1 18.1 19.6 17.8 13.9 0.4 1.7 neg

Interest coverage, times19.6 5.9 (4.7) 8.8 20.7 26.1 16.7 11.0 1.9 2.2 neg

Self-financing ratio, % 118 270 137 5 153 189 116 163 152 110 92

Self-financing ratio Industrial

Operations, % 210 294 (16) 78 265 235 173 268 243 196 148

Financial position, Industrial

Operations, SEK M (19,346) (24,691) (41,489) (29,795) (4,305) 23,076 18,675 18,110 (2,426) (6,063) (7,042)

Net financialposition as percentage of

shareholders' equity, Industrial Operations (25.2) (37.4) (70.9) (39.7) (5.7) 29.2 23.7 25.8 (3.3) (7.7) (8.2)

Shareholders’ equity as percentage of

total assets 24.3 23.3 20.2 22.7 25.7 33.7 30.6 31.3 31.4 32.8 32.8

Shareholders’ equity as percentage of

total assets, Industrial Operations 28.5 26.9 23.8 28.4 30.8 40.6 40.4 40.0 40.5 42.4 41.8

Shareholders’ equity excluding minority

interest as percentage of total assets 23.9 23.0 20.0 22.6 25.6 33.6 30.5 31.2 31.3 32.7 32.6

1 Pertains to the Industrial Operations. For periods up to and including 2006, Volvo Financial Services is included and consolidated according to the equity method.

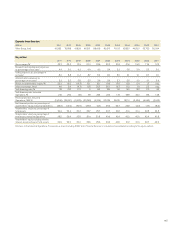

Exports from Sweden

SEK M 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001

Volvo Group, total 91,065 72,688 41,829 96,571 88,606 80,517 71,133 62,653 49,300 52,730 50,394

145