Volvo 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

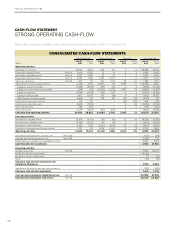

The cash flow within Industrial Operations was

positively affected by the operating income and

negatively affected by the increased working

capital. Accounts receivables and inventories

increased with SEK 3.1 and 7.1 billion respec-

tively, partly offset by the increase of trade pay-

ables of SEK 9.9 billion.

Financial items and paid income taxes had a

SEK 6.9 billion negative effect on cash flow

within Industrial Operations, mainly through

payments of interests and income tax.

Operating cash flow within Customer Finance

was a negative SEK 14.1 billion (pos: SEK 1.4

billion), mainly due to increased customer

financing-receivables.

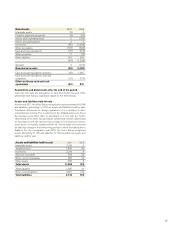

Investments

The Industrial Operations’ investments in fixed

assets and capitalized R&D during 2011

amounted to SEK 12.6 billion (10.3).

Capital expenditures in Trucks amounted to

SEK 8.4 billion (7.2). The capital expenditures

within Trucks consist to a large extent of invest-

ments related to product renewals in our product

program, with product development activities

and required adaptations in the plants. In the

plants there are also ongoing investments aim-

ing for increased capacity and flexibility, mainly

in the cab plant in Umeå, Sweden, and in the

engine plants with machining and assembly

processes in Skövde, Sweden, and Ageo,

Japan. During 2011 we have also invested in

the dealer network and workshops, mainly in

Europe and Asia, as well as in our joint venture

VE Commercial Vehicles (VECV).

Capital investments for Construction Equip-

ment amounted to SEK 1.9 billion (1.4). As for

Capital expenditures, Industrial Operations

11100908

3.22.62.12.1

4.05.04.33.6

7.17.710.58.0

Capitalized development

costs, SEK bn

Capital expenditures,

% of net sales

Property, plant and

equipment, SEK bn

07

4.1

4.1

8.5

Self-financing ratio,

Industrial Operations %

Cash-flow from operating activities

divided by net investments in fixed

assets and leasing assets.

1110090807

210294(16)78265

Operating cash flow,

Industrial Operations, SEK bn

2010 2011

Q4

10.7

Q3

2.2

Q2

5.2

Q1

(4.0)

Q4

15.1

Q3

(1.9)

Q2

8.5

Q1

(2.7)

previous year, the majority of the investments

refer to expansion of the excavator business for

both Volvo brand and SDLG brand. During 2011

mainly China and Korea have been impacted, in

capacity investments in machining and assem-

bly area. Product related investments during

the year refer to the emission regulations in

Europe and North America, and Tier 2 and Tier

3 requirements for new models in the BRIC

countries.

The investments within Volvo Aero was during

2011 SEK 0.5 billion (0.8). The majority of the

investments refer to the involvement in the new

engine programs, PW1100G and PW1000G

with Pratt & Whitney, and Trent XWB with Rolls-

Royce. The investments also refer to finalization

of a number of investments in Volvo Aero’s pro-

duction facilities in order to secure the capacity

required for the XWB and GP7000 program

(P&W), and rationalizations in the spool shop.

The investments in Buses were SEK 0.3 billion

(0.2), and in Volvo Penta SEK 0.2 billion (0.2).

Investments in leasing assets amounted to

SEK 1.4 billion (0.3), the increase versus previ-

ous year refers mainly to expansion of the rental

fleet as well as replacement of existing fleet.

For 2012, the Volvo Group estimates that

investments in property, plant and equipment

will be around SEK 10 billion. The investment

level is however pending the market develop-

ment, and in order to be able to adapt the level,

the ongoing and future investments are contin-

uously reviewed and prioritized. The invest-

ments in coming product programs continue

during 2012, as well as the expansion of the

business in the BRIC countries.

Acquisitions and divestments

Acquired and divested operations 2011 had a

negative impact on cash flow of SEK 1.6 billion

(positive 0.6).

Acquired operations refer mainly to several

minor acquisitions of assets and liabilities in

construction equipment rental operations. The

remaining minority interest in Volvo Aero Norge

and UD Trucks South Africa has also been

acquired during the year.

Financing and dividend

Net borrowings increased cash and cash equiv-

alents by SEK 8.7 billion during 2011.

During the year dividend of SEK 5.1 billion,

corresponding to SEK 2.50 per share, was paid

to the shareholders of AB Volvo.

Change in cash and cash equivalents

The Group’s cash and cash equivalents

increased by SEK 7.4 billion during the year and

amounted to SEK 30.4 billion at December 31,

2011.

Refer to Note 29 for principles for preparing

the cash flow analysis.

79