Volvo 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

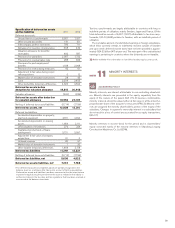

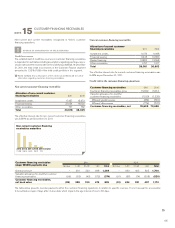

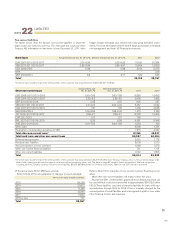

Earnings per share

The long-term share-based incentive program decided by the Annual

General Meeting 2011 creates a dilution effect. For 2010 AB Volvo had

no share-based incentive program. No other transactions have occurred

that affected, or will have an effect on, the compilation of the reported

share capital.

2011 2010

Number of shares, December 31, in millions 2,027 2,027

Average number of shares before dilution in

millions 2,027 2,027

Average number of shares after dilution in

millions 2,028 2,027

Average share price, SEK 94.84 85.75

Net income attributable to Parent Company

shareholders 17,751 10,866

Basic earnings per share, SEK 8.76 5.36

Diluted earnings per share, SEK 8.75 5.36

PROVISIONS FOR POST-EMPLOYMENT BENEFITS

20

NOTE

Volvo’s post-employment benefits, such as pensions, healthcare and

other benefits are mainly settled by means of regular payments to inde-

pendent authorities or bodies that assume pension obligations and

administer pensions through defined-contribution plans.

The remaining post-employment benefits are defined-benefit plans;

that is, the obligations remain within the Volvo Group or are secured by

proprietary pension foundations. The Volvo Group’s defined-benefit plans

relate mainly to subsidiaries in the U.S. and comprise both pensions and

other benefits, such as healthcare. Other large-scale defined-benefit

plans apply to salaried employees in Sweden (mainly through the Swedish

ITP pension plan) and employees in France and Great Britain.

SOURCES OF UNCERTAINTY IN ESTIMATES

!

Provisions and costs for post-employment benefits, mainly pensions and

health-care benefits, are dependent on assumptions used by actuaries in

calculating such amounts. The appropriate assumptions and actuarial cal-

culations are made separately for the respective countries of Volvo’s

operations which result in obligations for postemployment benefits. The

assumptions include discount rates, health care cost trends rates, inflation,

salary growth, long-term return on plan assets, retirement rates, mortality

rates and other factors. Health care cost trend assumptions are based on

historical cost data, the near-term outlook, and an assessment of likely

long-term trends. Inflation assumptions are based on an evaluation of

external market indicators. The salary growth assumptions reflect the his-

torical trend, the near-term outlook and assumed inflation. Retirement and

mortality rates are based primarily on officially available mortality statistics.

The actuarial assumptions are annually reviewed by Volvo and modified

when deemed appropriate to do so. Actual results that differ from man-

agement’s assumptions are accumulated and amortized over future periods.

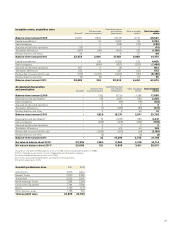

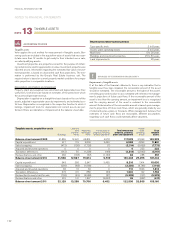

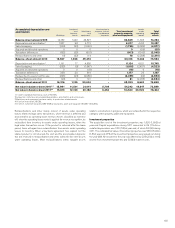

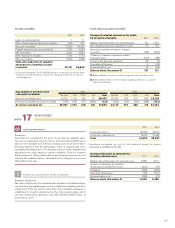

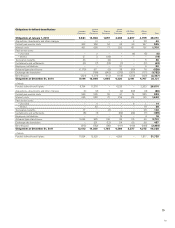

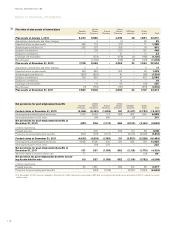

The following tables disclose information about defined-benefit plans in

the Volvo Group. Volvo recognizes the difference between the obligations

and the plan assets adjusted for unrecognized actuarial gains and losses

in the balance sheet. The information refers to assumptions applied for

actuarial calculations, periodical costs and the value of obligations and

plan assets at year-end. The tables also include reconciliation of obliga-

tions and plan assets during the year and the difference between fair

values and carrying amounts reported on the balance-sheet date.

ACCOUNTING POLICY

Volvo applies IAS 19, Employee Benefits, for post-employment benefits.

In accordance with IAS 19, actuarial calculations should be made for all

defined-benefit plans in order to determine the present value of obliga-

tions for benefits vested by its current and former employees. The actu-

arial calculations are prepared annually and are based upon actuarial

assumptions that are determined close to the balance-sheet date each

year. Changes in the present value of obligations due to revised actuarial

assumptions and experience adjustments constitute actuarial gains or

losses. These are expensed according to function over the employees’

average remaining service period to the extent they exceed the corridor

value for each plan.

Deviations between the expected return on plan assets and the actual

return are also treated as actuarial gains or losses. Provisions for post-

employment benefits in Volvo’s balance sheet correspond to the present

value of obligations at year-end, less fair value of plan assets, unrecog-

nized actuarial gains or losses and unrecognized unvested past service

costs.

As a supplement to IAS 19, Volvo applies UFR 4*, in accordance with

the recommendation from the Swedish Financial Reporting Board, in

calculating the Swedish pension liabilities.

For defined contribution plans, premiums are recognized as incurred in

profit and loss according to function.

IAS 19 will be amended as of January 1, 2013. For additional information,

refer to Note 1 under New Accounting Policies 2011 and later.

* UFR 4 states how Swedish special payroll tax and Swedish yield tax should be

accounted for regarding the part of the net pension liability that is attributable to

Swedish entities. Swedish special payroll tax is shown as a receivable/liability on

the difference compared to the legal pension liability. Swedish yield tax is con-

sidered when estimating expected return on plan asset.

109