Volvo 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

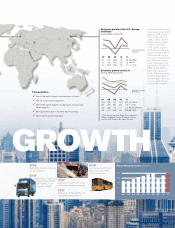

In September 2011 the Board of Directors of AB Volvo decided to implement new financial

targets for the Volvo Group starting in 2012. The new targets have been set in order to enable

the growth and profitability of the various operations to be measured and benchmarked annually

against competitors.

Transparent comparison with competitors

Volvo’s financial targets have included a focus on growth

since the end of the 1990s and the Board of Directors

expects growth to remain important in the future, but is

now adding a continuous benchmarking of the growth

and profitability of the various operations against a

number of selected competitors.

To facilitate comparisons, the truck operations will be

measured jointly with the bus operations and the con-

struction equipment operations will be measured jointly

with Volvo Penta. In 2012, the comparisons will be made

in accordance with the table below:

Trucks and buses Volvo CE and Volvo Penta

Daimler Brunswick

Iveco CAT

MAN CNH

Navistar Cummins

Paccar Deere

Scania Hitachi

Sinotruk Komatsu

Terex

The targets are followed up annually

• The annual organic sales growth for the truck, bus and

construction equipment operations, as well as Volvo

Penta, shall be equal to or exceed a weighted-average

for comparable competitors.

• Each year, the operating margin for the truck, bus and

construction equipment operations, as well as Volvo

Penta, shall be ranked among the top two companies

when benchmarked against relevant competitors.

• For Customer Finance Operations, the existing targets

of 12–15% return of equity (ROE) and an equity ratio

exceeding 8% stand firm.

• Volvo Aero has an ROE target of 15–25%. When calcu-

lating the ROE, Volvo Aero will be assigned the

same equity ratio as that for the Group’s Industrial

Operations.

• The capital structure target is set to a net debt, including

provisions for post-employment benefits, for the Indus-

trial Operations of a maximum of 40% of shareholders’

equity under normal conditions.

NEW TARGETS FROM 2012

“Following the Group’s successful

geographic and volume expansion,

we have the prerequisites in place

to compete successfully in our

various product segments and it is

with this in mind that the Board

has now decided to introduce new

financial targets.”

7