Volvo 2011 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

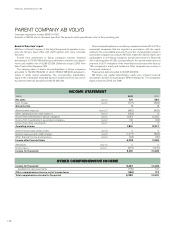

PARENT COMPANY AB VOLVO

Corporate registration number 556012-5790.

Amounts in SEK M unless otherwise specified. The amounts within parentheses refer to the preceding year.

Board of Directors’ report

AB Volvo is Parent Company of the Volvo Group and its operations com-

prise the Group’s head office with staff together with some corporate

functions.

Income from investments in Group companies includes dividends

amounting to 2,719 (8,145) and Group contributions, transfer price adjust-

ments and royalties net of 6,086 (5,126). Dividends include 2,500 from

Volvo Construction Equipment NV.

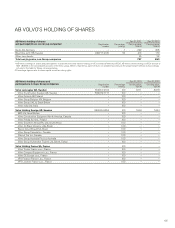

The carrying value of shares and participations in Group companies

amounted to 59,460 (59,429), of which 58,934 (58,903) pertained to

shares in wholly owned subsidiaries. The corresponding shareholders’

equity in the subsidiaries (including equity in untaxed reserves but exclud-

ing minority interests) amounted to 99,139 (90,261).

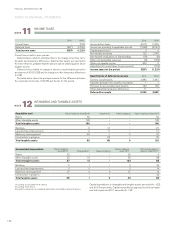

Shares and participations in non-Group companies included 413 (170) in

associated companies that are reported in accordance with the equity

method in the consolidated accounts. The portion of shareholders’ equity in

associated companies accruing to AB Volvo totaled 413 (322). Shares and

participations in non-Group companies include listed shares in Deutz AG

with a carrying value of 299, corresponding to the quoted market price at

year-end. In 2011 revaluation of the ownership has decreased the value by

159, recognized in equity and included in Other comprehensive income in

the income statement.

Financial net debt amounted to 30,665 (30,376).

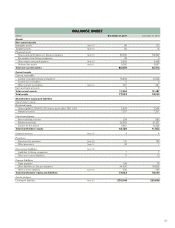

AB Volvo’s risk capital (shareholders’ equity plus untaxed reserves)

amounted to 42,163 corresponding to 55% of total assets. The comparable

figure at year-end 2010 was 54%.

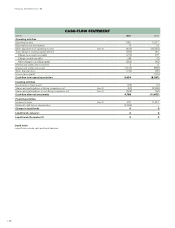

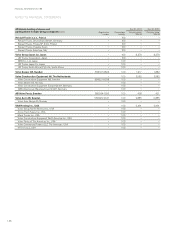

INCOME STATEMENT

SEK M 2011 2010

Net sales Note 2 721 564

Cost of sales Note 2 (721) (564)

Gross income 0 0

Administrative expenses Note 2, 3 (880) (652)

Other operating income and expenses Note 4 (146) 8

Income from investments in Group companies Note 5 8,743 13,252

Income from investments in associated companies Note 6 130 (94)

Income from other investments Note 7 4 3

Operating income 7,851 12,517

Interest income and similar credits Note 8 0 0

Interest expenses and similar charges Note 8 (1,677) (893)

Other financial income and expenses Note 9 (96) (65)

Income after financial items 6,078 11,559

Allocations Note 10 0 0

Income taxes Note 11 (597) (1,231)

Income for the period 5,481 10,328

OTHER COMPREHENSIVE INCOME

Income for the period 5,481 10,328

Available-for-sale investments (159) 172

Other comprehensive income, net of income taxes (159) 172

Total comprehensive income for the period 5,322 10,500

FINANCIAL INFORMATION 2011

126