Volvo 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

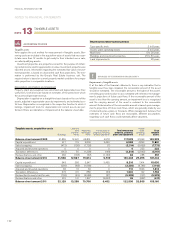

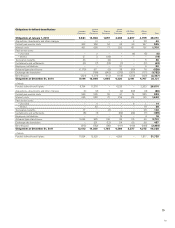

Fair value of plan assets in funded plans Sweden

Pensions

United

States

Pensions France

Pensions

Great

Britain

Pensions US Other

benefits Other

plans Total

Plan assets at January 1, 2010 6,430 9,866 – 4,392 28 1,894 22,610

Acquisitions, divestments and other changes – 4 – (1) – 26 29

Expected return on plan assets 386 719 – 216 – 77 1,398

Actuarial gains and (losses) 262 373 – 208 – 18 861

Employer contributions – 156 – 103 – 187 446

Employee contributions – – – 21 – 12 33

Exchange rate translation – (574) – (378) (2) (166) (1,120)

Benefits paid – (1,009) – (168) (2) (124) (1,303)

Plan assets at December 31, 2010 7,078 9,535 – 4,393 24 1,924 22,954

Acquisitions, divestments and other changes 3 8 – – – 6 17

Expected return on plan assets 426 683 – 204 – 92 1,405

Actuarial gains and (losses) (681) (628) – 81 – (96) (1,324)

Employer contributions 756 829 – 91 – 410 2,086

Employee contributions – – – 12 – 7 19

Exchange rate translation – 178 – 60 – (18) 220

Benefits paid (2) (763) – (161) – (578) (1,504)

Plan assets at December 31, 2011 7,580 9,842 – 4,680 24 1,747 23,873

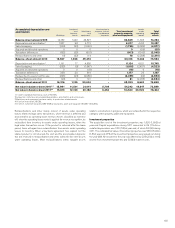

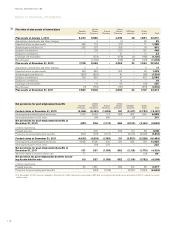

Net provisions for post-employment benefits Sweden

Pensions

United

States

Pensions France

Pensions

Great

Britain

Pensions US Other

benefits Other

plans Total

Funded status at December 31, 2010 (2,066) (3,463) (1,605) 167 (3,417) (2,783) (13,167)

Unrecognized actuarial (gains) and losses 1,475 4,054 113 388 322 643 6,995

Unrecognized past service costs – (65) 380 – (5) – 310

Net provisions for post-employment benefits at

December 31, 2010 (591) 526 (1,112) 555 (3,100) (2,140) (5,862)

of which reported as

Prepaid pensions – 900 – 555 110 83 1,648

Provisions for post-employment benefits (591) (374) (1,112) – (3,210) (2,223) (7,510)

Funded status at December 31, 2011 (4,432) (4,518) (1,765) 311 (3,553) (2,528) (16,485)

Unrecognized actuarial (gains) and losses 4,569 5,509 333 341 434 753 11,939

Unrecognized past service costs – (54) 276 – – – 222

Net provisions for post-employment benefits at

December 31, 2011 137 937 (1,156) 652 (3,119) (1,775) (4,324)

Whereof related to Assets held for sale 77 – – – – (13) 641

Net provision for post-employment benefits exclud-

ing Assets held for sale 60 937 (1,156) 652 (3,119) (1,762) (4,388)

of which reported as

Prepaid pensions 60 1,381 – 652 102 82 2,277

Provisions for post-employment benefits – (444) (1,156) – (3,221) (1,844) (6,665)

1 Per December 31, 2011 pension obligation amounted to 1,394, plan assets amounted to 926 and unrecognized actuarial losses amounted to 532 in regards to Assets

held for sale.

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

112