Volvo 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

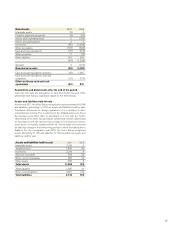

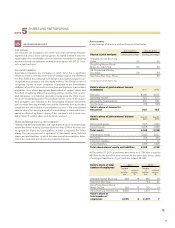

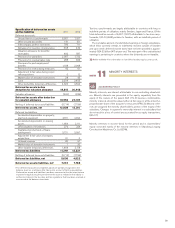

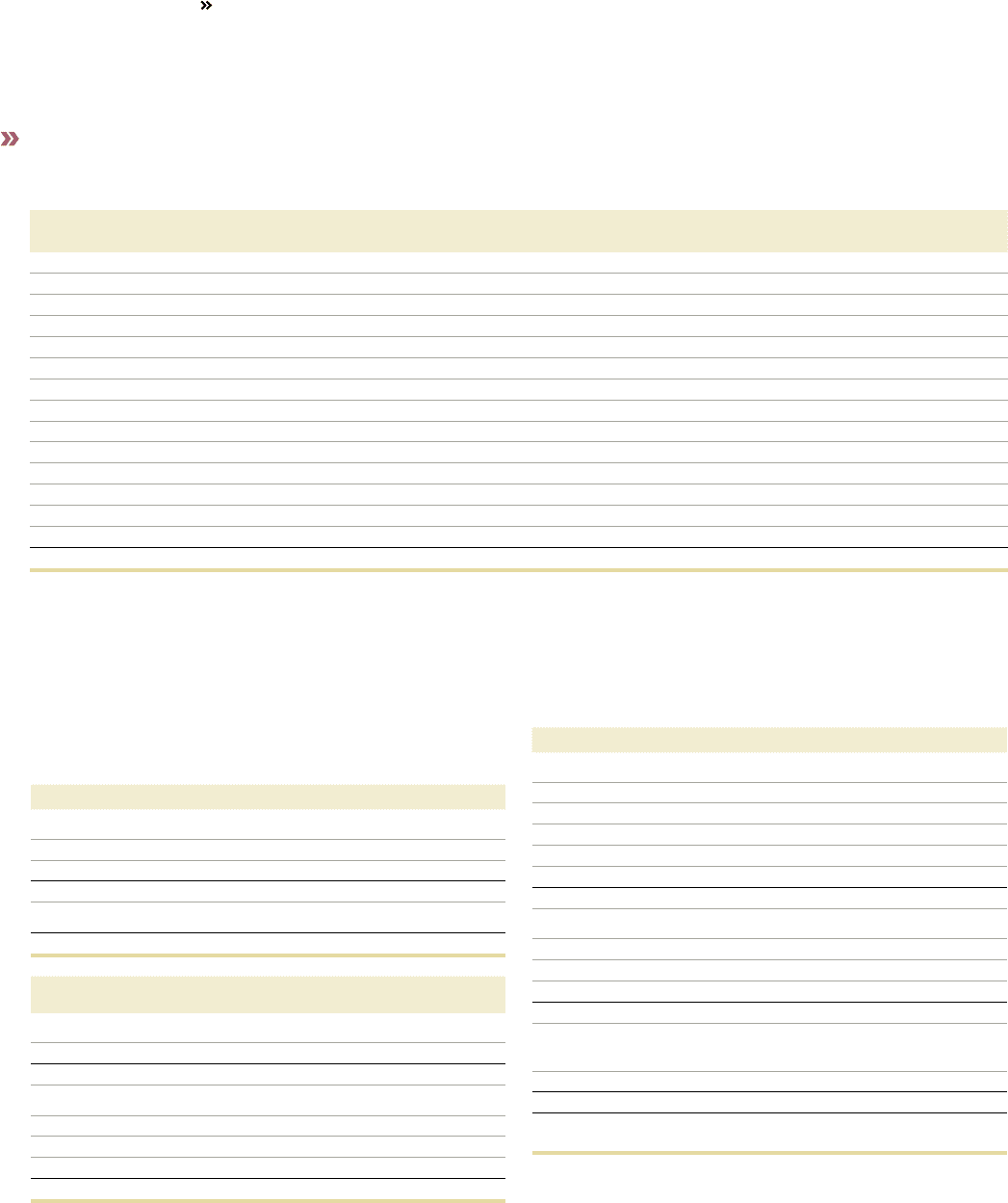

The following table presents summarized financial information for Volvo’s

associated companies. The income statement and balance sheet below

reflect the total associated companies, not only the part consolidated by

Volvo.

Income statement data 2011 2010

Net sales 2,543 3,794

Cost of sales (2,491) (3,840)

Financial income and expense (29) (32)

Income before taxes 23 (78)

Income taxes (23) (46)

Income of the period 0 (124)

Balance sheet data Dec 31

2011 Dec 31

2010

Non-current assets 2,094 2,085

Current assets 1,485 1,558

Total assets 3,579 3,643

Shareholders' equity 1,605 1,686

Provisions 53 61

Non-currentliabilities 621 452

Current liabilities 1,300 1,444

Total shareholders' equity and liabilities 3,579 3,643

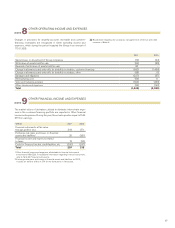

Income from investments in associated companies

Income/loss 2011 2010

UD TrucksNiigata Co 5 7

JV Fonderie Venissieux 4 (1)

Merkavim Metal Works Ltd 17 15

Blue Chip Jet I & II HB (46) (39)

Holdings of Volvo Technology Transfer1(6) (58)

Other companies 2 1

Subtotal (24) (75)

Revaluation and write-down of shares

Blue Chip Jet I & II HB – (11)

Holdings of Volvo Technology Transfer1(48) –

Other companies (4) –

Subtotal (52) (11)

Gains (losses) on divestment of shares in

associated companies

Holdings of Volvo Technology Transfer1(5) –

Subtotal (5) –

Total income (loss) from investments in

associated companies (81) (86)

1 Investments held by the Volvo venture-capital company.

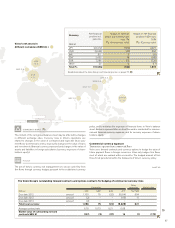

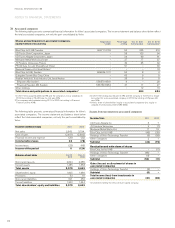

Associated companies

The following table presents summarized financial information for Volvo’s associated companies. The income statement and balance sheet below reflect

the total associated companies, not only the part consolidated by Volvo.

Shares and participations in associated companies,

equity method of accounting Registration

number Percentage

holding Dec 31, 2011

Carrying value Dec 31, 2010

Carrying value

Blue Chip Jet II HB, Sweden 969717-2105 50 405 319

UD Trucks Doto Corporation, Japan – 38 103 94

UD Trucks Niigata Corporation, Japan – 34 69 61

Merkavim Metal Works Ltd, Israel – 27 17 37

JV Fonderie Venissieux, France – 49 35 32

PK-UD Axle Co.,Ltd. (HangZhou), China1– 51 – 30

Diamond Finance Ltd, Great Britain2– – – 18

Blue Chip Jet HB, Sweden 969639-1011 50 8 3

Quingdao Sunwin Bus Corp, China – 43 9 9

Arabian Vehicle & Truck Industry Ltd, Saudi Arabia – 25 9 9

Effpower AB, Sweden3556570-8541 9 – 29

Powercell Sweden AB, Sweden 556759-8353 47 17 27

Other holdings – – 12 16

Total shares and participations in associated companies4 684 684

1 In 2011 Volvo acquired additional 6% and the company is now a subsidiary. In

2010 the holding in PK-UD Axle Co., Ltd was 45%.

2 The company was liquidated during 2011. In 2010 the holding in Diamond

Finance Ltd was 40%.

3 In 2011 the holding was reduced to 9% and the company is therefore no longer

accounted for as an associated company. In 2010 the holding in Effpower AB

was 34%.

4 Volvo’s share of shareholders’ equity in associated companies (incl. equity in

untaxed reserves) amounted to 684 (684).

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

92