Volvo 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

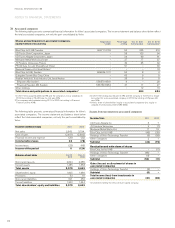

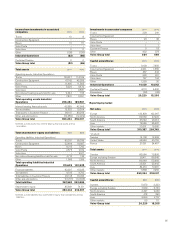

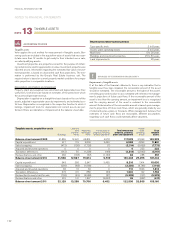

Specification of deferred tax assets

and tax liabilities 2011 2010

Deferred tax assets:

Unused tax-loss carryforwards 6,907 7,327

Other unused tax credits 141 121

Intercompany profitin inventories 780 711

Allowance for inventory obsolescence 368 439

Valuation allowance for doubtful

receivables 482 587

Provisions for warranties 2,067 1,722

Provisions for residual value risks 288 306

Provisions for post-employment

benefits 1,188 2,068

Provisions for restructuring measures 42 61

Adjustment to fair valueduring corpo-

rate acquisitions 0 12

Market value of derivative instruments 28 45

Land 2,204 2,455

Other deductible temporary differences 4,320 4,594

Deferred tax assets before

deduction for valuation allowance 18,815 20,448

Valuation allowance (263) (339)

Deferred tax assets after deduction

for valuation allowance 18,552 20,109

Netting of deferred tax assets/liabilities (5,714) (7,799)

Deferred tax assets, net 12,838 12,310

Deferred tax liabilities:

Accelerated depreciation on property,

plant and equipment 3,811 4,094

Accelerated depreciation on leasing

assets 1,959 2,111

LIFO valuation of inventories 270 224

Capitalized product and software

development 3,721 3,597

Adjustment to fair value at company

acquisitions 31 0

Untaxed reserves 92 97

Market value of derivative instruments 1 20

Other taxable temporary differences 1,464 2,178

Deferred tax liabilities 11,349 12,321

Netting of deferred tax assets/liabilities (5,714) (7,799)

Deferred tax liabilities, net 5,636 4,522

Deferred tax assets/liabilities, net17,203 7,788

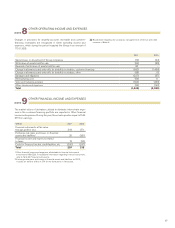

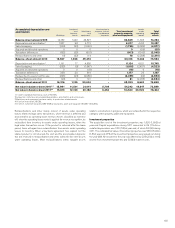

1 The deferred tax assets and liabilities above are partially recognized in the

balance sheet on a net basis after taking into account offsetting possibilities.

Deferred tax assets and liabilities have been measured at the tax rates that are

expected to apply during the period when the asset is realized or the liability is

settled, according to the tax rates and tax regulations that have been resolved or

announced at the balance-sheet date.

Tax-loss carryforwards are largely attributable to countries with long or

indefinite periods of utilization, mainly Sweden, Japan and France. Of the

total deferred tax assets of 6,907 (7,327) attributable to tax-loss carry-

forwards, 2,914 (3,665) pertains to Sweden, with an indefinite period of

utilization.

The cumulative amount of undistributed earnings in foreign subsidiaries,

which Volvo currently intends to indefinitely reinvest outside of Sweden

and upon which deferred income taxes have not been provided is approx-

imately SEK 62 billion (47) at year end. The main part of the undistributed

earnings is pertaining to countries where the dividends are not taxable.

Refer to Note 4 for information on how Volvo handles equity currency risk.

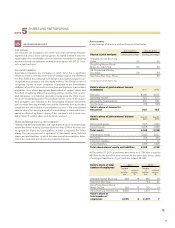

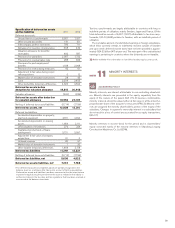

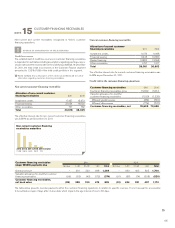

Minority interests, are interest attributable to non-controlling sharehold-

ers. Minority interests are presented in the equity, separately from the

equity of the owners of the parent (IAS 27). At business combinations

minority interests should be valued either at fair value or at the minority’s

proportionate share of the acquiree’s net assets (IFRS 3). Minority inter-

ests are assigned the minority shareholder’s portion of the equity of the

subsidiary. Changes in a parent’s ownership interest in a subsidiary that

do not result in a loss of control are accounted for as equity transactions.

(IAS 27)

Minority interests in income (loss) for the period and in shareholders’

equity consisted mainly of the minority interests in Shandong Lingong

Construction Machinery Co, Ltd (30%).

ACCOUNTING POLICY

MINORITY INTERESTS

11

NOTE

99