Volvo 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

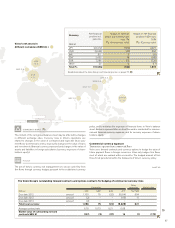

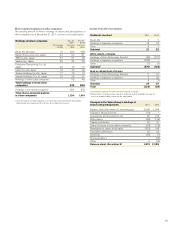

LIQUIDITY RISKS

Liquidity risk is defined as the risk that Volvo would be unable to finance

or refinance its assets or fulfill its payment obligations.

POLICY

Volvo assures itself of sound financial preparedness by always keeping a

certain percentage of its sales in liquid assets. A sound balance between

short and long-term borrowing, as well as borrowing preparedness in the

form of overdraft facilities, are intended to meet its long-term financing

needs.

LIQU IDIT Y RISKS

The adjacent graph J shows expected future cash-flows including deriv-

atives related to financial liabilities. Capital flow refers to expected pay-

ments of loans and derivatives, see note 22. Expected interest flow refers

to the future interest payments on loans and derivatives based on interest

rates expected by the market. The interest flow is recognized within cash

flow from operating activities.

In addition to derivatives included in capital flow in the table there are

also derivatives related to financial liabilities reported as assets, which are

expected to give a future capital flow of SEK 0.8 bn and a future interest

flow of SEK 3.4 bn.

Read more about the maturity structure concerning bond loans and other

loans, as well as granted but unutilized credit facilities in Note 22.

Read more about contractual term analyses of Volvo’s future rental payments

from non-annullable financial and operational lease contracts in Note 14.

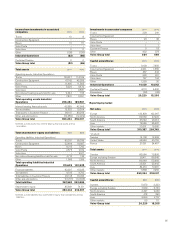

Future cash-flow including derivatives related to non-current

and current financial liabilities

Capital flow, SEK bn

Interest flow, SEK bn

2018

(0.7)

(0)

2015

(11.3)

(1.3)

2016

(13.0)

(0.9)

2017

(11.8)

(0.6)

2014

(20.9)

(2.7)

2013

(28.2)

(3.3)

2012

(44.5)

(5.6)

(50)

0

(40)

(30)

(20)

(10)

J

NOTES TO FINANCIAL STATEMENTS

FINANCIAL INFORMATION 2011

90