Volvo 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Volvo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For the Swedish part of the net pension liability there are still some uncer-

tainties regarding the accounting for Swedish special payroll tax and

Swedish yield tax. Swedish special payroll tax’ assignable to the amount

reported as the corridor for the Swedish entities amounts to approximately

SEK 1 billion. In the opening balance for 2012 in accordance with IAS 19

revised, this will likely be reported as an increase of the recognized pension

liability and in shareholders’ equity net of deferred taxes.

For further information of provision for post-employment benefit, see

note 20.

IFRS 10 Consolidated Financial Statements*, IFRS 11 Joint Arrangements*

and IFRS 12 Disclosures of Interests in Other Entities* applicable from

January 1, 2013.

IFRS 10 replaces the consolidation instructions in IAS 27 Consolidated

and Separate Financial Statements and SIC-12 Consolidation – Special

Purpose Entities and aims to implement a consolidation policy based on

control, defined as the extent to which the owner (i) has control of the

investment object, (ii) receives, or is entitled to, variable returns from his/

her involvement in the investment object and (iii) has the ability to exercise

his/her control of the investment object to influence the size of the return.

IFRS 11 replaces IAS 31 Interests in Joint Ventures and implements

new accounting requirements for joint ventures. The ability to apply the

proportionate method used by Volvo when recognizing jointly controlled

companies will be abolished, meaning that the equity method will remain

for the type of joint ventures that Volvo has. Hereafter Volvo will not con-

solidate the assignable part item by item, the assignable part will be

shown as income from investments in associated companies. The equity

interest of the joint ventures result will be affect the investment in joint

ventures in the balance sheet.

IFRS 12 Disclosure of Interests in Other Entities requires more detailed

disclosure reports on subsidiaries, associated companies and non-

consolidated structured companies, in which the company is involved.

Volvo is currently conducting a full analysis of the significance of these

standards and how they will affect Volvo. Although the standards are con-

sidered to change the recognition of joint ventures, they are not consid-

ered to have any significant impact on the consolidation of other compa-

nies of which Volvo has ownership or is involved. The scope of the

disclosures will probably increase in this area due to IFRS 12.

IFRS 9 Financial instruments*

IFRS 9 is published in three parts: Classification and Measurement,

Impairment and Hedge Accounting, which will replace the current IAS 39

with application not earlier than January 1, 2015. Prior application is vol-

untary, subject to EU approval. Volvo is currently conducting a review of

how the implementation of IFRS 9 will impact the Group. A joint position

will be taken in conjunction with the final version of all three components

of the project being published.

* These standards/interpretations had not been adopted by the EU when

this Annual Report was published. The dates listed for application may

thus be subject to change due to decisions made during the EU approval

process.

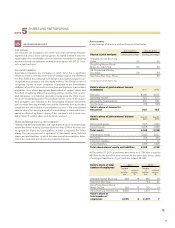

Volvo’s most significant accounting policies are primarily described

together with the applicable note. Refer to Note 1, Accounting Policies for

a specification. The preparation of Volvo’s Consolidated Financial State-

ments requires the use of estimates, judgements and assumptions that

affect the recognized amounts of assets, liabilities and provisions at the

date of the financial statements and the recognized amounts of sales and

expenses during the periods presented. In preparing these financial

statements, Volvo’s management has made its best estimates and judge-

ments of certain amounts included in the financial statements, giving due

consideration to materiality. Since future results are an unknown quantity,

actual results could differ from these estimates due to the application of

these assumptions. In accordance with IAS 1, the company is required to

provide additional disclosure of accounting policies in which estimates,

judgments and assumptions are particularly sensitive and which, if actual

results differ, may have a material impact on the financial statements.

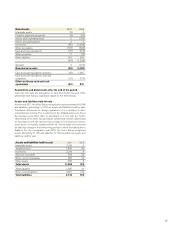

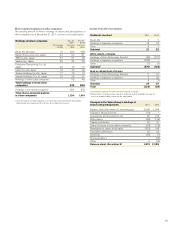

! The sources of uncertainty which has been identified by Volvo and

which fulfil those criterias are presented in connection to the items con-

sidered to be affected. The adjacent table shows where to find those

presentations.

Source of estimation uncetainty Note

Revenue recognition 7, Income

Deferred taxes 10, Income taxes

Impairment of goodwill and other intan-

gible assets 12, Intangible assets

Assets and other non-current assets 13, Tangible assets

Credit loss reserves 15, Customer-financing

receivables

16, Receivables

Inventory obsolescence 17, Inventories

Pensions and other post-employment

benefits 20, Provisions for post-

employment benefits

Product warranty costs 21, Other provisions

Legal proceedings 21, Other provisions

Residual value risks 21, Other provisions

KEY SOURCES OF ESTIMATION UNCERTAINTY

2

NOTE

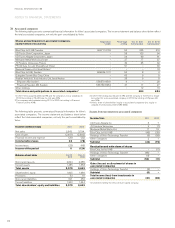

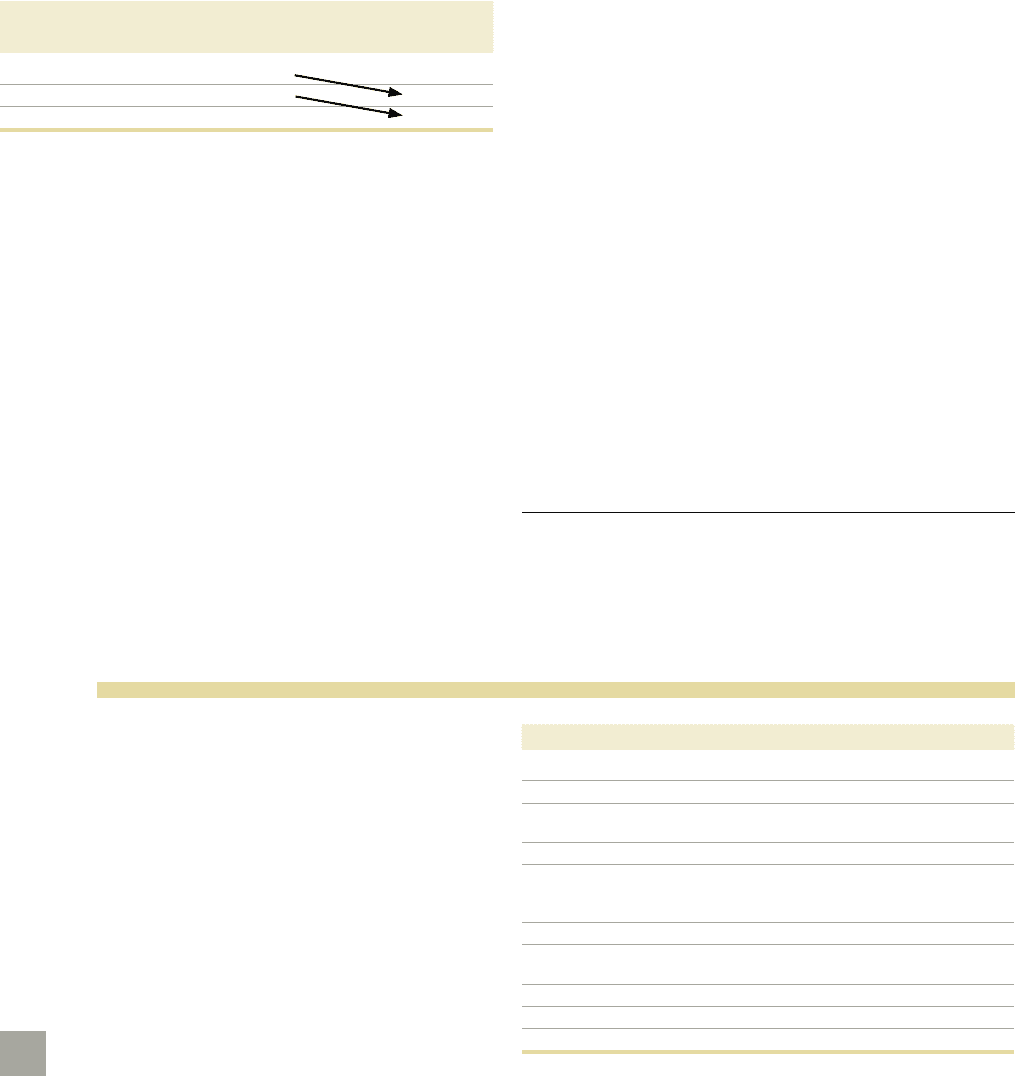

Off-balance Unrecognized actuarial

gains and losses

Effect on operating income of

amortization of unrecognized

actuarial losses

Dec 31, 2009 SEK 9 billion –

Dec 31, 2010 SEK 7 billion SEK 420 M

Dec 31, 2011 SEK 12 billion SEK 335 M

83