Vodafone 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials |97

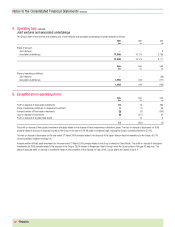

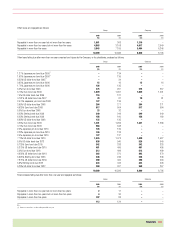

The cost of assets in the course of construction, which are not subject to depreciation, was:

2005

£m

Land and buildings 16

Equipment, fixtures & fittings 341

Network infrastructure 986

Total 1,343

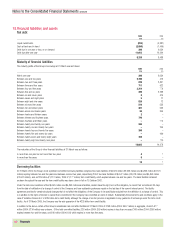

13.Fixed asset investments

Associated undertakings

Group

£m

Share of net assets:

1 April 2004 3,075

Exchange movements (41)

Share of retained results excluding goodwill amortisation 152

Share of goodwill amortisation (42)

31 March 2005 3,144

Capitalised goodwill:

1 April 2004 18,151

Exchange movements (173)

Acquisitions (note 25) 5

Goodwill amortisation (1,729)

31 March 2005 16,254

Net book value:

31 March 2005 19,398

31 March 2004 21,226

For acquisitions of associated undertakings prior to 1 April 1998, the cumulative goodwill written off to reserves, net of the goodwill attributed to business disposals, was

£467 million at 31 March 2005 (2004: £467 million).

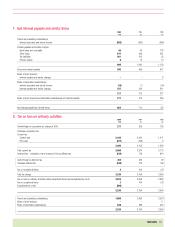

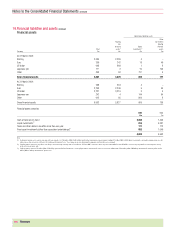

The Group’s share of its associated undertakings comprises:

2005 2004

£m £m

Share of turnover of associated undertakings 11,648 10,179

Share of assets:

Fixed assets 8,895 8,139

Current assets 2,651 2,263

11,546 10,402

Share of liabilities:

Liabilities due within one year 5,398 4,695

Liabilities due after more than one year 2,578 2,197

Minority interests 426 435

8,402 7,327

Share of net assets 3,144 3,075

Attributed goodwill net of accumulated amortisation and impairment 16,254 18,151

19,398 21,226

In addition, minority interests disclosed in the Consolidated Profit and Loss account for the year ended 31 March 2005 includes £45 million in respect of joint ventures and

associated undertakings (2004: £61 million; 2003: £(20) million).