Vodafone 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

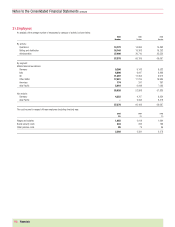

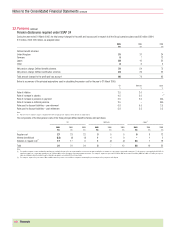

Notes to the Consolidated Financial Statements continued

112 |Financials

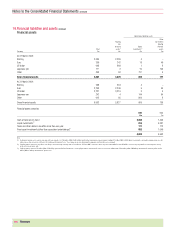

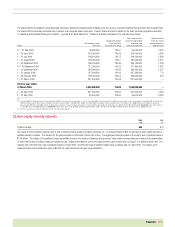

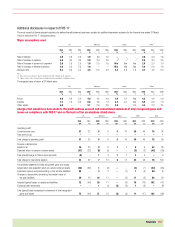

25.Acquisitions and disposals

The Group has undertaken a number of transactions during the year, including the acquisition of additional minority stakes in certain existing subsidiary undertakings. The

aggregate consideration and total cash outflow for all acquisitions was £2,461 million.

Under UK GAAP, the total goodwill capitalised in respect of transactions has been assessed as £1,762 million, including £5 million in relation to associated undertakings.

Acquisition of additional minority stakes in certain existing subsidiary undertakings

During the year ended 31 March 2005, the Company has directly or indirectly increased its interest in its subsidiary undertakings in Japan, Hungary and Greece. These

transactions are in line with the Group’s strategy of increasing its shareholding in existing operations where opportunities arise for the creation of enhanced value for the

Company’s shareholders.

Fair value net

assets Goodwill

Consideration acquired(1) capitalised

£m £m £m

Vodafone Japan(2) 2,380 690 1,690

Vodafone Hungary(3)(4) 55 12 43

Vodafone Greece(3) 1037

2,445 705 1,740

Notes:

(1) No adjustments were made for fair values as compared with book values at acquisition.

(2) In the first half of the year, the Group increased its effective shareholding in Vodafone K.K. from 69.7% to 98.2% and its stake in Vodafone Holdings K.K. from 66.7% to 96.1% for a total consideration of £2.4 billion. On 1 October 2004, the merger of

Vodafone K.K. and Vodafone Holdings K.K. was completed, resulting in the Group holding a 97.7% stake in the merged company, Vodafone K.K.

(3) As a result of these acquisitions, the Group’s interest in Vodafone Greece and Vodafone Hungary increased from 99.4% to 99.8% and from 87.9% to 100% respectively.

(4) Additional equity of HUF 89,301 million (£248 million) was subscribed for in Vodafone Hungary prior to this transaction.

As described in note 26 “Commitments”, the Group has entered into an agreement with Telesystem International Wireless Inc. of Canada to acquire approximately 79% of the

share capital of MobiFon S.A. in Romania, and 100% of the issued share capital of Oskar Mobil a.s. in the Czech Republic.

Disposals

In January 2005, the Group disposed of a 16.9% stake in Vodafone Egypt for cash consideration of £65 million, reducing the Group’s controlling stake to 50.1%.

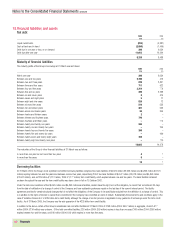

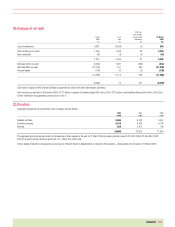

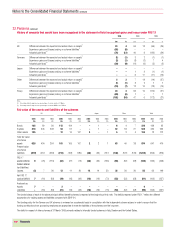

26.Commitments

Operating lease commitments

Commitments to non-cancellable operating lease payments are analysed as follows:

2005 2004

Land and Other Land and Other

buildings assets Total buildings assets Total

£m £m £m £m £m £m

In respect of leases expiring:

Within one year 99 91 190 79 97 176

Between two and five years 146 91 237 147 85 232

After five years 170 33 203 136 42 178

Payments due:

Within one year 415 215 630 362 224 586

In more than one year but less than two years 406 366

In more than two years but less than three years 352 295

In more than three years but less than four years 299 256

In more than four years but less than five years 255 218

Thereafter (more than five years) 1,132 1,016

3,074 2,737

Finance lease commitments

Details of commitments under finance leases are included in notes 17 and 18.