Vodafone 2005 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Shareholder information |139

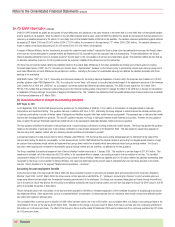

Principal differences between IFRS and UK GAAP

Measurement and Recognition

The Group has identified the principal differences between IFRS and the Group’s UK GAAP accounting policies, which are summarised below.

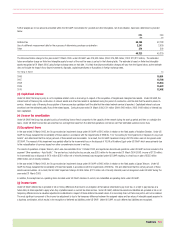

Proposed dividends

IAS 10, “Events after the Balance Sheet Date”requires that dividends declared after the balance sheet date should not be recognised as a liability at that balance sheet date as the

liability does not represent a present obligation as defined by IAS 37, “Provisions, Contingent Liabilities and Contingent Assets”.

The final dividend declared in May 2004 in relation to the financial year ended 31 March 2004 of £728 million has been reversed in the opening balance sheet.

Financial Instruments

IAS 32, “Financial Instruments: Disclosure and Presentation”and IAS 39, “Financial Instruments: Recognition and Measurement”address the accounting for, and reporting of,

financial instruments. IAS 39 sets out detailed accounting requirements in relation to financial assets and liabilities.

All derivative financial instruments are accounted for at fair market value whilst other financial instruments are accounted for either at amortised cost or at fair value depending on

their classification. Subject to stringent criteria, financial assets and financial liabilities may be designated as forming hedge relationships as a result of which fair value changes

are offset in the income statement or charged/credited to equity depending on the nature of the hedge relationship.

Reclassification of non-equity minority interests to liabilities

The primary impact of the implementation of IAS 32 is the reclassification of the $1.65 billion preferred shares issued by the Group’s subsidiary, Vodafone Americas Inc., from non-

equity minority interests to liabilities. The reclassification at 1 April 2004 was £875 million. Dividend payments by this subsidiary, which were previously reported in the Group’s

income statement as non-equity minority interests, have been reclassified to financing costs.

Fair value of available for sale financial assets

The Group has classified certain of its cost-based investments as ‘available for sale’ financial assets as defined in IAS 39. This classification does not reflect the intentions of

management in relation to these investments. These assets are measured at fair value at each reporting date with movements in fair value taken to equity. At 1 April 2004, a

cumulative increase of £233 million in the fair value over the carrying value of these investments has been recognised.

Other adjustments

Hedge accounting has been adopted for the majority of the Group’s interest rate swaps and underlying capital market debt, thereby reducing potential volatility in the income

statement.

Certain derivative financial instruments used to manage interest rate and foreign exchange exposures are not held in hedge relationships. However, these tend to be relatively short

term in nature, causing limited income statement volatility.

Defined benefit pension schemes

The Group currently applies the provisions of SSAP 24 under UK GAAP and provides detailed disclosure under FRS 17 in accounting for pensions and other post-employment

benefits.

The Group has elected to adopt early the amendment to IAS 19, “Employee Benefits”issued by the IASB on 16 December 2004 which allows all actuarial gains and losses to be

charged or credited to equity.

The Group’s opening IFRS balance sheet at 1 April 2004 reflects the assets and liabilities of the Group’s defined benefit schemes totalling a net liability of £154 million. This

amount represents less than 0.2% of the Group’s market capitalisation at 31 March 2004. The transitional adjustment of £257 million to opening reserves comprises the reversal

of entries in relation to UK GAAP accounting under SSAP 24 less the recognition of the net liabilities of the Group’s and associated undertakings’ defined benefit schemes.

Goodwill and acquired intangible asset amortisation

IAS 38, “Intangible Assets”requires that goodwill is not amortised. Instead it is subject to an annual impairment review. As the Group has elected not to apply IFRS 3

retrospectively to business combinations prior to the opening balance sheet date under IFRS, the UK GAAP goodwill balance at 31 March 2004 (£96,931 million) has been

included in the opening IFRS consolidated balance sheet and is no longer amortised.

Licence fee amortisation

Under IAS 38, capitalised payments for mobile licences are amortised on a straight line basis over their useful economic life. Amortisation is charged from the commencement of

service of the network. Under UK GAAP, the Group’s policy is to amortise such costs in proportion to the capacity of the network during the start up period and then on a straight-

line basis thereafter.