Vodafone 2005 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

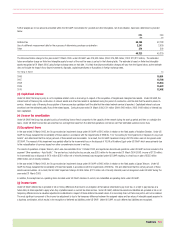

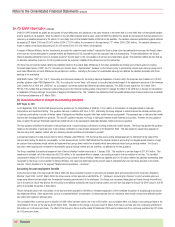

Notes to the Consolidated Financial Statements continued

134 |Financials

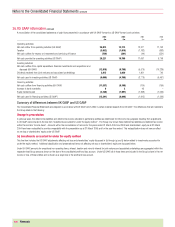

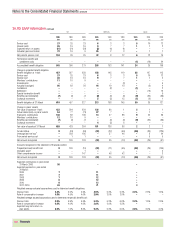

36.US GAAP information continued

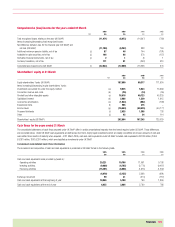

UK Germany Japan

2005 2004 2003 2005 2004 2003 2005 2004 2003

£m £m £m £m £m £m £m £m £m

Service cost 37 25 23 633510 12

Interest costs 26 19 16 977112

Expected return on assets (31) (21) (23) (8) (4) (1) –––

Actuarial gains and losses 72 16 9 25 23–11

Net periodic pension cost 104 39 25 32 812 612 15

Termination benefits and

curtailment costs ––––––(1) (16) 24

Accumulated benefit obligation 545 390 279 208 153 141 24 25 106

Change in projected benefit obligation:

Benefit obligation at 1 April 457 327 258 158 145 119 35 127 115

Service cost 37 25 23 633510 12

Interest cost 26 19 16 977112

Members’ contributions 11 10 9 ––––––

Amendments –––––(3) –– 5

Actuarial loss/(gain) 95 82 28 44 19 13 –(3) 4

Curtailment ––––(2) –(1) – 2

Settlement –––––––(76) 13

Special termination benefit –––––––– 9

Benefits paid (estimated) (7) (6) (7) (9) (9) (9) (9) (22) (36)

Exchange movement –––5(5) 15 (1) (2) 1

Benefit obligation at 31 March 619 457 327 213 158 145 30 35 127

Change in plans’ assets:

Fair value of assets at 1 April 433 264 229 136 86 1 211

Actual return/(loss) on plans’ assets 54 77 (73) 27 7 – –1 –

Employer’s contributions 136 88 106 14 57 88 922 36

Members’ contributions 12 10 9 ––––––

Benefits paid (estimated) (7) (6) (7) –(9) (9) (9) (22) (36)

Exchange movement –––4(5) 6 –––

Fair value of assets at 31 March 628 433 264 181 136 86 221

Funded status 9(24) (63) (32) (22) (59) (28) (33) (126)

Unrecognised net loss(1) –203 195 –57 46 –324

Prior period service cost –11––––55

Net amount recognised 9180 133 (32) 35 (13) (28) (25) (97)

Amounts recognised in the statement of financial position:

Prepaid/(accrued) benefit cost 9180 (15) (32) (11) (55) (28) (25) (105)

Intangible asset –– 1 ––––– 5

Other comprehensive income –– 147 –46 42 –– 3

Net amount recognised 9180 133 (32) 35 (13) (28) (25) (97)

Expected contributions in year ended

31 March 2006 36 ––

Expected payments in year ended

31 March:

2006 711 –

2007 711 –

2008 712 –

2009 812 –

2010 813 –

2011-2016 43 71 3

Weighted-average actuarial assumptions used to determine benefit obligations:

Discount rate 5.4% 5.5% 5.9% 4.5% 5.3% 5.3% 2.3% 2.3% 1.5%

Rate of compensation increase 4.8% 4.5% 4.0% 2.9% 3.0% 2.0% –––

Weighted-average actuarial assumptions used to determine net periodic benefit cost:

Discount rate 5.5% 5.9% 6.5% 5.3% 5.3% 6.0% 2.3% 1.5% 2.5%

Rate of compensation increase 4.5% 4.0% 4.0% 3.0% 2.0% 2.5% –––

Expected long-term return on

plan assets 6.9% 7.5% 8.0% 5.3% 5.3% 6.0% 2.8% 3.0% 4.4%