Vodafone 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

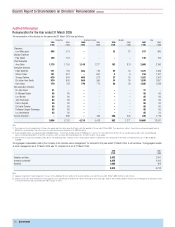

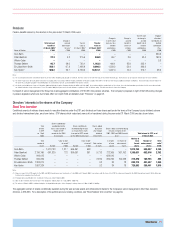

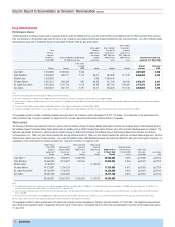

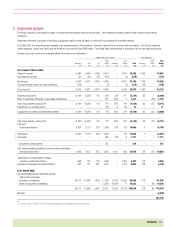

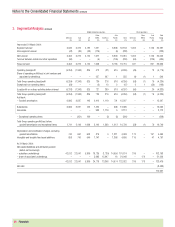

Consolidated Financial Statements

Financials |77

Index to the Consolidated Financial Statements

Page

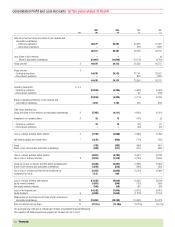

Consolidated Profit and Loss Accounts for the years ended 31 March ...............................................................................................................................................................78

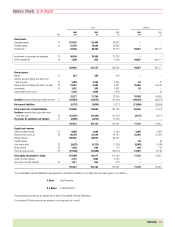

Balance Sheets at 31 March ............................................................................................................................................................................................................................79

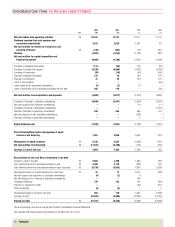

Consolidated Cash Flows for the years ended 31 March ...................................................................................................................................................................................80

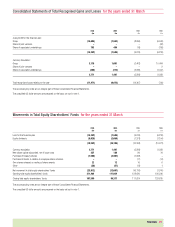

Consolidated Statements of Total Recognised Gains and Losses for the years ended 31 March..........................................................................................................................81

Movements in Total Equity Shareholders’ Funds for the years ended 31 March..................................................................................................................................................81

Notes to the Consolidated Financial Statements:

1. Basis of Consolidated Financial Statements.....................................................................................................................................................................................82

2. Accounting policies.........................................................................................................................................................................................................................82

3. Segmental analysis.........................................................................................................................................................................................................................85

4. Exceptional operating items ............................................................................................................................................................................................................88

5. Operating loss ................................................................................................................................................................................................................................88

6. Exceptional non-operating items .....................................................................................................................................................................................................90

7. Net interest payable and similar items.............................................................................................................................................................................................91

8. Tax on loss on ordinary activities.....................................................................................................................................................................................................91

9. Equity dividends .............................................................................................................................................................................................................................93

10.Loss per share ..............................................................................................................................................................................................................................94

11.Intangible fixed assets ...................................................................................................................................................................................................................95

12.Tangible fixed assets .....................................................................................................................................................................................................................96

13.Fixed asset investments.................................................................................................................................................................................................................97

14.Stocks...........................................................................................................................................................................................................................................99

15.Debtors.........................................................................................................................................................................................................................................99

16.Investments ................................................................................................................................................................................................................................100

17.Creditors: amounts falling due within one year .............................................................................................................................................................................100

18.Creditors: amounts falling due after more than one year...............................................................................................................................................................100

19.Financial liabilities and assets......................................................................................................................................................................................................102

20.Financial instruments ..................................................................................................................................................................................................................105

21.Provisions for liabilities and charges.............................................................................................................................................................................................106

22.Called up share capital................................................................................................................................................................................................................107

23.Reserves.....................................................................................................................................................................................................................................110

24.Non-equity minority interests .......................................................................................................................................................................................................111

25.Acquisitions and disposals...........................................................................................................................................................................................................112

26.Commitments .............................................................................................................................................................................................................................112

27.Contingent liabilities ....................................................................................................................................................................................................................113

28.Analysis of cash flows .................................................................................................................................................................................................................114

29.Analysis of net debt.....................................................................................................................................................................................................................115

30.Directors.....................................................................................................................................................................................................................................115

31.Employees ..................................................................................................................................................................................................................................116

32.Pensions.....................................................................................................................................................................................................................................117

33.Subsequent events......................................................................................................................................................................................................................121

34.Principal subsidiary undertakings, associated undertakings and investments.................................................................................................................................122

35.Related party transactions ...........................................................................................................................................................................................................123

36.US GAAP information...................................................................................................................................................................................................................124

37.Changes in accounting standards ................................................................................................................................................................................................136