Vodafone 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating and Financial Review and Prospects continued

40 |Performance

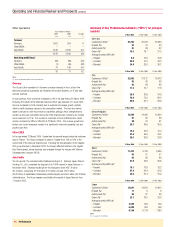

Japan

Vodafone continues to encounter difficult market conditions in Japan due to the

strength of competitor offerings, specifically in 3G customer propositions. A recent

strengthening of the management team and the ongoing transformation plan are

intended to improve Vodafone’s competitive position and financial performance over the

mid to long term.

Local currency turnover for the year ended 31 March 2005 fell marginally compared to

the prior year, with a 5% decrease in service revenue partially offset by an increase in

equipment and other revenue. Service revenue declined following a reduction in ARPU,

partially offset by an increase in the average customer base.

The ARPU erosion was caused by the loss of higher value customers, through the lack

of a competitive 3G offering during the financial year, together with the adverse impact

of lower termination charges caused by changes to the regulatory environment from

1 April 2004 and a total ban on using mobile phones whilst driving from 1 November

2004.

The average customer base grew 4% over the financial year, although market share

declined from 18.4% at 31 March 2004 to 17.3% at 31 March 2005. Prepaid

customers comprised 11% of closing customers, up from 9% at 31 March 2004. By

31 March 2005, Vodafone had 798,000 devices registered to use 3G data services in

Japan.

Non-voice service revenue decreased by 7% over the comparative period, primarily due

to the loss of higher value customers, who generally use more data services, and the

increased proportion of prepaid customers, who can only access basic data services. A

new flat rate data tariff for 3G customers was introduced in the winter and is

anticipated to improve the competitiveness of the data proposition.

Operating profit fell for the year ended 31 March 2005, principally due to the ARPU

dilution, the continued focus on customer retention and the migration of existing

customers to 3G service offerings. The impact of these issues has been partially offset

by a decrease in other direct costs due to a lower provision for slow moving handset

stocks in the year ended 31 March 2005, and other operational efficiencies. The

increase in payroll costs was largely due to one-off charges of approximately

£25 million associated with a voluntary redundancy programme in the first half of the

financial year, which was part of the transformation plan noted below, offset by lower

ongoing costs in the second half of the financial year. Operating profit was also

impacted by increased depreciation charges following 3G network roll out and the

disposal of assets in relation to the integration of regional systems.

During the financial year, Japan completed the majority of the consolidation of its

regional structure, with the integration of key business systems now complete. The

integration of billing and IT systems is a longer term, and more complex project and is

ongoing. Overall, Japan has improved its cost structure through reductions in general

overheads and the effective utilisation of dark fibre.

The Group has strengthened its management team in Japan through the appointment

of Shiro Tsuda and Bill Morrow during the year. Formerly Senior Executive Vice

President at NTT DoCoMo, Inc., Shiro Tsuda brings considerable experience of the

mobile telecommunications industry, together with an extensive knowledge of the

Japanese business and consumer markets. Bill Morrow has significant experience

through various global leadership positions within the Vodafone Group for the last eight

years and was formerly President of Japan Telecom.

In the year ending 31 March 2006, management will focus on enhancing customer

satisfaction, through an improved handset portfolio, targeted new product offerings,

improvements in both network coverage and capacity and a renewed focus on

business customers. In addition, cost reductions are expected through leveraging the

Group’s global scale and scope. With these measures it is hoped that Vodafone will be

more agile and commercially driven when facing mobile number portability in the

Japanese market in the 2006 financial year.

In the first half of the year, the Group increased its effective shareholding in Vodafone

K.K. to 98.2% and its stake in Vodafone Holdings K.K. to 96.1% for a total

consideration of £2.4 billion. On 1 October 2004, the merger of Vodafone K.K. and

Vodafone Holdings K.K. was completed, resulting in the Group holding a 97.7% stake

in the merged company, Vodafone K.K.

Other Asia Pacific subsidiaries

In the Australian market, value promotions and strategic changes in the tariff structures

led to Vodafone increasing market share, turnover and profitability. ARPU also

increased, despite falling prices, due to increased usage. In August 2004, Vodafone

announced an agreement with another Australian telecommunications carrier to share

3G network equipment to reduce the total cost of ownership of the 3G network and

increase speed to market. This is expected to lead to the launch of 3G services in

October 2005.

In New Zealand, turnover and market share improved over the year as a result of

enhanced customer propositions. Operating profit also increased as reduced

equipment costs offset the effect of increased interconnection costs as the proportion

of activity to non-Vodafone networks increased. The launch of a high speed network

upgrade by competitors in the second half of the financial year has intensified

competition in the market. Vodafone is expected to launch 3G services in July 2005.

Other Asia Pacific

China Mobile, in which the Group has a 3.27% stake, and which is accounted for as an

investment, grew its customer base by 42% over the year to 213,874,000 at

31 March 2005, including 26,831,000 from customers added as a result of

acquisitions. Dividends totalling £18 million were received from China Mobile during

the year.

Changes to the regional structure

From 1 April 2005, Japan will report directly to the Chief Executive whilst the Group’s

other operations in Asia Pacific will form part of an extended Other Europe, Middle East

and Africa region, which will in future be referred to as Other Mobile Operations.

Other operations

Years ended 31 March

2005 2004 Change

£m £m %

Turnover

Germany 1,108 1,002 11

Asia Pacific –1,126

1,108 2,128 (48)

Operating profit/(loss)(1)

Germany 66 (58)

Other EMEA (37) (1)

Asia Pacific –79

29 20 45

Notes:

(1) before goodwill amortisation and exceptional items

Germany

In local currency, Arcor’s turnover increased by 14%, primarily due to customer and

usage growth, partially offset by tariff decreases in a competitive market. Arcor

strengthened its position as the main competitor to the incumbent fixed line market

leader during the year growing contract ISDN voice (direct access) customers by 83%

to 712,000 and contract DSL (broadband Internet) customers by 169% to 455,000 in

the twelve months to 31 March 2005. Market share in the fast growing broadband