Vodafone 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Board’s Report to Shareholders on Directors’ Remuneration continued

74 |Governance

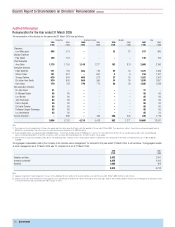

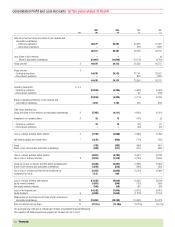

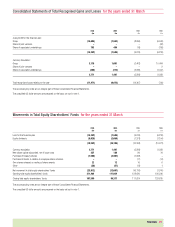

Details of the options exercised by directors of the Company in the year ended 31 March 2005, are as follows:

Options exercised

during the Market price Gross pre-tax

year at date of gain

(Number) Option price exercise (£’000)

Arun Sarin 2,890,000 $1.6125 $2.76765 1,767.8

2,110,000 $1.6125 $2.70020 1,215.3

Peter Bamford 150,500 £0.5870 £1.2056 93.1

5,150,500 3,076.2

Notes:

The aggregate gross pre-tax gain made on the exercise of share options in the 2005 financial year by the Company’s above directors was £3,076,276 (2004: £1,903,983). The closing middle market price of the Company’s shares at 31 March 2005 was

140.5p, its highest closing price in the 2005 financial year having been 146.75p and its lowest closing price having been 114p.

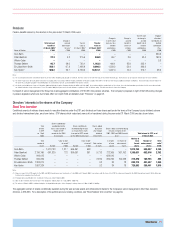

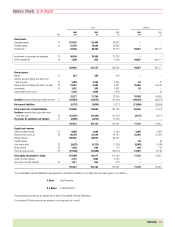

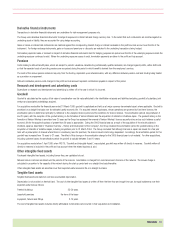

Beneficial interests

The directors’ beneficial interests in the ordinary shares of the Company, which includes interests in the Vodafone Group Profit Sharing Scheme and the Vodafone Share Incentive

Plan, but which excludes interests in the Vodafone Group Share Option Schemes, the Vodafone Group Short Term Incentive or in the Vodafone Group Long Term Incentives, are

shown below:

1 April 2004 or date of

23 May 2005 31 March 2005 appointment

Lord MacLaurin 92,495 92,495 92,495

Paul Hazen 360,900 360,900 360,900

Arun Sarin(1) 4,832,560 4,832,560 4,832,560

Peter Bamford 247,092 246,736 290,518

Thomas Geitner 417,700 417,700 12,350

Sir Julian Horn-Smith 1,818,613 1,818,257 1,734,834

Ken Hydon 2,446,869 2,446,513 2,325,200

Sir John Bond(2) 34,423 34,423 –

Dr Michael Boskin 212,500 212,500 212,500

Lord Broers 19,819 19,819 19,379

John Buchanan 104,318 104,318 102,000

Penny Hughes 22,500 22,500 22,500

Sir David Scholey 50,000 50,000 50,000

Professor Jürgen Schrempp 10,000 10,000 –

Luc Vandevelde 20,000 20,000 20,000

Notes:

(1) Arun Sarin also has a non-beneficial interest as the trustee of two family trusts, each holding 5,720 shares.

(2) Sir John Bond was appointed to the Board on 1 January 2005.

Changes to the interests of the directors of the Company in the ordinary shares of the Company during the period from 1 April 2005 to 23 May 2005 relate to shares acquired

either through Vodafone Group Personal Equity Plans or the Vodafone Share Incentive Plan. As at 31 March 2005, and during the period from 1 April 2005 to 23 May 2005, no

director had any interest in the shares of any subsidiary company.

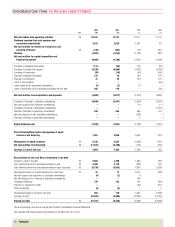

Other than those individuals included in the table above who were Board members as at 31 March 2005, members of the Group’s Executive Committee, at 31 March 2005, had

an aggregate beneficial interest in 2,290,975 ordinary shares of the Company. At 23 May 2005, Executive Committee members at that date, including Tim Miles who was

appointed to the Executive Committee in April 2005, had an aggregate beneficial interest in 2,344,266 ordinary shares of the Company, none of whom had an individual beneficial

interest amounting to greater than 1% of the Company’s ordinary shares.

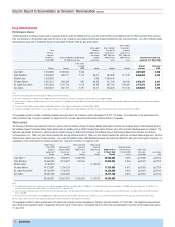

Interests in share options of the Company at 23 May 2005

At 23 May 2005, there had been no change to the directors’ interests in share options from 31 March 2005.

Other than those individuals included in the table above, at 23 May 2005, members of the Group’s Executive Committee at that date held options for 49,281,976 ordinary shares

at prices ranging from 48.3 pence to 293.7 pence per ordinary share, with a weighted average exercise price of 144.0 pence per ordinary share exercisable at dates ranging from

July 1999 to July 2014, and options for 273,254 ADSs at prices ranging from $13.65 to $45.3359 per ADS, with a weighted average exercise price of $23.316 per ADS,

exercisable at dates ranging from July 2001 to July 2013.

Lord MacLaurin, Paul Hazen, Sir John Bond, Dr Michael Boskin, Lord Broers, John Buchanan, Penny Hughes, Sir David Scholey, Professor Jürgen Schrempp and Luc Vandevelde

held no options at 23 May 2005.

Penny Hughes

On behalf of the Board