Vodafone 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating and Financial Review and Prospects continued

38 |Performance

improved customer satisfaction contributed to local currency service revenue growth of

over 20%, despite a reduction in termination rates of 10.5% on 1 November 2004

required by the regulator.

In local currency, turnover increased by 24%, due principally to a 22% increase in

service revenue. A successful customer acquisition strategy, including a focus on

customers transferring from other operators, led to an 11% increase in the average

customer base. Loyalty programmes and promotional activity resulted in a reduction in

churn levels from 23.6% for the year ended 31 March 2004 to 21.9% for the 2005

financial year. An ongoing marketing campaign encouraging customers to switch from

prepaid to contract contributed to the proportion of contract customers rising from 43%

at 31 March 2004 to 47% at 31 March 2005. This, along with usage stimulation

promotions and initiatives, has resulted in a 10% increase in ARPU.

Non-voice service revenue for the year increased by 46%, with messaging remaining

the principal driver of the increase. Text messaging volumes increased 27% year on

year, primarily due to promotions stimulating increased messaging per customer. The

success of service offerings such as Vodafone live! and Vodafone Mobile Connect data

cards led to non-messaging data revenue increasing by 201% in local currency to £65

million. The number of Vodafone live! active devices rose to 2,992,000.

Strong growth in customer additions, principally in the first half of the year relative to

the previous financial year, and the increased proportion of new contract customers, led

to increased acquisition costs. Interconnect costs increased due to higher usage offset

by the impact of the termination rate cut in November and promotions in the second

half of the year focusing on calls to other Vodafone and fixed-line numbers, which incur

relatively lower interconnect costs. Operating profit before goodwill amortisation was

impacted by the increased acquisition costs and the rise in depreciation and

amortisation charges mainly due to the commencement of 3G services.

Other EMEA subsidiaries

Controlled venture customers for the Group’s operations in the Other EMEA region,

other than Spain, increased by 12% in the year to 31 March 2005.

Turnover increased by 8%, with the primary driver being an 8% increase in service

revenue, as a result of the 12% higher average controlled venture customer base,

partially offset by cuts in termination rates across the region. Non-voice service

revenue grew strongly over the prior financial year to represent 13.2% of service

revenue for the year ended 31 March 2005. In Greece, local currency service revenue

grew by 14% due to a 4% increase in the average customer base, higher voice usage

and a strong rise in non-voice service revenue. Visitor revenue also increased due to a

national roaming agreement with Greece’s fourth mobile operator and high usage

during the Olympic Games. Service revenue growth in Portugal was 11% in local

currency, driven by a 7% increase in the average customer base and good

improvements in non-voice revenue and visitor revenue, due in part to the UEFA Euro

2004 football tournament and a particularly strong start in 3G, partially offset by lower

termination rates. Service revenue in Ireland increased by 10%, in local currency,

primarily as a result of additional voice usage. Intense competition restricted growth in

local currency service revenue in the Netherlands to 1% and contributed to a 4%

decline in Sweden.

Operating profit before goodwill amortisation increased by 7% over the prior financial

year, following increased turnover partially offset by higher depreciation charges,

primarily due to the launch of 3G services.

On 12 January 2005, the Group completed the acquisition of the remaining 7.2%

shareholding in Vodafone Hungary from Antenna Hungaria Rt. with the effect that

Vodafone Hungary became a wholly-owned subsidiary of the Group. On 26 January

2005, Telecom Egypt acquired a 16.9% stake in Vodafone Egypt from the Group,

reducing the Group’s controlling stake to 50.1%. The transaction followed the reaching

business segment, there were strong sales of Vodafone Mobile Connect 3G/GPRS data

cards.

Operational efficiencies and market effectiveness were achieved in the UK from the

execution of the structured plan announced in the prior financial year. The key

elements of this plan are to sustainably differentiate and segment the customer base

allowing more effective targeted marketing and to drive lower costs whilst positioning

the organisation for the future. Under the drive to lower costs, Vodafone has continued

to consolidate call centres, simplify its network and IT platforms and reduce support

costs.

Net other revenue and other direct costs both increased as a result of non-Vodafone

customers acquired as part of service provider acquisitions in the prior year. Other

direct costs increased further due to higher content costs associated with the increased

data revenue.

Operating profit before goodwill amortisation and exceptional items was impacted by

an increase in both depreciation and licence amortisation charges, primarily due to the

commencement of 3G services towards the end of the previous financial year.

Recent independently-audited tests have shown that Vodafone has the best call

success rate of all mobile networks in Britain.

Other Europe, Middle East and Africa

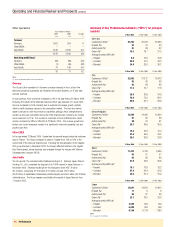

Years ended 31 March Local currency

2005 2004 Change change

£m £m % %

Turnover

Spain 3,261 2,686 21 24

Other EMEA 5,402 4,983 8

Less: intra-segment

turnover (49) (42) 17

8,614 7,627 13

Operating profit(2)(3)

Spain 775 703 10 12

Other EMEA 2,608 2,439 7

3,383 3,142 8

Spain trading results

Voice services 2,558 2,191 17 19

Data services 405 282 44 46

Total service revenue 2,963 2,473 20 22

Net other revenue 23 (33) (22)

Interconnect costs (540) (477) 13 15

Other direct costs (263) (201) 31 33

Net acquisition costs (246) (146) 68 71

Net retention costs (172) (137) 26 27

Payroll (138) (146) (5) (3)

Other operating

expenses(3) (473) (393) 20 22

Depreciation and

amortisation(2) (358) (273) 31 33

Operating profit(2)(3) 775 703 10 12

Notes:

(1) Turnover for Spain includes revenue of £296 million (2004: £210 million) which has been excluded from other revenue and

deducted from acquisition and retention costs in the trading results.

(2) Before goodwill amortisation.

(3) Before exceptional items.

Spain

In Spain, Vodafone continued to deliver strong growth throughout the year. A focus on

acquiring high value customers, targeted promotions encouraging increased usage and