Vodafone 2005 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements continued

128 |Financials

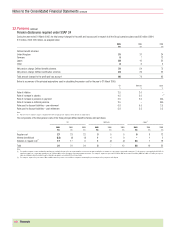

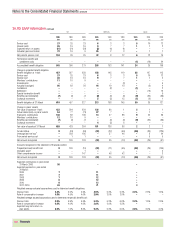

36.US GAAP information continued

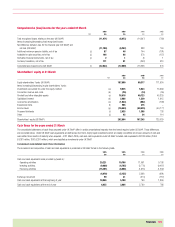

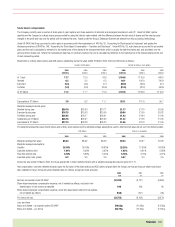

The following tables reconcile Vodafone Italy’s turnover, loss for the financial year and equity shareholders’ funds from UK GAAP to their related amounts in US GAAP as used

in determining the net loss and shareholder’s equity in the Consolidated Financial Statements.

2005 2004 2003

£m £m £m

Turnover (UK GAAP) 5,521 5,276 4,371

Item increasing/(decreasing) revenue:

Connection revenue 109 4 (179)

Turnover (US GAAP) 5,630 5,280 4,192

Loss for the financial year (UK GAAP) (2,565) (2,381) (2,709)

Items (increasing)/decreasing net loss:

Goodwill and other intangible assets (2,885) (2,942) (2,702)

Income taxes 2,440 3,234 2,245

Other (2) (24) (8)

Net loss (US GAAP) (3,012) (2,113) (3,174)

2005 2004

£m £m

Equity shareholders’ funds (UK GAAP) 17,280 20,855

Items increasing/(decreasing) equity shareholders’ funds:

Goodwill and other intangible assets 14,049 16,526

Income taxes (10,736) (12,812)

Other (54) (31)

Shareholders’ equity (US GAAP) 20,539 24,538

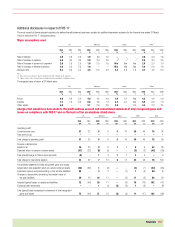

Vodafone Italy had the following effects on consolidated cash flows from operating, investing and financing activities presented in a US GAAP format:

2005 2004 2003

£m £m £m

Cash and cash equivalents were provided by/(used in):

Operating activities 2,272 2,588 1,846

Investing activities (769) (585) (724)

Financing activities –––

1,503 2,003 1,122

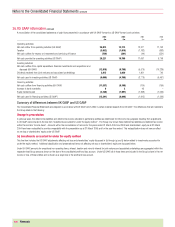

Equity in losses of investments accounted for under the equity method

2005 2004 2003

£m £m £m

Share of operating profit/(loss) in associated undertakings (UK GAAP) 1,193 546 (156)

Reclassification of exceptional non-operating items, interest, taxation and minority interests (789) (565) (614)

Share of Vodafone Italy’s loss for the financial year under UK GAAP (2,565) (2,381) (2,709)

US GAAP differences resulting in an effect on net income/(loss)(1) (18) 1,306 656

Equity in losses of investments accounted for under the equity method (US GAAP) (2,179) (1,094) (2,823)

Note:

(1) These differences represent the differences described in (b) through (g) and (j) below as they relate to investments accounted for under the equity method.

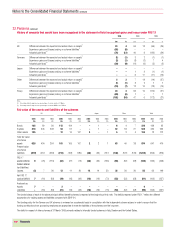

Carrying value of investments accounted for under the equity method

2005 2004

£m £m

Investments in associated undertakings (UK GAAP) 19,398 21,226

Carrying value of Vodafone Italy under UK GAAP 22,151 24,028

US GAAP differences affecting the carrying value of the investments(1) 5,043 15,669

Investments accounted for under the equity method (US GAAP) 46,592 60,923

Note:

(1) These differences represent the differences described in (b) through (g) and (j) below as they relate to investments accounted for under the equity method.