Vodafone 2005 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financials |113

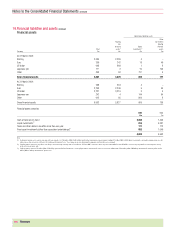

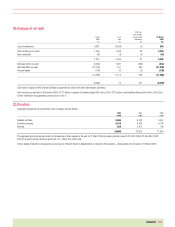

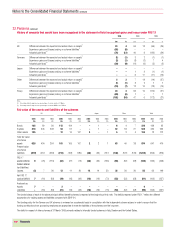

Capital and other commitments

2005 2004

£m £m

Tangible and intangible fixed asset expenditure contracted for but not provided 749 866

Purchase commitments 1,242 957

Share purchase programme 565 –

Purchase of Mobifon and Oskar 1,858 –

4,414 1,823

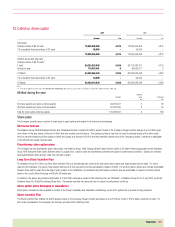

On 15 March 2005, the Group announced it had entered into agreements with Telesystem International Wireless Inc. (“TIW”) of Canada to acquire approximately 79% of the

share capital of MobiFon S.A. (“MobiFon”) in Romania, increasing the Group’s ownership of MobiFon to approximately 99%, and 100% of the issued share capital of Oskar

Mobil a.s. in the Czech Republic for cash consideration of approximately $3.5 billion (£1.9 billion) to be satisfied from the Group’s cash resources. In addition, the Group will

be assuming approximately $0.9 billion (£0.5 billion) of net debt. The acquisition is conditional on TIW shareholder approval, the receipt of all necessary unconditional

regulatory and Canadian Court approvals and certain customary conditions and is expected to complete by the end of June 2005.

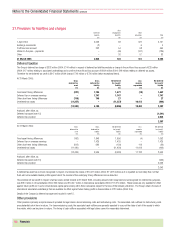

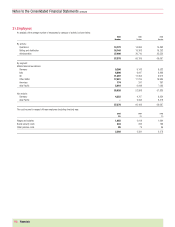

27.Contingent liabilities

Group Company

2005 2004 2005 2004

£m £m £m £m

Performance bonds 382 667 176 200

Credit guarantees – third party indebtedness 67 97 1,424 1,498

Other guarantees and contingent liabilities 18 29 117

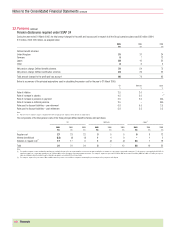

Performance bonds

Performance bonds require the Company, or certain of its subsidiary undertakings, to make payments to third parties in the event that the Company or subsidiary undertaking

does not perform what is expected of it under the terms of any related contracts.

Group performance bonds include £189 million (2004: £434 million) in respect of undertakings to roll out 2G and 3G networks in Germany while the Company and Group

performance bonds include £149 million (2004: £145 million) in respect of undertakings to roll out 3G networks in Spain. The majority of the German performance bonds

expire by December 2005 and for Spain by November 2009.

Credit guarantees – third party indebtedness

Credit guarantees comprise guarantees and indemnities of bank or other facilities including those in respect of the Group’s associated undertakings and investments.

At 31 March 2005, the Company had guaranteed debt of Vodafone Finance K.K. amounting to £1,111 million (2004: £1,177 million) and issued guarantees in respect of

notes issued by Vodafone Americas, Inc. amounting to £311 million (2004: £320 million). The Japanese facility expires by January 2007 and the majority of Vodafone

Americas, Inc. bond guarantees by July 2008.

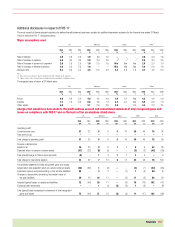

Other guarantees and contingent liabilities

Other guarantees principally comprise commitments to support disposed entities.

In addition to the amounts disclosed above, the Group has guaranteed financial indebtedness and issued performance bonds for £36 million (2004: £53 million) in respect of

businesses which have been sold and for which counter indemnities have been received from the purchasers.

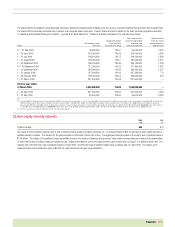

The Group also enters into lease arrangements in the normal course of business, which are principally in respect of land, buildings and equipment. Further details on the

minimum lease payments due under non-cancellable operating lease arrangements can be found in note 26.

Save as disclosed within “Risk Factors and Legal Proceedings – Legal Proceedings”, the Company and its subsidiaries are not involved in any legal or arbitration proceedings

(including any governmental proceedings which are pending or known to be contemplated) which are expected to have, or have had in the twelve months preceding the date

of this document, a significant effect on the financial position or profitability of the Company and its subsidiaries.