Vodafone 2005 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2005 Vodafone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements continued

136 |Financials

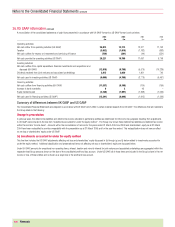

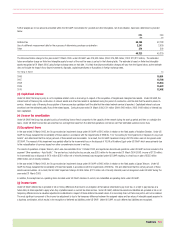

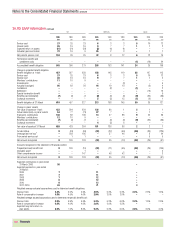

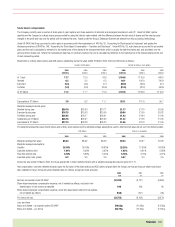

36.US GAAP information continued

(k) Loss per share

The share options and share plans described in note 22 were excluded from the calculation of diluted loss per share as the effect of their inclusion in the calculation would be

antidilutive due to the Group recognising a loss in all periods presented.

(l) Comprehensive (loss)/income

Total recognised losses under UK GAAP include net loss and currency translation adjustment. Under US GAAP, comprehensive (loss)/income is the change in equity during a

period resulting from transactions other than with shareholders. Comprehensive (loss)/income is comprised of net loss, the minimum pension liability adjustment, changes in

the fair value of available for sale securities and derivatives used in cash flow hedging relationships, and currency translation adjustment.

During the year ended 31 March 2005, £63 million of foreign currency losses were reclassified from other comprehensive income and included in the determination of net

loss as a result of the partial disposal of Vodafone Egypt.

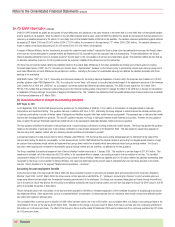

37.Changes in accounting standards

International Financial Reporting Standards

On 19 July 2002, the European Parliament adopted Regulation No. 1606/2002 requiring listed companies in the Member States of the European Union to prepare their

consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) from 2005. IFRS will apply for the first time in the Group’s Annual

Report for the year ending 31 March 2006. Consequently, the Group’s interim results for the six month period ending 30 September 2005 will be presented under IFRS

together with restated information for the six months ended 30 September 2004 and the year ended 31 March 2005.

US standards

SFAS No. 123 (Revised 2004), “Share-Based Payment”

In December 2004, the FASB issued a revised version of SFAS No. 123 (SFAS No. 123R), which among other changes, eliminates the option to account for share-based

payment to employees using the intrinsic value method and requires share-based payment to be recorded using the fair value method. Under the fair value method,

compensation cost for employees and directors is determined at the date awards are granted and recognised over the service period. The Group is currently analysing the

effects of the new standard including the alternative methods of adoption.

Staff Accounting Bulletin 107

The SEC issued SAB 107 in March 2005. SAB 107 summarizes the views of the SEC staff regarding the interaction between SFAS No. 123R and certain Securities and

Exchange Commission rules and regulations and provides the staff’s views regarding the valuation of share-based payment arrangements for public companies. The Group is

currently analysing the effects of this SAB and will adopt SAB 107 concurrently with SFAS No. 123.